Steel and Aluminum Tariffs: Commerce Should Update Public Guidance to Reflect Changes in the Exclusion Process

Fast Facts

In 2018, the President imposed tariffs on many steel and aluminum imports, and told the Department of Commerce to allow companies to request relief from paying these tariffs in certain circumstances.

In 2020, Commerce made changes to its procedures for deciding such "tariff exclusion requests." For instance, the agency established general tariff exclusion for certain products so that some importers no longer have to apply for case-by-case approval. However, Commerce's public guidance has not been updated to reflect these changes.

We recommended that Commerce regularly update its public guidance to reflect changes to its process.

Highlights

What GAO Found

In 2020, Commerce made numerous changes to its procedures for deciding requests for relief, or exclusion, from steel and aluminum tariffs. For instance, the agency established general tariff exclusion for certain products, so that some importers no longer have to apply for case-by-case approval. However, Commerce's public guidance does not reflect the changes because it has not been updated since June 2019, and the agency has no process to review and update its guidance as needed. For example, the guidance does not state that domestic producers who object to a tariff exclusion request may have more time than previously allowed to supply comparable products. Without regularly updated public guidance, importers and producers may not be informed of important details about the process, which could lead to challenges and delays for eligible requesters and potential objectors.

Commerce has rejected a lower percentage of exclusion requests for containing errors since launching its Exclusion Portal website in June 2019: 10 percent of requests compared with 18 percent of requests submitted to Regulations.gov. Rejected requests typically include incorrect or incomplete information. Nevertheless, more than 22,000 requests submitted to the Exclusion Portal have been rejected for such errors, which means importers must submit new requests and wait longer for relief. Commerce stated that it plans to further reduce the rejection rate by adding features to the Exclusion Portal to prevent these errors.

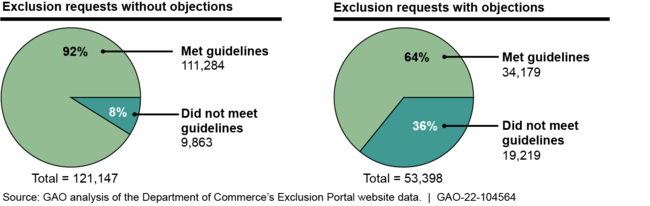

Commerce has improved its timeliness since the introduction of the Exclusion Portal. More than 80 percent of all requests are now decided within its timeliness guidelines, and the agency reduced its backlog of undecided requests. However, many requests that received objections are still not decided within those guidelines, as shown in the figure. Also, Commerce's public guidance does not reflect the time it takes Commerce to decide many requests. Although Commerce states in its public user guide that most requests will be decided within 90 days, Commerce on average took 143 days to decide requests with objections. Requests without objections were decided in about 45 days, half of the publicly posted time frame. Commerce has not assessed and updated its guidance concerning timeliness since 2019. As a result, the public lacks accurate information about how long Commerce takes to make a decision, increasing business uncertainty for those submitting and objecting to requests.

Department of Commerce Decisions on Tariff Exclusion Requests, with and without Objections, That Met Its Established Timeliness Guidelines as of June 2021

Why GAO Did This Study

Citing national security concerns over excess global supply of steel and aluminum, in March 2018 the President placed tariffs on the import of some products under Section 232 of the Trade Expansion Act of 1962. Commerce established a process to provide relief, or exclusion, from the tariffs for importers of eligible products. Commerce originally accepted exclusion requests through the website Regulations.gov, but in June 2019 launched a custom-built website, the Exclusion Portal, for these requests.

GAO was asked to review Commerce's Section 232 tariff exclusion process, and previously reported on exclusion requests submitted to Regulations.gov in GAO-20-517. This current report examines the process since the launch of the Exclusion Portal; specifically: (1) changes to the procedures Commerce uses to decide tariff exclusion requests, and the guidance it provides; (2) the extent to which Commerce rejects requests because of errors; and (3) the timeliness of its decisions.

GAO analyzed records from March 2018 to June 2021 from Commerce's Bureau of Industry and Security and International Trade Administration, and interviewed agency officials.

Recommendations

GAO is making two recommendations for Commerce to establish policies to regularly update its public guidance to incorporate changes in procedures and reflect its decision-making time frames. Commerce concurred with both recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Commerce | The Secretary of Commerce should ensure that the Acting Under Secretary of Commerce for Industry and Security creates a policy to regularly review and update the public Section 232 exclusion process guidance. (Recommendation 1) |

The Department of Commerce agreed with this recommendation and stated that it would work to conduct an overarching review of existing public guidance regarding the Section 232 Exclusion Process to update current guidance as needed. As of September 2024, Commerce officials stated that they planned to issue guidance in 2024 addressing the issues that GAO has raised. Presidential Proclamations 10895 and 10896 implemented changes to the Section 232 Steel and Aluminum process, including the termination of the tariff exclusions. According to Commerce, the Department is no longer accepting or considering new or pending Section 232 exclusion requests as of February 10, 2025. As a result, this recommendation is overtaken by events and GAO has closed the recommendation as no longer valid as of April 2025.

|

| Department of Commerce | The Secretary of Commerce should ensure that the Acting Under Secretary of Commerce for Industry and Security creates a policy to regularly assess and update its public guidance to ensure that it is consistent and accurately reflects the time the agency takes to decide exclusion requests. (Recommendation 2) |

The Department of Commerce agreed with this recommendation and stated that it would work to update published average timeframes for decisions as part of an overarching review of existing public guidance regarding the Section 232 Exclusion Process. As of September 2024, Commerce officials stated that they planned to issue guidance in 2024 addressing the issues that GAO has raised. Presidential Proclamations 10895 and 10896 implemented changes to the Section 232 Steel and Aluminum process, including the termination of the tariff exclusions. According to Commerce, the Department is no longer accepting or considering new or pending Section 232 exclusion requests as of February 10, 2025. As a result, this recommendation is overtaken by events and GAO has closed the recommendation as no longer valid as of April 2025.

|