Retirement Plans: Improved Communication Needed on Church Plan Eligibility for Federal Insurance Coverage

Fast Facts

We examined "church plans"—retirement plans sponsored by religious organizations such as denominations, hospitals, or schools.

Church plans are exempt from many federal retirement plan requirements, such as ensuring enough money will be available in the plan to pay benefits. These plans generally are ineligible for federal insurance, but we found some that may be paying premiums for it anyway. We recommended that the Pension Benefit Guaranty Corporation—the federal insurer—tell these plans they may be ineligible.

We also reviewed lawsuits in which church plan participants alleged losing benefits. Some settlements helped reinstate lost benefits.

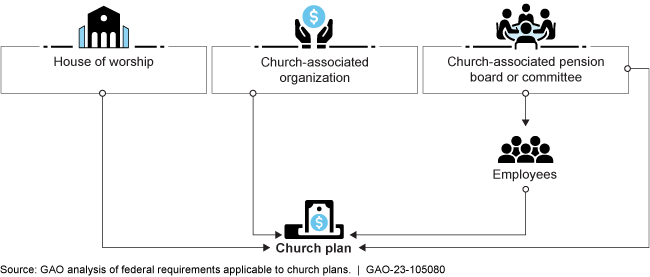

Types of Organizations Typically Involved in Church Plans

Highlights

What GAO Found

Church plans are retirement plans sponsored by a church or church-associated organization. Because sponsors of church plans are generally exempt from reporting requirements in the Employee Retirement Income Security Act of 1974 (ERISA), available data are limited. According to an Internal Revenue Service (IRS) analysis of 2019 tax filings, the most current data available at the time of our analysis, nearly 33,000 church employers reported plan contributions from 589,000 participants. These data do not include church-associated entities, such as hospitals or schools. GAO obtained documentation from selected church plan sponsors and administrators for 2018-2022 showing these plans held over $89 billion in assets. Employers in church-associated healthcare and education organizations also offer these plans. Officials representing four denominations said the ERISA church plan exemption provided certain flexibilities, such as using religious doctrines to help guide their investments.

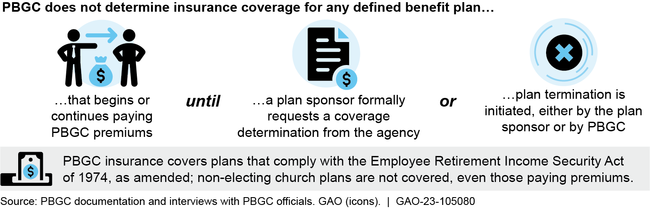

Federal involvement with church plans is limited; states can also provide oversight. The IRS, if asked by a sponsor, can determine if a plan qualifies as a church plan. Church plans are generally ineligible for federal insurance from the Pension Benefit Guaranty Corporation (PBGC). However, GAO identified 120 potential church plans that paid PBGC premiums in 2018. PBGC determined the eligibility of 11 of these plans, which it does generally at the plan's request (see fig.). Despite possibly not insuring these plans, PBGC does not communicate with potential church plan sponsors that they may be paying premiums in error. Until PBGC takes steps to preemptively contact potential church plans that pay premiums to the agency, these plans may continue to pay premiums erroneously and remain unaware of their potential ineligibility for PBGC insurance. For church plans that are exempted from ERISA, states can have a potential role in their oversight. GAO found that two of the states in its review reported enacting laws that apply to church plans.

Pension Benefit Guaranty Corporation (PBGC) Policy Determining Defined Benefit Plan Insurance Coverage

Expected outcomes for church plan participants varied among the selected bankruptcy cases and settlement agreements GAO reviewed. In the bankruptcy cases reviewed, participant benefits were expected to be protected and kept whole at pre-bankruptcy levels to the extent they were funded and vested at the time their employer filed for bankruptcy. In the settlement agreements reviewed, participants who had allegedly lost benefits pursued litigation to compel sponsors to sufficiently fund their church plans. Settlements in these cases awarded money to participants to help protect their benefits and in some cases included agreements to provide participants financial disclosures similar to those required by ERISA.

Why GAO Did This Study

Church plans are generally exempt from most ERISA requirements, including rules to fund plans, disclose information, and insure benefits. Media reports have described retirees losing benefits because their church plan was underfunded and uninsured. GAO was asked to review church plans. This report addresses (1) data available on church plans and plan administration, (2) federal and state roles regarding church plans, and (3) expected outcomes for participant benefits from church plan litigation.

GAO analyzed aggregated tax data, federal employer data, and data provided by church plan sponsors and administrators; reviewed relevant federal laws, regulations, and agency guidance; and selected five states for review, based in part on states' oversight activity of church plans. GAO also conducted a non-generalizable review of four cases where employers provided a church plan and filed for bankruptcy between 2005 and 2021; and reviewed three settled civil lawsuits brought by church plan participants who alleged underfunding and benefit cuts by the sponsor and that had settlement agreements approved by the court. GAO interviewed officials from churches and denominations and from federal and state agencies, and industry experts.

Recommendations

GAO recommends PBGC preemptively communicate with potential church plans to inform them of federal rules governing their plans and eligibility for insurance coverage under federal law. PBGC concurred and described actions to address the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Pension Benefit Guaranty Corporation | The Director of the Pension Benefit Guaranty Corporation should direct the agency to preemptively communicate with any defined benefit plan that appears to be sponsored by a church or controlled by or associated with a church organization and that is reporting on the Form 5500 and paying benefit insurance premiums, to provide the plan sponsor information describing requirements applicable to governing church plans. This could include actions such as informing these sponsors that their plan may be a church plan as described in the Employee Retirement Income and Security Act of 1974, as amended, and that if found to be a church plan, that refunds are only available for 6 years of premium payments. PBGC also could refer these sponsors to the PBGC website's guidance on benefit insurance coverage, and could suggest these sponsors share this information with participants and seek professional advice about the legal status of their plan. (Recommendation 1) |

PBGC agreed with and implemented this recommendation. As of March 2024, PBGC sent out informational letters to 46 potential church plans identified during the review process. The letter provided plans with information on federal rules governing church plans and referred plans to seek professional advice on the legal status of their plan and to request that IRS provide a public letter ruling on the matter. For plans ultimately deemed church plans, the letter also provided instructions on how to obtain PBGC coverage or refunds for premiums paid in error. In addition, PBGC confirmed it will send the letter to new premium filers each year, identified during the agency's annual review process, who have one of the key words used by GAO and that the agency cannot eliminate based on several criteria, such as plans that are not paying PBGC premiums or are already terminated.

|