COVID-19 Relief: Treasury Could Improve Its Administration and Oversight of State and Local Fiscal Recovery Funds

Fast Facts

In March 2021, the American Rescue Plan Act appropriated $350 billion in State and Local Fiscal Recovery Funds to help with the COVID-19 pandemic. Treasury is responsible for administering and monitoring these funds.

Officials in selected states and localities identified challenges with how Treasury administers these funds. For example, Treasury has a contact center to respond to recipients' questions. Some state and local officials said that the center's phone and email assistance was not timely. This issue was partly due to limited staffing.

We made 4 recommendations to Treasury, including that it assess its contact center staffing needs.

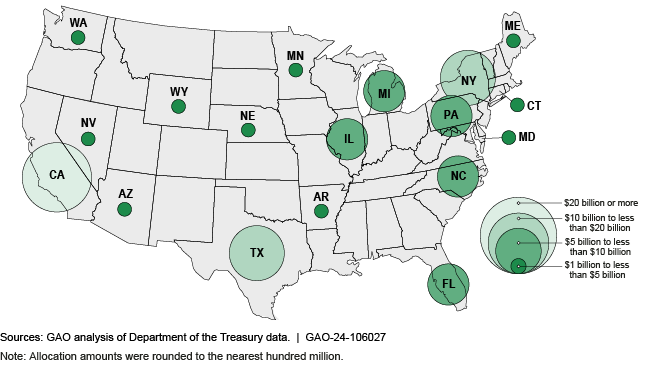

Ranges in Coronavirus State and Local Fiscal Recovery Funds Allocation Amounts for Selected States

Highlights

What GAO Found

Nearly all—$325.5 billion—of the $350 billion in State and Local Fiscal Recovery Funds (SLFRF) was allocated to state and local governments. As of March 31, 2023, states reported obligating 60 percent and spending 45 percent of SLFRF awards they received. Localities reported obligating 54 percent and spending 38 percent, of SLFRF awards they received. Recipients have until December 31, 2024, to obligate, and until December 31, 2026, to spend their awards.

Officials in all 18 selected states and most larger selected localities GAO reviewed said they expanded their capacity to manage their awards, such as by reassigning existing or hiring new staff. Officials in most smaller localities said they administered their SLFRF awards with their existing staff and processes.

Officials in most selected states and localities told GAO they benefitted from using their SLFRF awards to replace revenue lost during the pandemic—an allowable use under the SLFRF program. Specifically, they said that using funds to replace lost revenue (1) enhanced spending flexibilities by allowing funding of a broad range of government services; and (2) made it easier to meet the Department of the Treasury's reporting requirements.

State and local officials identified a range of challenges in using their SLFRF awards, such as those related to

- Performance indicators. Officials in some selected states and one selected locality told GAO that the performance indicators they are required to report do not always align with their uses of SLFRF awards. Treasury established these indicators to understand and aggregate program outcomes across SLFRF recipients. However, some selected state and local officials said they needed clarity from Treasury on how to report on required performance indicators when they do not align with their uses of SLFRF awards and spending categories. Based on GAO's analysis, Treasury updated its guidance on November 30, 2023, to clarify reporting on these indicators.

- Treasury assistance. Officials in most selected states and some selected localities told GAO that the assistance Treasury provided by telephone or email through its Contact Center was not timely and did not meet their needs. Treasury established the center to field and respond to recipients' inquiries about programs administered by Treasury, but these officials said limited resources affected Treasury's assistance. Treasury has assessed some, but not all, of its staffing needs, limiting its ability to provide timely and useful assistance going forward.

Treasury has established monitoring procedures for reviewing states' and localities' spending reports and annual single audit findings. Treasury modified its procedures for reviewing spending reports, adapting to lessons it learned. However, it did not document those changes in key internal program guidance, creating a risk that the new procedures will not be implemented consistently. Additionally, Treasury did not issue timely management decisions pertaining to SLFRF findings in recipients' single audit reports. As a result, Treasury does not have reasonable assurance that unallowable uses of funds are identified or remediated.

Why GAO Did This Study

In March 2021, the American Rescue Plan Act of 2021 appropriated $350 billion through the SLFRF to help tribal governments, states, localities, the District of Columbia, and U.S. territories cover costs stemming from the health and economic effects of the COVID-19 pandemic.

The CARES Act includes a provision for GAO to report on its ongoing monitoring and oversight efforts related to the pandemic. GAO was also asked to review Treasury's administration of SLFRF. This report, part of a series on COVID-19 assistance to recipients, examines selected states' and localities' (1) actions to administer their awards, and (2) benefits and challenges they experienced, as well as (3) Treasury's plan to monitor the use of awards and the extent to which it has been implemented.

GAO reviewed documents and interviewed officials in 18 states and 18 localities (one per state) selected based on SLFRF funding amount, population size, and geographic region. Combined, these states represent nearly 60 percent of the U.S. population and were allocated 60 percent of SLFRF funds. GAO also reviewed Treasury's policies and procedures for monitoring recipients' award uses and reviewing spending reports and single audit findings.

Recommendations

GAO is making four recommendations to Treasury, including assessing future Contact Center staffing needs and improving the documentation and timeliness of award monitoring processes. Treasury generally agreed with the four recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should comprehensively assess staffing needs for the Contact Center to ensure that it is able to respond timely to SLFRF recipient requests for assistance and with information that meets their needs. (Recommendation 1) |

On November 20, 2024, Treasury officials provided an update, stating that they are in the process of working to address to the recommendation and will send GAO another update once complete.

|

| Department of the Treasury | The Secretary of the Treasury should update and implement the agency's documented policies and procedures for monitoring recipients' use of SLFRF awards to reflect lessons learned from reviewing recipients' project and expenditure reports. (Recommendation 2) |

On November 20, 2024, officials provided documentation on Treasury's award management policy, recently issued data and reporting procedures, compliance monitoring, recipient submitted data testing procedures, and compliance monitoring, recipient noncompliance and remediation procedures. We plan to follow up with Treasury to clarify the information provided and obtain additional information on these policies and procedures.

|

| Department of the Treasury | The Secretary of the Treasury should conduct timely systematic reviews of SLFRF recipients' single audit reports and document the results of those reviews. (Recommendation 3) |

On November 20, 2024, Treasury officials provided an update on the status of this recommendation, stating that they have revised their processes and issued new Single Audit policies and procedures. We plan to follow up with Treasury officials to gain clarity on the documents provided and ask additional questions.

|

| Department of the Treasury | The Secretary of the Treasury should issue timely management decisions related to SLFRF findings in accordance with OMB's single audit guidance. (Recommendation 4) |

On November 20, 2024, Treasury officials provided an update on the status of this recommendation, stating that they have revised their processes and issued new Single Audit policies and procedures. We plan to follow up with Treasury officials to gain clarity on the documents provided and ask additional questions.

|