Money Market Mutual Funds: Pandemic Revealed Unresolved Vulnerabilities

Fast Facts

During the 2007-2009 financial crisis, investors in money market mutual funds "ran"—cashed in their shares at the same time—to avoid losses. In 2014, SEC tried to prevent runs by revising its rules. The change allowed funds to impose a "gate" to temporarily block investors' access to shares if the funds were low on cash and assets easily sold for cash.

But during the pandemic, investors ran again—with many cashing in shares to avoid a potential gate.

In 2022, SEC proposed a rule that could reduce run risk—partly by removing gates—and provide more data to monitor risks at these funds. SEC plans to finalize the rule in April 2023.

Highlights

What GAO Found

In 2010 and 2014, the Securities and Exchange Commission (SEC) revised its money market mutual fund (MMF) rules after some MMFs experienced runs (heavy redemptions) during the 2007–2009 financial crisis. For example, SEC required MMFs to hold minimum levels of liquid assets that they could sell to meet redemptions. If these liquidity levels fell below the minimum, SEC allowed certain MMFs to charge investors a liquidity fee for redeeming shares or to impose a redemption gate to temporarily suspend redemptions.

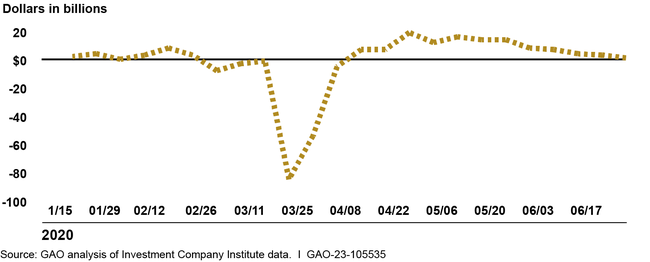

Evidence indicates that SEC's reforms did not prevent runs during the COVID-19 pandemic. For example, prime MMFs—which can invest in all types of short-term debt instruments—held by institutional investors experienced net redemptions of about 30 percent of their total assets in a 2-week period in March 2020 (see figure). Some evidence also indicates SEC's reforms may have contributed to the runs. Some investors may have preemptively redeemed MMF shares to avoid incurring a liquidity fee or losing access to their funds under a redemption gate. To stabilize the financial system during the pandemic, the federal government created lending and liquidity programs, including one to help support prime and tax-exempt MMFs.

Change in Total Net Assets of Prime Money Market Mutual Funds, January–June 2020

In February 2022, SEC proposed a rule intended to reduce run risk by removing fees and gates, increasing minimum liquidity requirements, and adopting a new method to price certain MMF shares. Industry, academic, and other stakeholders generally support removing the link between gates and fees and minimum liquid asset levels and increasing minimum liquidity requirements. Moreover, a few stakeholders maintain that the proposed new pricing method could reduce run risk, but stakeholders generally have raised concerns about the method's complexity and cost. Consistent with its guidance, SEC staff conducted economic analyses to support the proposed rulemaking. The analyses were largely qualitative because SEC does not have data to quantify most of the proposed rule's benefits and costs. As part of the rulemaking, SEC has proposed amending an MMF reporting form, which could provide it with additional data to monitor run risk at MMFs. SEC currently plans to complete the rulemaking in April 2023.

Why GAO Did This Study

The COVID-19 pandemic highlighted the ongoing vulnerability of certain MMFs to runs. Currently holding around $5 trillion in assets, MMFs act as intermediaries between investors seeking liquid, safe investments and corporate and government entities that issue short-term debt. If investors perceive a risk that their MMFs will suffer losses, they have an incentive to be the first to redeem their shares. A run on MMFs can spread to other entities and financial markets because MMFs are interconnected to financial firms, the financial system, and the economy.

The CARES Act and the American Rescue Plan Act included provisions for GAO to monitor the federal government's efforts to respond to the COVID-19 pandemic. This report reviews (1) SEC's reforms designed to reduce run risk at MMFs exposed by the 2007–2009 financial crisis, (2) available evidence on the effectiveness of MMF reforms in reducing run risk during the pandemic, and (3) current actions SEC is taking to reduce run risk at MMFs.

GAO reviewed studies and reports by federal agencies and other stakeholders about the vulnerability of MMFs to runs, analyzed MMF data on changes in fund assets, and reviewed SEC rule releases and related materials. GAO also interviewed officials from SEC and other federal agencies, three industry associations, and three MMFs.

For more information, contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.