Financial Audit: FY 2023 and FY 2022 Consolidated Financial Statements of the U.S. Government

Fast Facts

The Financial Report of the U.S. Government provides a comprehensive view of government finances, including revenues, costs, assets, liabilities, and long-term sustainability.

We audit the financial statements in that report each year, but we haven't yet been able to determine if they are fairly presented. This year, it was primarily due to:

Serious financial management problems at the Department of Defense

Problems in accounting for transactions between federal agencies

Weaknesses in the process for preparing the statements

Inadequate support for the cost of Small Business Administration and Department of Education loan programs

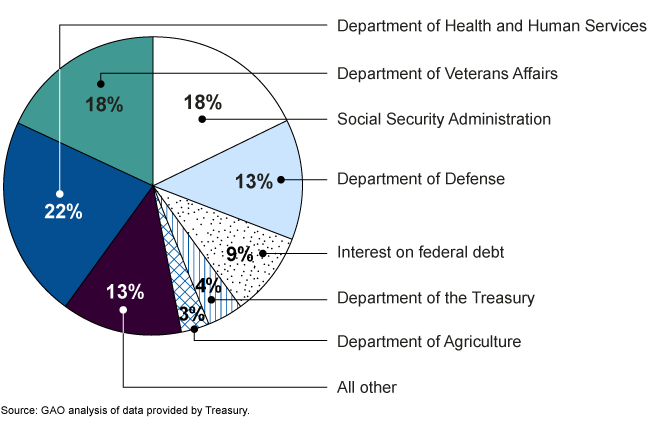

FY 2023 Net Costs of U.S. Government Operations ($7.9 trillion)

Highlights

What GAO Found

To operate as effectively and efficiently as possible, Congress, the administration, and federal managers must have ready access to reliable and complete financial and performance information—both for individual federal entities and for the federal government as a whole. GAO's report on the U.S. government's consolidated financial statements for fiscal years 2023 and 2022 discusses progress that has been made, but also underscores that much work remains to improve federal financial management and that the federal government continues to face an unsustainable long-term fiscal path.

GAO found the following:

- Certain material weaknesses in internal control over financial reporting and other limitations resulted in conditions that prevented GAO from expressing an opinion on the accrual-based consolidated financial statements as of and for the fiscal years ended September 30, 2023, and 2022.

- Significant uncertainties, primarily related to the achievement of projected reductions in Medicare cost growth, prevented GAO from expressing an opinion on the sustainability financial statements, which consist of the 2023 and 2022 Statements of Long-Term Fiscal Projections; the 2023, 2022, 2021, 2020, and 2019 Statements of Social Insurance; and the 2023 and 2022 Statements of Changes in Social Insurance Amounts. A material weakness in internal control also prevented GAO from expressing an opinion on the 2023 and 2022 Statements of Long-Term Fiscal Projections.

- Material weaknesses resulted in ineffective internal control over financial reporting for fiscal year 2023.

- Material weaknesses and other scope limitations, discussed above, limited tests of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements for fiscal year 2023.

Three major impediments have continued to prevent GAO from rendering an opinion on the federal government’s accrual-based consolidated financial statements: (1) serious financial management problems at the Department of Defense, (2) the federal government’s inability to adequately account for intragovernmental activity and balances between federal entities, and (3) weaknesses in the federal government’s process for preparing the consolidated financial statements.

In addition, the Small Business Administration and Department of Education were unable to obtain opinions on their fiscal years 2022 and 2023 financial statements because of weaknesses related to loans and loan guarantees. Efforts are under way to resolve these issues.

The material weaknesses underlying these financial management challenges (1) hamper the federal government’s ability to reliably report a significant portion of its assets, liabilities, costs, and other related information; (2) affect the federal government’s ability to reliably measure the full cost, as well as the financial and nonfinancial performance, of certain programs and activities; (3) impair the federal government’s ability to adequately safeguard significant assets and properly record various transactions; and (4) hinder the federal government from having reliable, useful, and timely financial information to operate effectively and efficiently.

Two other continuing material weaknesses are the federal government’s inability to (1) determine the full extent to which improper payments occur and reasonably assure that appropriate actions are taken to reduce them and (2) identify and resolve information system control deficiencies and manage information security risks on an ongoing basis. The fiscal year 2023 government-wide total of reported improper payment estimates was $236 billion, but it did not include estimates for certain government programs. Thirteen of the 24 agencies covered by the Chief Financial Officers Act of 1990 reported material weaknesses or significant deficiencies in information system controls.

The comprehensive long-term fiscal projections presented in the Statement of Long-Term Fiscal Projections and related information show that based on current revenue and spending policies, the federal government continues to face an unsustainable long-term fiscal path. Since 2017, GAO has stated that Congress should develop a fiscal plan to place the federal government on a sustainable fiscal path and ensure that the United States remains in a strong economic position to meet its social and security needs, as well as to preserve flexibility to address unforeseen events like public health emergencies. Additionally, GAO recommended that Congress consider alternative approaches to the current debt limit as part of any long-term fiscal plan.

In commenting on a draft of this report, Department of the Treasury and Office of Management and Budget (OMB) officials expressed their continuing commitment to addressing the problems this report outlines.

Why GAO Did This Study

The Secretary of the Treasury, in coordination with the Director of OMB, is required to annually submit audited financial statements for the U.S. government to the President and Congress. GAO is required to audit these statements. The Government Management Reform Act of 1994 has required such reporting, covering the executive branch of government, beginning with financial statements prepared for fiscal year 1997. The consolidated financial statements include the legislative and judicial branches.

For more information, contact Dawn B. Simpson at (202) 512-3406 or simpsondb@gao.gov or Robert F. Dacey at (202) 512-3406 or daceyr@gao.gov.