Financial Stability Oversight Council: Assessing Effectiveness Could Enhance Response to Systemic Risks

Fast Facts

In 2010, the Dodd-Frank Act established the Financial Stability Oversight Council to help identify and respond to emerging threats to the U.S. financial system. Recent bank failures demonstrate the importance of responding to risks before they harm the system.

The council issues an annual report with recommendations—which staff say could address most risks. But we've previously noted that the council's authority—in part, the nonbinding nature of its recommendations—is out of alignment with its mission to respond to systemic problems.

Our recommendations, both prior and new, may help the council respond more effectively to systemic risks.

Highlights

What GAO Found

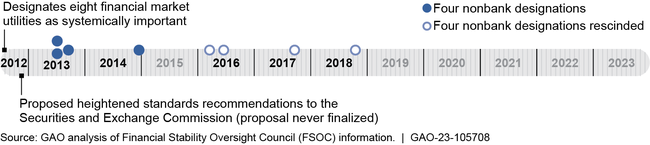

The Financial Stability Oversight Council (FSOC) regularly uses its authority to issue nonbinding recommendations in its annual reports to address financial stability risks. From 2012 through 2014, FSOC used its authority to designate nonbank entities and financial market utilities for additional regulation. It also used its authority to recommend that regulators apply new or heightened standards for certain financial activities or practices once, in 2012. However, FSOC has never used its authority to designate certain activities as systemically important. According to FSOC Secretariat staff, most risks can be addressed through annual report recommendations or other means and thus, FSOC has not used its other authorities in recent years.

FSOC's Use of Selected Authorities, 2012–2023

Limitations in FSOC's authorities may affect its ability to respond to systemic risk. In previous work, GAO highlighted limitations in FSOC's authorities—including the nonbinding nature of its recommendations—and recommended Congress consider legislative changes to align FSOC's authorities with its mission to respond to systemic risks. GAO maintains that aligning FSOC's authorities with its mission to respond to systemic risk would help FSOC respond to risks that its current authorities do not effectively address. In April 2023, FSOC proposed new guidance on its authority to designate nonbank entities for additional regulation. The new guidance would facilitate FSOC's ability to exercise this authority, as well as its authority to apply new or heightened standards for financial activities or practices, because it removed some procedures FSOC was to perform under previous guidance in connection with these authorities. For example, the proposed guidance removed provisions for FSOC to perform cost-benefit analyses before it could use these authorities.

FSOC conducted three internal evaluations of its policies, procedures, and governance structure since 2013, but these reviews do not represent a comprehensive evaluation of all FSOC activities. FSOC does not have a process to determine what aspects of its activities it should evaluate and when. Regular and comprehensive reviews by FSOC on the effectiveness of its policies, procedures, and governance structure could help it identify areas for improvement and thus enhance its ability to respond to systemic risk. For instance, recent bank failures provide FSOC with an opportunity to assess its procedures for identifying and following up on annual report recommendations it made related to interest rate risk, a factor in the failures.

Why GAO Did This Study

The Dodd-Frank Wall Street Reform and Consumer Protection Act created FSOC in 2010 to identify and respond to potential risks to the stability of the U.S. financial system. The act granted FSOC authorities to make recommendations and designate certain entities and activities for additional regulation to allow it to respond to potential risks. Recent bank failures demonstrate the importance of a regulatory system that is able to respond to risks before they cause systemic issues.

This report examines FSOC's authorities to respond to potential threats to financial stability, including (1) how it used its authorities, (2) the extent to which its authorities and procedures support its ability to respond, and (3) the extent to which FSOC has evaluated whether its procedures and governance structure facilitate its ability to respond. GAO analyzed FSOC documents, including annual reports and guidance on the nonbank designation process. GAO also interviewed FSOC Secretariat staff, member agency staffs, and four experts, selected on factors including relevant research.

Recommendations

GAO reiterates its 2016 recommendation (GAO-16-175) that Congress consider legislative changes to align FSOC's authorities with its mission. GAO also recommends that FSOC establish a process for conducting regular and comprehensive reviews of its effectiveness. Treasury partially agreed with the recommendation. GAO maintains the recommendation is valid.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should ensure that FSOC establishes a process for conducting regular and comprehensive reviews of its effectiveness, including the extent to which its policies, procedures, and governance structure facilitate its ability to respond to financial stability risks. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|