Emergency Rental Assistance: Treasury's Oversight is Limited by Incomplete Data and Risk Assessment

Fast Facts

Through the $46 billion Emergency Rental Assistance program, the Department of the Treasury helps those who can't pay rent due to the COVID-19 pandemic. Third party studies and eviction data suggest that the program has helped limit evictions.

But Treasury doesn't have complete data on payments or recipients. For example, Treasury is missing data on 26% of payments made to households in 2021. In addition, the agency hasn't fully assessed the risks of potential misuse of funds—like paying ineligible recipients.

We recommended Treasury improve its data collection and complete a detailed risk assessment.

Highlights

What GAO Found

The Department of the Treasury administers the Emergency Rental Assistance (ERA) program, which provides nearly $46.55 billion to tribal, state, territorial, and local governments (grantees) to help low-income households affected by the COVID-19 pandemic pay rent and utilities. By June 2021—5 months into the program—about one-quarter of grantees had not made any payments. Multiple factors contributed to payment delays, based on GAO's interviews with grantees and review of their documentation. These factors included limited grantee staff and technology resources, gathering information for tenant eligibility determinations, and unclear program guidance. Grantees had spent less than half of the available funding by Treasury's deadline to begin reallocating excess funds (September 30, 2021).

Treasury's reallocation of excess funds did not consistently align with renters' needs. Rebalancing the distribution of funds was critical to maximizing their use because renters' needs and grantees' capacity to deliver assistance varied across states. Treasury reallocated about $3.1 billion in ERA1 funds by the end of October 2022, but its prioritization of transfers between grantees in the same state limited its ability to address large funding differences across states and better align payments to the needs of renters and grantee capacity.

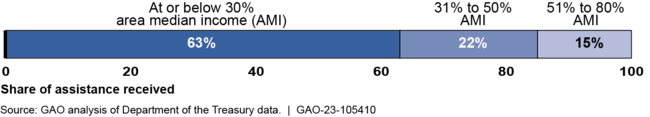

Available data suggest that ERA payments served low-income renters and varied to meet local needs. According to limited Treasury data, 85 percent of households served by the first ERA appropriation had incomes below 50 percent of the area median, consistent with a legal requirement to prioritize such renters. Data also suggest grantees used funds to address local needs. Households received larger average payments in urban areas ($7,200) than in rural areas ($5,200) and in counties with higher rents and more rent-burdened households.

Emergency Rental Assistance (ERA1) Distribution by Income Level, Quarter 4, 2021

Oversight of the ERA program would benefit from improved data collection and assessment of improper payment risks. Although Treasury has taken recent steps to improve data collection and reporting, including issuing detailed final reporting requirements, to date the agency has not collected or reported complete data as required by the authorizing statute. Without better data collection and reporting, Congress and Treasury will lack information on the program's outcomes. And although Treasury completed a required assessment of improper payment risks for the program, the assessment focused on allocations to grantees and did not address missing payment data and potentially duplicative payments to households. Without a more detailed assessment of improper payment risks, Treasury's awareness of such risks and oversight of the ERA program will be limited.

Why GAO Did This Study

Congress twice authorized funding for the ERA program in response to financial and housing instability resulting from the COVID-19 pandemic. Because of the emergency nature and expedited implementation of the program, Treasury had to develop program guidance and oversight procedures as grantees were beginning to make payments. GAO previously reported on the program's early implementation challenges and the need for effective oversight of grantees and payments.

The CARES Act includes a provision for GAO to monitor federal efforts to respond to the COVID-19 pandemic. This report examines (1) factors that affected the timeliness of ERA payments, (2) reallocation of excess ERA funds, (3) ERA recipient and grantee spending characteristics, and (4) Treasury's ERA data collection and oversight efforts.

GAO analyzed ERA payment and demographic data, as well as reallocation documentation; reviewed relevant federal laws and agency documentation; and interviewed officials from Treasury and 21 grantees selected based on expenditures, government type, and geography.

Recommendations

GAO is making three recommendations to Treasury to complete a detailed assessment of improper payment risks and improve ERA data collection and reporting. Treasury agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury |

Priority Rec.

The Chief of the Office of Recovery Programs should expediently collect complete and accurate data, including quarterly payment data and performance measures required by the Consolidated Appropriations Act, 2021. (Recommendation 1) |

As of April 16, 2024, Treasury had not taken sufficient action to address this recommendation.

|

| Department of the Treasury | The Chief of the Office of Recovery Programs should expediently publish complete ERA program data, including all required disaggregated performance measures required by the Consolidated Appropriations Act, 2021, for all applicable quarters from program inception through the end of the award performance period. Such reporting should include information necessary for determining data quality, such as the rate of missing or erroneous data for key data elements. (Recommendation 2) |

As of April 16, 2024, Treasury had not taken action to address this recommendation.

|

| Department of the Treasury |

Priority Rec.

The Chief of the Office of Recovery Programs should complete a detailed assessment of the ERA program's susceptibility to improper payments, such as a quantitative analysis that incorporates grantee payment data and other relevant data sources. (Recommendation 3) |

As of April 16, 2024, Treasury had not taken sufficient action to address this recommendation.

|