Financial Audit: Bureau of the Fiscal Service's FY 2021 and FY 2020 Schedules of Federal Debt

Fast Facts

Treasury's Fiscal Service issues debt to borrow money for federal operations, and reports the debt on financial statements called the Schedules of Federal Debt.

As of Sept. 30, 2021, the federal debt was $28.4 trillion—up $1.5 trillion from 2020, due largely to the pandemic response.

We audit and issue opinions annually on the Schedules and on related internal controls (e.g., processes to reasonably assure that transactions are properly authorized and recorded).

In FY21, we found the Schedules were reliable and that controls over financial reporting were effective—although some information system controls could be improved.

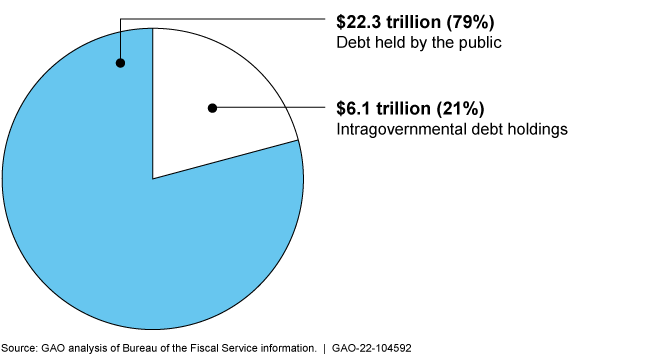

2021 Federal Debt of the U.S. Government

Highlights

What GAO Found

GAO found (1) the Bureau of the Fiscal Service's Schedules of Federal Debt for fiscal years 2021 and 2020 are fairly presented in all material respects, and (2) although internal controls could be improved, Fiscal Service maintained, in all material respects, effective internal control over financial reporting relevant to the Schedule of Federal Debt as of September 30, 2021. GAO's tests of selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt disclosed no instances of reportable noncompliance for fiscal year 2021. Although Fiscal Service made some progress in addressing previously reported control deficiencies, unresolved information system control deficiencies continued to represent a significant deficiency in Fiscal Service's internal control over financial reporting, which although not a material weakness, is important enough to merit attention by those charged with governance of Fiscal Service.

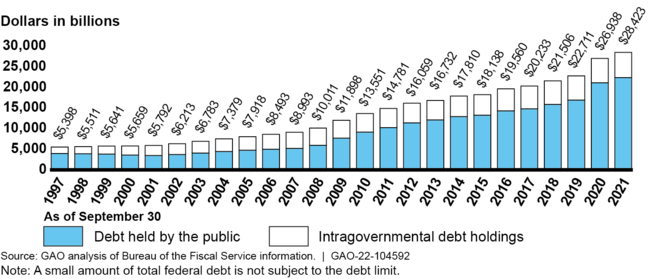

From fiscal year 1997, GAO's first year auditing the schedules, through September 30, 2021, total federal debt managed by Fiscal Service has increased from $5.4 trillion to $28.4 trillion, and the debt limit has been raised 21 times.

Total Federal Debt Outstanding, September 30, 1997, through September 30, 2021

During fiscal year 2021, total federal debt increased by $1.5 trillion, with debt held by the public increasing by $1.3 trillion, and intragovernmental debt holdings increasing by $0.2 trillion. The main factor for the increase in debt held by the public was the reported $2.8 trillion federal deficit in fiscal year 2021, which was due primarily to economic disruptions caused by COVID-19 and federal spending in response. The increase in debt held by the public was less than the deficit primarily because of a $1.6 trillion decrease in the government's cash balance.

Due to delays in raising the debt limit during fiscal year 2021, the Department of the Treasury deviated from its normal debt management operations and took extraordinary actions—consistent with relevant laws—to avoid exceeding the debt limit. Delays in raising the debt limit have created disruptions in the Treasury market and increased borrowing costs. To improve federal debt management and place the government on a sustainable long-term fiscal path, GAO has previously suggested that Congress consider establishing a long-term plan that includes alternative approaches to the debt limit, and fiscal rules and targets.

Why GAO Did This Study

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the federal debt to the government-wide financial statements, GAO audits Fiscal Service's Schedules of Federal Debt annually to determine whether, in all material respects, (1) the schedules are fairly presented and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedule of Federal Debt. Further, GAO tests compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

Federal debt managed by Fiscal Service consists of Treasury securities held by the public and by certain federal government accounts, referred to as intragovernmental debt holdings. Debt held by the public primarily represents the amount the federal government has borrowed to finance cumulative cash deficits and is held by investors outside of the federal government—including individuals, corporations, state or local governments, the Federal Reserve, and foreign governments. Intragovernmental debt holdings represent balances of Treasury securities held by federal government accounts—primarily federal trust funds such as Social Security and Medicare—that typically have an obligation to invest their excess annual receipts (including interest earnings) over disbursements in federal securities.

In commenting on a draft of this report, Fiscal Service concurred with GAO's conclusions.

For more information, contact Cheryl E. Clark at (202) 512-3406 or clarkce@gao.gov.