Anti-Money Laundering: Better Information Needed on Effectiveness of Federal Efforts [Reissued with revisions on Jun. 13, 2024]

Fast Facts

The Anti-Money Laundering Act of 2020 aims to modernize how federal agencies combat money laundering and other financial crimes.

The Financial Crimes Enforcement Network is responsible for implementing many of the Act's requirements—like assessing how new technologies can help detect such crimes. But FinCEN has yet to provide a full update to Congress and the public on its progress meeting these requirements.

Also, the government doesn't collect comprehensive financial crime data across different law enforcement agencies—-making it hard to know if efforts to combat these crimes are effective.

We recommended ways to address these and other issues.

Revised June 13, 2024 to correct table 4 on page 37. The corrected section should read: Organized Crime Drug Enforcement Task Forces, Percentage of investigations with indictments resulting in financial convictions, 27%.

Highlights

What GAO Found

Financial institution representatives that GAO interviewed identified actions the Financial Crimes Enforcement Network (FinCEN) could take to enhance the institutions' ability to identify and report suspicious activity. These include more updates on priority threats and tips to improve suspicious activity reports (SAR), which institutions file if they identify potential criminal activity. FinCEN may cover some of these actions as it implements the Anti-Money Laundering Act of 2020, the aims of which include improving information sharing and technology.

GAO identified 31 sections in the Anti-Money Laundering Act of 2020 for which FinCEN is responsible for implementing. For example, FinCEN is to establish standards for financial institutions to test new anti-money laundering-related technology. As of November 2023, GAO found that FinCEN collectively had described its progress in implementing 19 sections through multiple publications and in varying detail. More complete disclosure of FinCEN's progress implementing the act would provide greater transparency and accountability.

FinCEN surveys law enforcement agencies about their use of and satisfaction with FinCEN's products and services, such as its database of SARs. However, the surveys may not provide reliable information. FinCEN's 2018–2022 surveys had low response rates (ranging from 2 to 10 percent), raising the risk of biased results that do not represent the views of all agencies. FinCEN also did not analyze and adjust, as needed, results for nonresponse bias. As a result, the surveys may not provide FinCEN with a complete and reliable picture of law enforcement's satisfaction with its products and services.

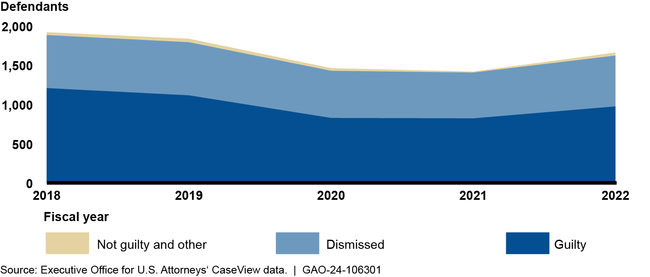

Federal agencies, including the Departments of Justice and Homeland Security, individually track outcomes of their illicit finance investigations (e.g., convictions and forfeitures). Some Justice data track these outcomes across multiple federal agencies (see figure). However, comprehensive, government-wide data do not exist because data collection is fragmented across multiple agencies and data may be incomplete. Developing a consistent methodology to comprehensively track outcomes would better inform federal agencies and Congress about the results and effectiveness of U.S. efforts to combat illicit finance.

Outcomes of Defendants Charged under Money Laundering-Related Statutes, Fiscal Years 2018–2022

Why GAO Did This Study

Criminal organizations launder illicit proceeds to facilitate and conceal crime. The Bank Secrecy Act, as amended, requires financial institutions to file SARs (which help law enforcement investigate crime) under certain conditions. FinCEN administers the act and maintains these reports in a database.

GAO was asked to review U.S. efforts to combat illicit finance. This report examines (1) financial institution suggestions to enhance SAR processes, (2) FinCEN communication of its progress implementing the Anti-Money Laundering Act, (3) FinCEN surveys on law enforcement satisfaction with its products and services, and (4) data collection on efforts to combat illicit finance.

GAO reviewed laws, guidance, and investigation data and interviewed FinCEN and federal law enforcement agencies. GAO also interviewed a nongeneralizable selection of 46 representatives of financial institutions and industry associations (such as banks, casinos, money services businesses, and broker-dealers).

Reissued with revisions on Jun. 13, 2024

Revised June 13, 2024 to correct table 4 on page 37. The corrected section should read: Organized Crime Drug Enforcement Task Forces, Percentage of investigations with indictments resulting in financial convictions, 27%.Recommendations

GAO recommends that FinCEN (1) communicate in full its progress in implementing the Anti-Money Laundering Act and (2) improve the reliability of its law enforcement surveys. GAO also recommends that (3) Justice coordinate with other agencies to develop a methodology to produce government-wide data on investigation outcomes. FinCEN did not comment on GAO's recommendations. Justice agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN develop and implement a communications plan to regularly inform Congress and the public in full about its progress implementing the Anti-Money Laundering Act of 2020. (Recommendation 1) |

In September 2024, FinCEN informed us that the agency is updating its internal tracking mechanisms with respect to the Anti-Money Laundering Act's (AMLA) sections for which FinCEN has rulemaking, reporting, or other anti-money laundering-related implementation responsibilities. These tracking mechanisms will be used as a basis for a public communications plan that will include updates to FinCEN's AMLA webpage and congressional notification of such updates. FinCEN anticipates implementing the communications plan by the end of February 2025.

|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN work with its survey vendor to improve the reliability of the agency's annual customer satisfaction surveys and appropriately disclose survey data limitations when results are reported. (Recommendation 2) |

In September 2024, FinCEN informed us that it is working with its vendor to explore the cost of a nonresponse bias analysis for its surveys and ways to improve survey response rates. In the meantime, beginning with its FY 2026 budget submission, FinCEN included language disclosing survey data limitations. FinCEN plans to complete its evaluation of pricing options for a nonresponse bias analysis by year-end of 2024 and its action plan to improve survey response rates in March 2025.

|

| Department of Justice | The Attorney General should lead an effort, in coordination with the Departments of Homeland Security and the Treasury, to develop a methodology for producing government-wide data on the outcomes of anti-money laundering investigations. This effort could be conducted in conjunction with the interagency working group DOJ was directed to form in the joint explanatory statement accompanying its fiscal year 2023 appropriation. (Recommendation 3) |

DOJ agreed with our recommendation. We will update the status of this recommendation when DOJ provides its 180-day letter, which is due in September 2024.

|