Real Estate Appraisals: Most Residential Mortgages Received Appraisals, but Waiver Procedures Need to Be Better Defined

Fast Facts

While automated tools to assess home values are becoming more common, federally regulated banks and credit unions still obtain appraisals from state-credentialed appraisers for most home loans to protect themselves and borrowers.

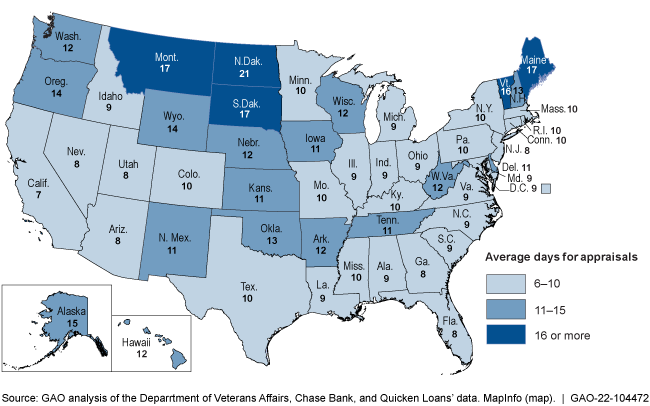

North Dakota asked to temporarily allow appraisals from non-credentialed appraisers, citing significant loan delays and appraiser scarcity. Uncertainty about the definitions of "significant delays" and "scarcity"—and the standards for proving them—made it hard to determine whether to grant the request.

Our recommendation addresses this issue.

Average Number of Days for Completing a Residential Real Estate Appraisal, by State, in 2018

Highlights

What GAO Found

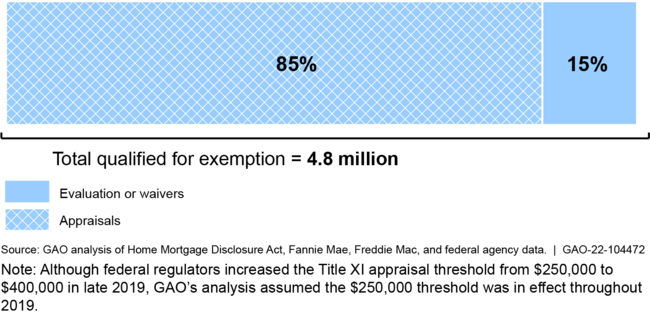

Although Title XI permits federal regulators to exempt certain mortgages from an appraisal requirement, such exemptions likely have not increased overall risks for regulated lenders (e.g., banks and credit unions) and homebuyers. This is because GAO estimates the lenders obtained appraisals for around 85 percent of the mortgages eligible for an exemption in 2018–2019 (see figure). An appraisal of a home's market value can help lenders mitigate the risk of loss and homebuyers mitigate the risk of overpaying. Regulated lenders obtained appraisals even when not required by Title XI for various reasons. For example, Fannie Mae and Freddie Mac generally require appraisals for mortgages they purchase from lenders, so lenders obtained appraisals in order to sell mortgages to them. In addition, regulated lenders typically obtained appraisals for mortgages of $250,000 or less, although they were permitted to use an evaluation (an estimate of a home's market value not conducted by a state-approved appraiser) in place of an appraisal.

Most Residential Mortgages Originated in 2018–2019 That Qualified for a Title XI Appraisal Exemption Still Had an Appraisal

The Appraisal Subcommittee (ASC) followed its process in granting a waiver to North Dakota in 2019 but faced challenges in making the determination. ASC may temporarily waive the requirement that only state-approved appraisers perform Title XI appraisals if it determines a scarcity of appraisers led to a significant delay in obtaining appraisals. However, ASC's regulations and guidance for processing temporary waiver requests do not define scarcity and significant delay or establish standards to determine when these conditions exist. For North Dakota's request, the absence of such standards led different stakeholders to use different definitions and data to prove or disprove the conditions existed—creating challenges for ASC in making its determination. Defining the key terms in measurable ways and establishing standards to determine if such conditions exist would better ensure that ASC has a consistent and objective process for reviewing and granting future waiver requests.

Why GAO Did This Study

Congress enacted Title XI in the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 to require regulated lenders to obtain appraisals for residential mortgages from state-approved appraisers, unless eligible for one of its exemptions. Title XI also created ASC to monitor Title XI-related activities and authorized it to grant waivers related to appraiser credentialing requirements. In late 2019 and early 2020, federal regulators raised the threshold under which lenders can (but do not have to) obtain an evaluation instead of an appraisal for mortgages to $400,000 or less. Also, in 2018, North Dakota requested a temporary waiver, citing delays in appraisals because of a scarcity of appraisers.

GAO was asked to review Title XI exemptions. This report examines the extent to which (1) Title XI appraisal exemptions increased risks for federally regulated lenders and homebuyers, and (2) ASC followed its waiver review process or faced challenges when it granted North Dakota a temporary waiver.

GAO reviewed and analyzed Title XI and related regulations, most recently available mortgage data, research on appraisals, and ASC records, and interviewed federal agencies and industry stakeholders.

Recommendations

GAO recommends that ASC define appraiser scarcity and significant delay in measurable ways and establish standards that ASC can use to objectively determine whether these conditions exist. ASC generally agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Appraisal Subcommittee | The Chairman of ASC should define appraiser scarcity and significant delay, so that these conditions can be consistently measured, and establish standards to objectively determine whether these conditions exist. These actions could be taken by revising regulations or by developing other procedures. (Recommendation 1) |

In October 2022, the Appraisal Subcommittee (ASC) issued a final rule to amend its procedures governing temporary waiver proceedings and include definitions for the terms "appraisal scarcity" and "significant delay." In its proposed rule, ASC defined scarcity and delay, but two commenters noted that the two definitions lacked the specificity needed to be consistently measured or objectively determined as we recommended. In its final rule release, ASC noted it considered the comments and determined that more precise definitions would limit ASC's flexibility in making waiver determinations. Instead, ASC noted that it included new or revised definitions and interpretations of terms in the final rule to provide more clarity on the processing of a waiver request. As of February 2024, ASC had not taken any additional actions to address our recommendation. We will continue to monitor ASC's efforts in this area.

|