2022 Tax Filing: Backlogs and Ongoing Hiring Challenges Led to Poor Customer Service and Refund Delays

Fast Facts

For three years, IRS has struggled with a backlog of work. During the 2022 filing season, IRS focused on reducing its correspondence backlog, which left most phone calls from taxpayers unanswered. IRS also prioritized processing its backlog of returns from 2021, but then had more than 12 million returns from 2022 to process as of late September.

IRS hired the staff it needed with the help of a short-term authority that speeds the hiring process. However, most of those staff started working after the filing season ended.

We highlighted 13 related prior recommendations to IRS and Treasury and 3 prior recommendations for Congress to consider.

Highlights

What GAO Found

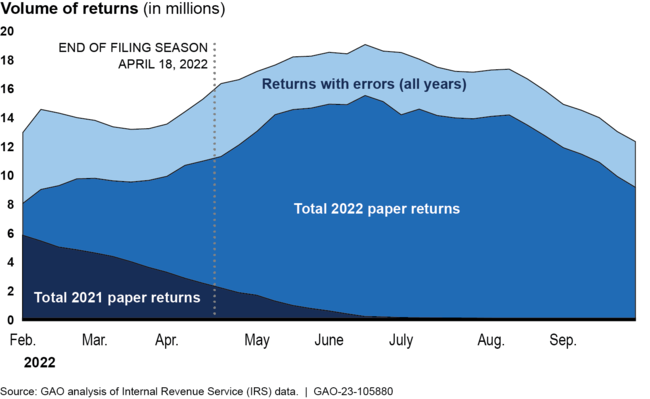

In its third filing season since the COVID-19 pandemic began, the Internal Revenue Service (IRS) prioritized processing its backlog of tax returns but its current inventory of unprocessed returns remains high. At the end of 2021, IRS had a backlog of about 10.5 million paper returns and returns stopped for errors. As shown in the figure, IRS addressed its backlog of 2021 paper returns. However, as of late September 2022, IRS had about 12.4 million returns to process, resulting in refund delays for millions of taxpayers. GAO previously recommended that IRS improve paper processing by digitizing more paper returns and addressing barriers to e-filing.

Total IRS Returns Inventory in Process, February to September 2022

From January to September 2022, IRS reduced its prior year backlog of taxpayer correspondence from about 5 million to about 400,000. IRS used a combination of strategies to work through this inventory, including reassigning staff from answering phones to processing correspondence. However, partly as a result, IRS answered less than one in five calls during the filing season. Addressing GAO's prior recommendation to modernize its online “Where's My Refund” application will help IRS better serve taxpayers and reduce the burden of additional calls and letters on IRS staff.

As of September 2022, IRS met its hiring goals for fiscal year 2022 through a combination of direct and traditional hiring. IRS's direct hire authority allows it to make on-the-spot job offers to applicants. However, this authority did not start until a month after the filing season began. As a result, about 95 percent of direct hires did not start working until after the 2022 filing season ended. IRS officials said their recent hiring efforts will help prepare IRS for a strong 2023 filing season.

Why GAO Did This Study

During the annual tax filing season, IRS processes more than 150 million individual and business tax returns. IRS also provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. Partly as a result of the COVID-19 pandemic, IRS has faced significant return processing backlogs and a decline in customer service since 2020.

GAO was asked to review IRS's performance during the 2022 filing season. This report assesses IRS's performance on (1) processing tax returns, (2) providing customer service to taxpayers, and (3) hiring staff to support filing season operations.

GAO analyzed IRS documents and filing season performance data related to customer service, inventory processing, and hiring. GAO also interviewed cognizant IRS officials.

Recommendations

GAO has previously made 13 recommendations to IRS and the Department of the Treasury, as well as three recommendations to Congress, that could improve returns processing and customer service performance. IRS has taken steps to implement some of its recommendations, but they remain unimplemented. Additionally, one recommendation to Treasury and three recommendations to Congress remain unimplemented. In its letter, IRS summarized actions taken to reduce the current and projected inventory. IRS also stated that the long-term funding provided by the Inflation Reduction Act of 2022 will help improve processing and service during the 2023 filing season.