Emergency Relief Funds: Significant Improvements Are Needed to Address Fraud and Improper Payments

Fast Facts

The federal government distributed funds quickly during the COVID-19 pandemic. This led to an increase in fraud and other "improper payments"—payments that shouldn't have been made or were made in the incorrect amount. The extent of fraud in COVID-relief programs is not yet known but our estimate suggests that one program, Unemployment Insurance, made over $60 billion in fraudulent payments.

We testified on contributing factors and our prior related recommendations to agencies and Congress. For example, we suggested that Congress reinstate requirements that agencies report annually on their efforts to prevent, detect, and respond to fraud.

For an update on COVID-19 relief funding, spending, and funds that remain available, see GAO-23-106647, published February 2023.

Highlights

What GAO Found

While fraud and accountability issues will continue to occur in COVID-19 relief programs, there is already ample evidence of widespread fraud, improper payments, and accountability deficiencies during the pandemic. For example, GAO found that from March 2020 through January 13, 2023, at least 1,044 individuals pleaded guilty to or were convicted at trial of federal charges of defrauding COVID-19 relief programs. This includes the Small Business Administration's (SBA) Paycheck Protection Program (PPP) and COVID-19 Economic Injury Disaster Loan (COVID-19 EIDL) program, the Department of Labor's (DOL) Unemployment Insurance (UI) programs, and economic impact payments issued by the Department of the Treasury and the Internal Revenue Service.

Also, federal charges were pending against at least 609 individuals or entities for attempting to defraud COVID-19 relief programs. The number of individuals facing fraud-related charges has continued to grow since March 2020 and will likely increase, as these cases take time to develop.

- SBA Office of Inspector General (OIG). According to SBA OIG officials, as of January 25, 2023, the SBA OIG has 536 ongoing investigations involving PPP, the COVID-19 EIDL program, or both.

- DOL OIG. From April 1, 2020 through January 10, 2023, the DOL OIG opened over 198,000 complaints and investigations involving UI. It continues to open at least 100 new UI fraud matters each week.

The extent of fraud associated with PPP, COVID-19 EIDL, UI, and other COVID-19 relief programs has not yet been fully determined. Nevertheless, in December 2022, GAO found that measures and estimates indicate substantial levels of fraud and potential fraud in UI during the pandemic. Specifically, GAO reported that if the lower bound of DOL's 2021 estimated national fraud rate for the regular UI program was extrapolated to total spending across all UI programs during the pandemic, it would suggest over $60 billion in fraudulent UI payments. However, such an extrapolation has inherent limitations and should be interpreted with caution.

One of the many challenges in determining the full extent of fraud is its deceptive nature. Programs can incur financial losses related to fraud that are never identified and such losses are difficult to reliably estimate. In ongoing work, GAO is seeking to calculate a comprehensive estimate of UI fraud and is exploring ways to estimate the amount of fraud more broadly across the federal government.

The amount of funds the government will ultimately be able to recover from fraud losses is yet to be determined as well. Various reporting from the OIGs provides insight into completed investigations and recoupment efforts. For example, SBA's OIG reported that its collaboration with SBA and the U.S. Secret Service has resulted in the seizure of more than $1 billion stolen by fraudsters from the COVID-19 EIDL program. DOL OIG investigations and investigative assistance to state workforce agencies have resulted in UI fraud monetary results, including forfeitures and restitution amounts, in excess of $905 million.

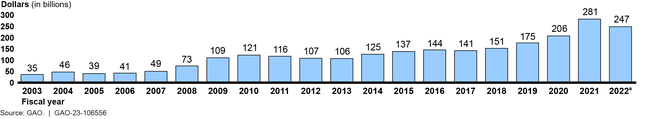

In addition to noted vulnerabilities to fraud, COVID-19 relief funding exacerbated an already growing improper payments problem in the federal government.

Government-wide Improper Payment Estimates for Fiscal Years 2003 – 2022

Note: Prior year improper payment estimates have not been adjusted for inflation. aThis does not include estimates related to certain significant expenditures to fund response and recovery efforts for the COVID-19 pandemic, such as the Department of Labor's (DOL) Pandemic Unemployment Assistance program in the Unemployment Insurance (UI) system.

GAO identified four major factors that contributed to federal programs' exposure to fraud, improper payments, and other accountability challenges when administering COVID-19 relief programs. Specifically, agencies:

- Did not strategically manage fraud risks and were not adequately prepared to prevent fraud

- Lacked appropriate controls to prevent, detect, and recover fraudulent and other improper payments

- Lack permanent, government-wide analytic capabilities to help agencies identify fraud

- Continue to have challenges with improper payments

GAO has made 374 recommendations and 19 matters for congressional consideration across its COVID-19 work. As of January 20, 2023, agencies had fully or partially addressed 147 of these 374 recommendations. Congress had fully addressed one matter and partially addressed another. The intent of these recommendations were for agencies to implement mid-course corrections where appropriate and to increase transparency and accountability of the COVID-19 response and for future emergencies. For example 22 recommendations and matters involved actions to address fraud risks, 11 were tied to specific improper payment issues, and 5 were related to both issues across multiple COVID-19 relief programs.

The matters for congressional consideration include the following 10 that GAO made in March 2022 to enhance the transparency and accountability of federal spending.

- New program improper payment reporting. (1) Designate all new federal programs distributing more than $100 million in any one fiscal year as “susceptible to improper payments,” and, thus, subject to more timely improper payment reporting requirements; and (2) require agencies to report improper payment information in their annual financial reports.

- Fraud risk management reporting. Reinstate the requirement that agencies report on their antifraud controls and fraud risk management efforts in their annual financial reports. Such reporting will increase congressional oversight to better ensure fraud prevention during normal operations and emergencies.

- Fraud analytics. Establish a permanent analytics center of excellence to aid the oversight community in identifying improper payments and fraud.

- Internal control plans. Require the Office of Management and Budget (OMB) to provide guidance for agencies to develop internal control plans in advance, that can then be put to immediate use for future emergency funding.

- Data sharing. Amend the Social Security Act to accelerate and make permanent the requirement for the Social Security Administration to share its full death data with Treasury's Do Not Pay working system.

- Chief Financial Officer (CFO) authorities. Clarify that agency CFOs have oversight responsibility for internal controls over financial reporting and key financial information; and require agency CFOs to (1) certify the reliability and validity of improper payment risk assessments and estimates and monitor associated corrective action plans, and (2) approve improper payment estimate methodology in certain circumstances.

- USAspending.gov. (1) Clarify the responsibilities and authorities of OMB and Treasury for ensuring the quality of federal spending data available on USAspending.gov, and (2) extend the previous requirement for agency inspectors general to review agency data submissions on a periodic basis.

Collectively, these actions can help agencies distribute funds rapidly while maintaining appropriate safeguards. In addition, these actions will help increase transparency and accountability and strengthen agency efforts to provide proper stewardship of federal funds.

Why GAO Did This Study

During emergencies, federal agencies must distribute relief funds quickly while ensuring appropriate safeguards are in place. GAO noted early in the COVID-19 pandemic that given the urgency of public health needs and economic disruptions, agencies gave priority to swiftly distributing funds and implementing new programs. However, tradeoffs were made that limited progress in achieving accountability goals.

As of November 30, 2022, the government had obligated $4.4 trillion and expended $4.1 trillion, or 97 percent and 89 percent, respectively, of the $4.6 trillion from six COVID-19 relief laws.

Three programs—SBA's PPP and COVID-19 EIDL program, and DOL's UI program—account for a large portion of COVID-19 relief funding. Based on GAO's findings and other audits, GAO added SBA's emergency loans for small businesses issued under PPP and COVID-19 EIDL, and the UI system to its High-Risk List in March 2021 and June 2022, respectively.

This testimony summarizes (1) fraud, improper payments, and accountability deficiencies in COVID-19 relief programs; (2) shortcomings in agencies' fraud risk management practices and internal controls; and (3) the status of recommended actions to improve these practices in the future.

GAO reviewed its prior COVID-19 findings and recommendations on internal controls and fraud risk management practices.

For more information, contact Rebecca Shea at (202) 512-6722 or shear@gao.gov.