Flood Insurance: FEMA's New Rate-Setting Methodology Improves Actuarial Soundness but Highlights Need for Broader Program Reform

Fast Facts

FEMA's National Flood Insurance Program is charged with keeping flood insurance affordable and staying financially solvent. But a historical focus on affordability has led to insurance premiums being lower than they should be. The program hasn't collected enough revenue to pay claims, and has had to borrow billions from the Treasury.

FEMA revamped how it sets premiums in 2021—more closely aligning them with the flood risk of individual properties. But affordability concerns accompany the premium increases some will experience.

We recommended that Congress consider creating a means-based assistance program that's reflected in the federal budget.

Flooding from Hurricane Katrina in New Orleans, LA in 2005

Highlights

What GAO Found

In October 2021, the Federal Emergency Management Agency (FEMA) began implementing Risk Rating 2.0, a new methodology for setting premiums for the National Flood Insurance Program (NFIP). The new methodology substantially improves ratemaking by aligning premiums with the flood risk of individual properties, but some other aspects of NFIP still limit actuarial soundness. For example, in addition to the premium, policyholders pay two charges that are not risk based. Unless Congress authorizes FEMA to align these charges with a property’s risk, the total amounts paid by policyholders may not be actuarially justified, and some policyholders could be over- or underpaying. Further, Congress does not have certain information on the actuarial soundness of NFIP, such as the risk that the new premiums are designed to cover and projections of fiscal outlook under a variety of scenarios. By producing an annual actuarial report that includes these items, FEMA could improve understanding of Risk Rating 2.0 and facilitate congressional oversight of NFIP.

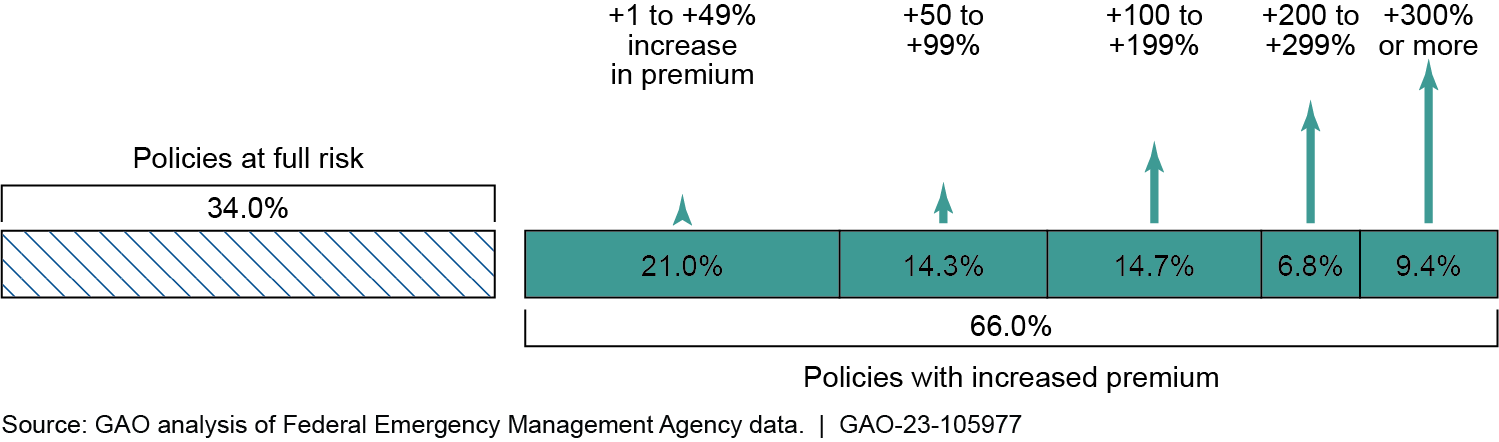

Risk Rating 2.0 is aligning premiums with risk, but affordability concerns accompany the premium increases. FEMA had been increasing premiums for a number of years prior to implementing Risk Rating 2.0. By December 2022, the median annual premium was $689, but this will need to increase to $1,288 to reach full risk. Under Risk Rating 2.0, about one-third of policyholders are already paying full-risk premiums. Many of these policyholders had their premiums reduced upon implementation of Risk Rating 2.0. All others will require higher premiums, including 9 percent who will eventually require increases of more than 300 percent. Further, Gulf Coast states are among those experiencing the largest premium increases. Policies in these states have been among the most underpriced, despite having some of the highest flood risks.

Estimated Premium Changes under Risk Rating 2.0, as of December 2022

Annual premium increases for most policyholders are limited to 18 percent by statute. These caps help address some affordability concerns in the near term, but have several limitations.

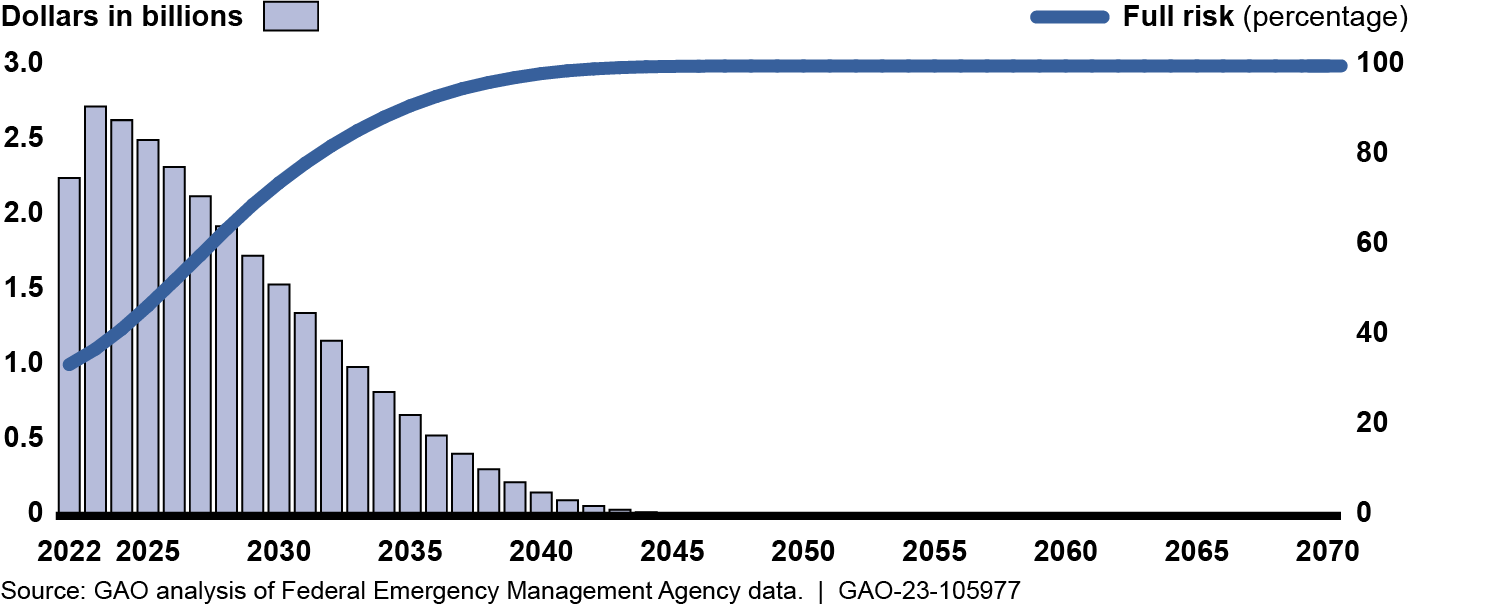

- First, the caps perpetuate an unfunded premium shortfall. GAO estimated it would take until 2037 for 95 percent of current policies to reach full-risk premiums, resulting in a $27 billion premium shortfall (see figure below). The costs of shortfalls are not transparent to Congress or the public because they are not recognized in the federal budget and become evident only when NFIP must borrow from the Department of the Treasury after a catastrophic flood event.

- Second, the caps address affordability poorly. For example, they are not cost-effective because some policyholders who do not need assistance likely are still receiving it. Concurrently, some policyholders needing assistance likely are not receiving it, and the discounts will gradually disappear as premiums transition to full risk.

- Third, the caps keep NFIP premiums artificially low, which undercuts private-market premiums and hinders private-market growth.

An alternative to caps on annual premium increases is a means-based assistance program that would provide financial assistance to policyholders based on their ability to pay and be reflected in the federal budget. Such a program would make NFIP’s costs transparent and avoid undercutting the private market. If affordability needs are not addressed effectively, more policyholders could drop coverage, leaving them unprotected from flood risk and more reliant on federal disaster assistance. Addressing affordability needs is especially important as actions to better align premiums with a property’s risk could result in additional premium increases.

Estimated Premium Shortfall and Percentage of National Flood Insurance Program Policies at Full-Risk Premiums, by Calendar Year

FEMA has had to borrow from Treasury to pay claims in previous years and would have to use revenue from current and future policyholders to repay the debt. NFIP’s debt largely is a result of discounted premiums that FEMA has been statutorily required to provide. In addition, a statutorily-required assessment has the effect of charging current and future policyholders for previously incurred losses, which violates actuarial principles and exacerbates affordability concerns. Even with this assessment, it is unlikely that FEMA will ever be able to repay the debt as currently structured. For example, with the estimated premium shortfalls, repaying the debt in 30 years at 2.5 percent interest would require an annual payment of about $1.9 billion, equivalent to a 60 percent surcharge for each policyholder in the first year. Such a surcharge could cause some policyholders to drop coverage, leaving them unprotected from flood risk and leaving NFIP with fewer policyholders to repay the debt. Unless Congress addresses this debt—for example, by canceling it or modifying repayment terms—and the potential for future debt, NFIP’s debt will continue to grow, actuarial soundness will be delayed, and affordability concerns will increase.

Risk Rating 2.0 does not yet appear to have significantly changed conditions in the private flood insurance market because NFIP premiums generally remain lower than what a private insurer would need to charge to be profitable. Further, certain program rules continue to impede private-market growth. Specifically, NFIP policyholders are discouraged from seeking private coverage because statute requires them to maintain continuous coverage with NFIP to have access to discounted premiums, and they do not receive refunds for early cancellations if they switch to a private policy. By authorizing FEMA to allow private coverage to satisfy NFIP’s continuous coverage requirements and to offer risk-based partial refunds for midterm cancellations replaced by private policies, Congress could promote private-market growth and help to expand consumer options.

Why GAO Did This Study

NFIP was created with competing policy goals—keeping flood insurance affordable and the program fiscally solvent. A historical focus on affordability has led to premiums that do not fully reflect flood risk, insufficient revenue to pay claims, and, ultimately, $36.5 billion in borrowing from Treasury since 2005.

FEMA’s new Risk Rating 2.0 methodology is intended to better align premiums with underlying flood risk at the individual property level.

This report examines several objectives, including (1) the actuarial soundness of Risk Rating 2.0, (2) how premiums are changing, (3) efforts to address affordability for policyholders, (4) options for addressing the debt, and (5) implications for the private market.

GAO reviewed FEMA documentation and analyzed NFIP, Census Bureau, and private flood insurance data. GAO also interviewed FEMA officials, actuarial organizations, private flood insurers, and insurance agent associations.

Recommendations

GAO recommends six matters for congressional consideration. Specifically, Congress should consider the following:

- Authorizing and requiring FEMA to replace two policyholder charges with risk-based premium charges

- Replacing discounted premiums with a means-based assistance program that is reflected in the federal budget

- Addressing NFIP’s current debt—for example, by canceling it or modifying repayment terms—and potential for future debt

- Authorizing and requiring FEMA to revise NFIP rules hindering the private market related to (1) continuous coverage and (2) partial refunds for midterm cancellations

GAO is also making five recommendations to FEMA, including that it publish an annual report on NFIP’s actuarial soundness and fiscal outlook. The Department of Homeland Security agreed with the recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider authorizing and requiring FEMA to incorporate the reserve fund assessment, to the extent necessary based on actuarial principles, into the risk charge within the full-risk premium. (Matter for Consideration 1) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. | |

| Congress should consider repealing the HFIAA surcharge and authorizing and requiring FEMA to replace forgone revenue with actuarially determined premium adjustments. (Matter for Consideration 2) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. | |

| Congress should consider providing any affordability assistance for flood insurance through a means-based program that is reflected in the federal budget rather than through statutorily discounted premiums. Options that Congress might consider include allowing assistance to be used for private policies and shortening or ending the period of discounted premiums for those that do not qualify for assistance. (Matter for Consideration 3) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. | |

| Congress should consider addressing NFIP's legacy and potential future debt and should consider the best means for doing so. Options for addressing the legacy debt include canceling the debt or creating specific repayment terms funded by a transparent premium surcharge. Options for addressing future debt include providing funding to make up for the statutorily-generated premium shortfall, allowing immediate transition to full-risk rates accompanied by a means-based assistance program, changing the financing of catastrophic losses, and enabling FEMA to purchase additional reinsurance. (Matter for Consideration 4) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. | |

| Congress should consider authorizing and requiring FEMA to allow private flood insurance coverage to satisfy NFIP's continuous coverage requirement. (Matter for Consideration 5) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. | |

| Congress should consider authorizing and requiring FEMA to offer risk-based partial refunds for midterm cancellations of NFIP policies that are replaced by private flood insurance policies and authorizing and requiring FEMA to implement these refunds in an actuarially sound manner. (Matter for Consideration 6) | As of September 24, 2024, we have not observed any congressional action that would fulfill this recommendation. We will continue to monitor. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Emergency Management Agency | The Assistant Administrator of FEMA's Federal Insurance Directorate should adjust CRS by calculating a community's rating based only on community activities that reduce flood risk and by incorporating discounts into the full-risk premium based on the actuarial evaluation of risk reduction. (Recommendation 1) |

DHS agreed with our recommendation and stated that FEMA was undertaking a multi-year effort to redesign CRS. In September 2024, FEMA reported that it had developed alternative program designs for CRS and obtained public input on them. FEMA said it will continue to obtain input from external stakeholders and anticipates finalizing the new program design by October 2025 and begin implementing the new program design by December 2027. To fully implement this recommendation, FEMA will need to complete this system redesign. We will continue to monitor the progress DHS makes in implementing this recommendation.

|

| Federal Emergency Management Agency | The Assistant Administrator of FEMA's Federal Insurance Directorate should evaluate other means for incentivizing desirable community activities that cannot be actuarially justified but are currently a basis for discounts in CRS. (Recommendation 2) |

DHS agreed with our recommendation and stated that FEMA was undertaking a multi-year effort to redesign CRS. In September 2024, FEMA reported that it had developed alternative program designs for CRS and obtained public input on them. FEMA said it will continue to obtain input from external stakeholders and anticipates completing its evaluation of evaluating community incentives by August 2025. To fully implement this recommendation, FEMA will need to complete this evaluation. We will continue to monitor the progress DHS makes in implementing this recommendation.

|

| Federal Emergency Management Agency | The Assistant Administrator of FEMA's Federal Insurance Directorate should publish an annual actuarial report that includes the loss levels that full-risk premiums are designed to cover and that current discounted premiums are able to cover, and the associated uncertainty; the estimated premium revenue and shortfall for current and future years; and an evaluation of NFIP's fiscal outlook, including projections of future debt. (Recommendation 3) |

DHS agreed with our recommendation and stated that FEMA would publish its first report by the end of fiscal year 2025. In September 2024, FEMA reported that it is in the process of developing the report and anticipates publishing it in September 2025. To fully implement this recommendation, FEMA will need to complete and publish this report. We will continue to monitor the progress DHS makes in implementing this recommendation.

|

| Federal Emergency Management Agency | The Assistant Administrator of FEMA's Federal Insurance Directorate should take steps to directly inform individual policyholders about Risk Rating 2.0 and make them aware of available information. (Recommendation 4) |

DHS agreed with our recommendation and stated that FEMA would review its policyholder communication products and its public-facing websites. In September 2024, FEMA reported that it had reviewed declaration pages used by Write-Your Own and private insurers. FEMA anticipates publishing a declaration page fact sheet in November 2024 and collecting feedback on the declaration page from NFIP policyholders in January 2025. To fully implement this recommendation, FEMA will need to complete this declaration page fact sheet. We will continue to monitor the progress DHS makes in implementing this recommendation.

|

| Federal Emergency Management Agency | The Assistant Administrator of FEMA's Federal Insurance Directorate should take additional steps to make available to policyholders, agents, or both more detailed property-specific flood risk information to help them better understand the justification for individual premiums and potential savings associated with available mitigation options. (Recommendation 5) |

DHS agreed with our recommendation and stated that FEMA would develop a mitigation discount visualization tool and an online quoting tool. In September 2024, FEMA reported that it had deployed the mitigation discount visualization tool and that it anticipated deploying the online quoting tool by August 2025. To fully implement this recommendation, FEMA will need to complete and implement both tools. We will continue to monitor the progress DHS makes in implementing this recommendation.

|