Blockchain: Emerging Technology Offers Benefits for Some Applications but Faces Challenges

Fast Facts

Blockchain combines several technologies to provide a tamper-resistant record of transactions between parties without a central authority, such as a bank.

Although cryptocurrency is the best known use, blockchain has potential non-financial uses. For example, it could be used to manage supply chains, create less hierarchical organizations, and document real estate title transfers.

This report also highlights potential benefits and challenges of blockchain. Data privacy, energy consumption, and regulatory uncertainty are key concerns. We present policy options for oversight, standard-setting, and more.

There are potential applications for blockchain in supply chains, financial services, digital IDs, and more

Highlights

What GAO Found

Blockchain combines several technologies to provide a trusted, tamper-resistant record of transactions by multiple parties without a central authority such as a bank. Blockchain can be used for a variety of financial and non-financial applications, including cryptocurrency, supply chain management, and legal records. GAO found that blockchain is useful for some applications but limited or even problematic for others. For example, because of its tamper resistance, it may be useful for applications involving many participants who do not necessarily trust each other. But it may be overly complex for a few trusted users, where traditional spreadsheets and databases may be more helpful. Blockchain may also present security and privacy challenges and can be energy-intensive.

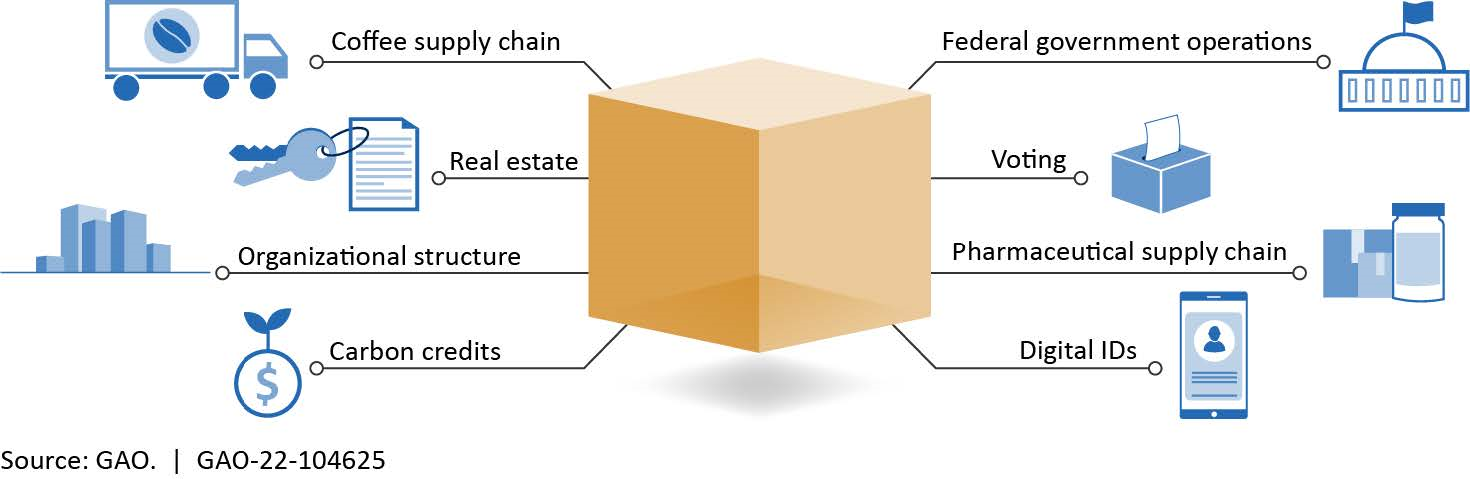

Blockchain has a wide range of potential non-financial uses (see figure).

Blockchain has many potential non-financial applications

For example, it could be used to organize supply chains, create less hierarchical organizations, and document title registries for real estate. However, most such efforts are not yet beyond the pilot stage and face challenges. For example, most blockchain networks are not designed to be interoperable and cannot communicate with other blockchains. Organizations that want to use blockchain also face legal and regulatory uncertainties, and have found it difficult to find skilled workers to implement blockchain.

Financial applications of blockchain have the potential to reduce costs and improve access to the financial system, but they also face multiple challenges. Cryptocurrencies, likely the most widely known application, are a digital representation of value protected through cryptographic mechanisms, which facilitates payments. Some are known for volatility (i.e., frequent or rapid changes in value), but a type known as stablecoins may help reduce this risk. Similarly, an emerging area known as decentralized finance offers services such as blockchain-based lending and borrowing, which also face several challenges. For example, blockchain-based financial applications can facilitate illicit activity, may reduce consumer and investor protections compared to traditional finance, and, in some cases, are subject to unclear and complex rules.

GAO developed four policy options that could help enhance benefits or mitigate challenges of blockchain technologies. The policy options identify possible actions by policymakers, which may include Congress, federal agencies, state and local governments, academic and research institutions, and industry. In addition, policymakers could choose to maintain the status quo, whereby they would not take additional action beyond any current efforts. See below for details of the policy options and relevant opportunities and considerations.

Policy Options That Could Help Enhance Benefits or Mitigate Challenges of Blockchain Technologies

| Opportunities | Considerations | |

|

Standards (report p. 38)

|

|

|

|

Oversight (report p. 39)

|

|

|

|

Educational materials (report p. 40)

|

|

|

|

Appropriate uses (report p. 41)

|

|

|

Source: GAO. | GAO-22-104625

Why GAO Did This Study

Economies rely on central authorities and trusted intermediaries to facilitate business transactions. Blockchain is a technology that could reduce the need for such entities while establishing a system of verification. It might therefore improve a variety of financial and non-financial applications. However, the use of blockchain technologies raises a variety of ethical, legal, economic, and social concerns.

GAO was asked to conduct a technology assessment on the use of blockchain, with an emphasis on foresight and policy implications. This report discusses (1) non-financial applications of blockchain, including potential benefits and challenges, (2) financial applications of blockchain, including potential benefits and challenges, and (3) policy options that could help enhance benefits or mitigate challenges of blockchain technologies.

GAO assessed blockchain applications developed for or used in finance, government, supply chain management, and organization management; interviewed a range of stakeholder groups including government, industry, academia, and a venture capital firm; convened a meeting of experts in collaboration with the National Academies of Sciences, Engineering, and Medicine; and reviewed key reports and scientific literature. GAO is identifying policy options in this report.

For more information, contact Karen L. Howard at (202) 512-6888 or howardk@gao.gov.