Federal Oil and Gas Royalties: Opportunities Exist to Improve Interior's Compliance Program

Fast Facts

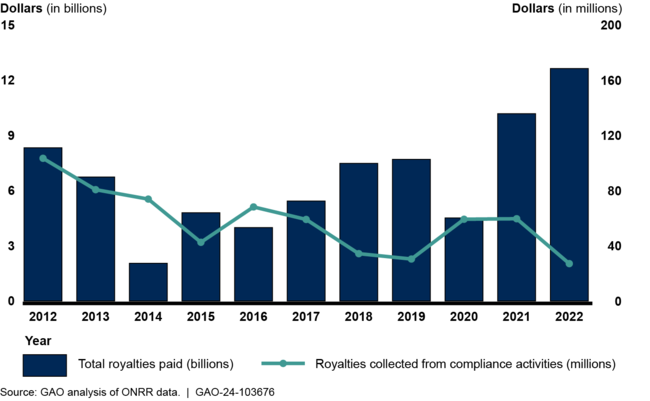

Royalties on the sale of oil and gas produced on federal lands are a significant source of federal revenue. From 2012-2022, companies paid the U.S. government $74 billion in royalties. The Interior Department's efforts to ensure that companies pay the royalties they owe produced $600 million in additional payments in this period.

Our recommendations are to help Interior improve on these results. For example, Interior could improve its data quality and collect additional data to better select compliance cases that are more likely to yield additional payments.

Interior's management of oil and gas has been on our High Risk List since 2011.

Highlights

What GAO Found

The Department of the Interior's Office of Natural Resources Revenue (ONRR) collected $74 billion in royalties on $600 billion total sales of oil and gas produced by companies on federal leases from 2012–2022. Royalties collected depended in large part on the price of oil and gas, which increased from 2012 through 2022. ONRR generated $600 million through compliance activities for 2012–2022.

Office of Natural Resources Revenue (ONRR) Royalty and Compliance Collections, 2012–2022

ONRR has made progress developing new risk models for selecting cases for compliance. However, incomplete data and resource challenges have impeded ONRR's ability to analyze its compliance data. ONRR is developing its own risk models for case selection, which should increase its capacity to analyze data, officials said. However, ONRR does not have certain data that could be used to inform the risk models, such as complete data on violations. By assessing the need for complete compliance data, ONRR could better inform its compliance strategy. Additionally, ONRR has not prioritized hiring staff with data analysis skills. By assessing human capital needs, ONRR could better determine what skills and staff it needs to strengthen compliance efforts.

ONRR last estimated a royalty gap of approximately $100 million for both 2010 and 2011. The royalty gap is the difference between the payments ONRR collects from companies and what it should collect. ONRR staff recommended improving the model to continue estimating the royalty gap. However, ONRR management did not continue this effort after 2011. GAO attempted to estimate a royalty gap for more recent years using a different model but was unable to do so due to limitations with ONRR's data. Rigorous and improved estimates of its royalty gap could help ONRR enhance its decision-making and strategic planning of compliance efforts on an ongoing basis.

Why GAO Did This Study

The federal government receives significant revenues from royalties paid on the sale of oil and gas extracted from leased federal lands and waters. Interior has faced challenges verifying the accuracy of royalty payments. In 2011, GAO added Interior's management of federal oil and gas resources to its High Risk List. Interior has since taken steps to operate more effectively.

GAO was asked to examine ONRR's federal oil and gas royalty compliance efforts. This report (1) describes ONRR's royalties and compliance activities for 2012 through 2022, the most current data available at the time of our review; (2) examines how staffing resources affected its ability to analyze compliance data; and (3) examines ONRR's latest estimates of an oil and gas royalty gap, and what opportunities ONRR has to improve its royalty gap model. GAO reviewed relevant laws, regulations, agency guidance, and Interior's annual performance documentation and budget justifications for the period. GAO also analyzed ONRR compliance data and interviewed ONRR officials.

Recommendations

GAO is making 14 recommendations, including that ONRR improve the completeness of its compliance data, assess its human capital needs related to its data and data systems, and periodically estimate a royalty gap of adequate rigor. Interior concurred with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Natural Resources Revenue | The Director of ONRR should assess the benefits of incorporating randomly selected compliance activities into its workplans, including the resources necessary to conduct the appropriate number of random compliance activities, to validate its risk models. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider adding related violation data to already closed cases in OMT to better assure ONRR has complete data on violations in its current compliance data system. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider examining how to better link compliance royalty collections with the associated violation. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should assess the need to develop a consistent and complete dataset from ONRR's multiple compliance data systems to better analyze historical compliance performance and inform its compliance strategy. (Recommendation 4) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider how to better assure that it will have a consistent and complete compliance dataset should OMT be replaced, including an assessment of migrating key compliance data to its future compliance data system. (Recommendation 5) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should reiterate its existing policy for using PAD numbers—for example, through additional training—to ONRR staff about how payments resulting from compliance activities are to be recorded in accordance with existing policies (i.e., PAD number). (Recommendation 6) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should examine adding functionality in its current and future compliance data systems to comprehensively crosswalk the PAD number between its compliance and royalty data systems as a means of providing greater assurance that all compliance payments are correct. (Recommendation 7) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should create a report with aggregate data on the federal oil and gas royalties subject to audits and compliance reviews, respectively. (Recommendation 8) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should ensure that its Technical Metadata Dictionary is accurate, including descriptions of variables and the associated values and categories. (Recommendation 9) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should ensure that its compliance data system schematic is accurate and updated to reflect any changes. (Recommendation 10) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should determine the number of staff it needs to better assure it has the necessary staff with skills to both understand ONRR's compliance data systems and analyze its data. (Recommendation 11) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider using the OPM IPA program to bring in additional skills needed to enhance its own compliance data analysis, which could improve compliance efforts. (Recommendation 12) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR, in coordination with Interior's Statistical Official, should assess the costs and benefits of developing a plan and implementation timeline to create a royalty gap model of adequate rigor, including the collection of additional data, as needed, to inform decision-making and strategic planning of compliance efforts. (Recommendation 13) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Office of Natural Resources Revenue | The Director of ONRR, in coordination with Interior's Statistical Official, should periodically estimate a royalty gap to inform decision-making and strategic planning of compliance efforts. (Recommendation 14) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|