Private Debt Collection Program: IRS Could Improve Results and Better Promote Equitable Outcomes for Taxpayers

Fast Facts

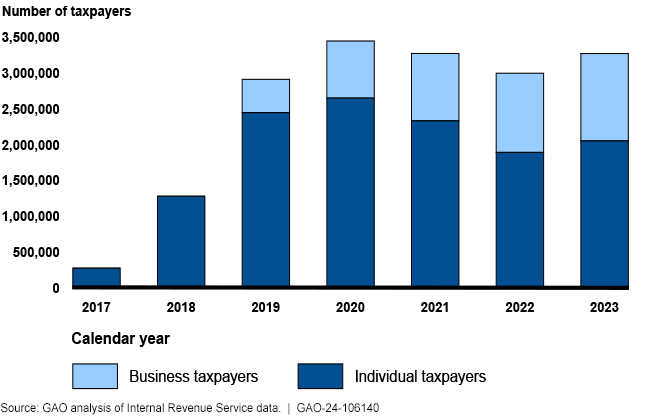

Under the Private Debt Collection Program, the IRS contracts with private collection agencies to collect certain taxes that haven't been paid. Most of the individual and business taxpayers that IRS assigns to this program owe $5k or less.

The IRS should evaluate potential equity disparities in this program, such as unintended and unwarranted differences in collection referrals by race, sex, or location. However, the IRS doesn't have standards to indicate when referrals to this program are out of alignment with equity goals.

We recommended that it establish such standards.

Number of Taxpayers Assigned to the PDC Program, 2017-2023

Highlights

What GAO Found

The Internal Revenue Service (IRS) assigns taxpayers with certain inactive tax debts to private collection agencies—rather than IRS's collection function—under its Private Debt Collection (PDC) program. The majority of individual and business taxpayers IRS assigned to the PDC program owed $5,000 or less and did not file income tax returns. Of individual taxpayers who did file, generally more than half filed as single, had no dependents, or reported an income of $50,000 or less.

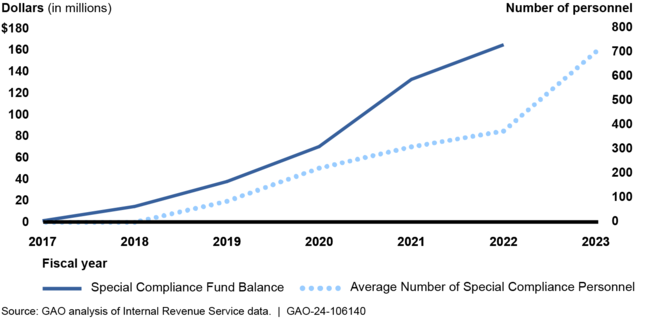

IRS allocates a portion of the payments recovered under the PDC program to its Special Compliance Personnel Program Fund. It uses the fund to hire IRS personnel to work other, non-PDC collection cases. The fund balance grew to over $160 million in fiscal year 2022. IRS has not established clear goals for managing this fund, which could help it optimize the fund's performance.

IRS's Special Compliance Personnel Program Fund Balance Growth and Hires

Note: Fund data for 2023 were not publicly available as of January 2024.

Department of the Treasury and IRS have established policies that call for IRS to evaluate enforcement equity, but IRS has not yet established measurable standards related to the PDC program, such as for comparing rates that different demographic groups are assigned to the program. Doing so would better position IRS to determine whether taxpayers with debt get equitable services, information, and opportunities to meet their tax obligations.

Certain taxpayers are legally excluded from the program, including more than 1 million taxpayers with limited financial means. Excluded taxpayers receive one mailed notice per year with mostly boilerplate language about unpaid taxes. Without tailored information, these taxpayers may not be aware of their cases' statuses, the consequences of not resolving their debts, and the best options to resolve their debts. In addition, IRS has not yet addressed two GAO recommendations from 2019, which if implemented, could improve PDC program efficiency and enhance revenue collection.

Why GAO Did This Study

IRS attempts to collect tax debts to help reduce the tax gap and promote voluntary compliance. A 2015 law establishing the PDC program requires IRS to contract with private collection agencies for certain tax debts, including those IRS determined it lacked resources to pursue.

GAO was asked to review the PDC program. This report (1) identifies characteristics of taxpayers in the program, and (2) assesses the extent to which IRS is effectively managing the program and promoting equitable outcomes among taxpayers.

GAO used IRS data to identify characteristics of taxpayers assigned to the PDC program from calendar years 2017 through 2023. GAO reviewed documentation and interviewed IRS officials about IRS's PDC program management and efforts to promote equitable outcomes.

Recommendations

GAO is making four new recommendations, including that IRS establish clear goals or targets for its Special Compliance Fund; establish standards to assess equity related to the PDC program, and address any issues; and provide taxpayers excluded from the PDC program tailored information about their cases. GAO also maintains that two open recommendations from 2019 are warranted and should be fully implemented to improve program results, as discussed in the report.

IRS agreed with all four of GAO's new recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish clear fund balance goals or staffing targets for IRS's Special Compliance Fund. (Recommendation 1) |

IRS agreed with this recommendation and as of August 2024, said it is taking steps to implement it. We requested a meeting with IRS to obtain additional information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish standards for evaluating equity for taxpayers who are either assigned to or excluded from the PDC program, including IRS's process of routing taxpayers to the inactive inventory (shelf). (Recommendation 2) |

IRS agreed with this recommendation and as of August 2024, reported the agency plans to implement it by October 2026. Specifically, IRS reported it had established a Private Debt Collection Equity team that will work with stakeholders to develop Private Debt Collection program equity standards. Such standards could enable IRS to determine whether there are potential disparities associated with the program.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should assess IRS's performance against its standards for equity and take actions to address any identified issues. (Recommendation 3) |

IRS agreed with this recommendation and as of August 2024, reported the agency plans to implement it by October 2026. Specifically, IRS reported its Private Debt Collection Equity team is developing methodologies to assess its equity performance based on factors including age, income, and race/ethnicity probability estimates. Assessing its performance against its equity standards could enable IRS to identify any issues and take steps to address them.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should provide taxpayers in the inactive inventory (shelf) and excluded from the PDC program tailored taxpayer-centric information about their debts and options for resolving them. (Recommendation 4) |

IRS agreed with this recommendation and as of August 2024, reported the agency plans to implement it by November 2024. Specifically, IRS reported it had started developing new annual notices for taxpayers on IRS's shelf excluded from the Private Debt Collection program with information about how to resolve their tax debt tailored to their circumstances. Implementing this recommendation could allow IRS to provide taxpayers better information about their case statuses, the consequences of not resolving their debts, and the best options to dispute and resolve their debts.

|