U.S. Territories: Public Debt Outlook – 2021 Update

Fast Facts

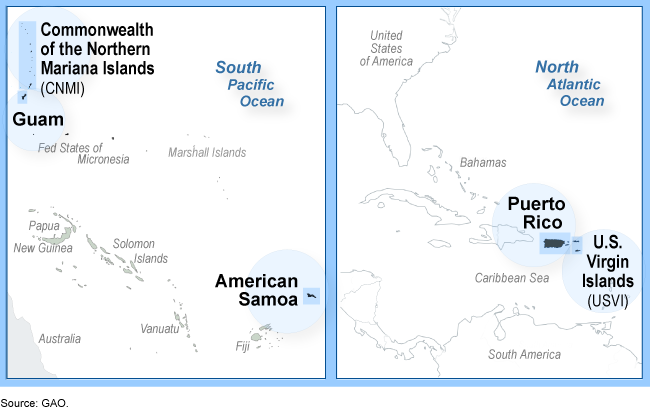

The 5 permanently inhabited U.S. territories borrow through financial markets to fund infrastructure projects and government operations. We review the territories' public debt every 2 years.

We found that outstanding public debt has increased relative to the size of the economy in Puerto Rico, American Samoa, and the U.S. Virgin Islands. Debt in the Commonwealth of the Northern Mariana Islands remained constant, and Guam's debt decreased slightly.

Most of these territories rely on tourism—an industry hurt by the COVID-19 pandemic. Further, natural disasters, such as hurricanes, have limited economic growth in these territories in recent years.

Map of the U.S. Territories

Highlights

What GAO Found

Commonwealth of Puerto Rico (Puerto Rico): Puerto Rico remains in default. It has finalized three debt restructuring agreements or settlements to date, pursuant to three distinct legal approaches, and it is using one of these approaches to restructure additional debt. Puerto Rico's total public debt outstanding as a share of Gross National Product increased slightly from 93 to 95 percent between fiscal years 2016 and 2017, the most recent year for which audited financial data are available. Puerto Rico's total revenue remained consistent between fiscal years 2016 and 2017 at about $30.0 billion and the territory operated with a $3.1 billion deficit in fiscal year 2017. Puerto Rico's future capacity for debt repayment depends primarily on the outcomes of the ongoing debt restructuring process, its ability to generate sustained economic growth, and the disbursement of federal funding.

American Samoa: American Samoa's total public debt outstanding as a share of Gross Domestic Product (GDP) increased from 19 to 37 percent between fiscal years 2017 and 2019. This increase was partially due to a series of general revenue bonds issued in late 2018 to fund infrastructure projects. During this period, American Samoa's yearly total revenue fluctuated but was 24 percent higher in fiscal year 2019 compared to fiscal year 2017, and the territory had a surplus of $34.0 million in fiscal year 2019. Continued reliance on a single industry and significant pension liabilities remain fiscal risks in American Samoa.

Commonwealth of the Northern Mariana Islands (CNMI): CNMI's total public debt outstanding as a share of GDP remained constant at about 8 percent between fiscal years 2017 and 2019. During this period, CNMI's yearly total revenue fluctuated but was 27 percent higher in fiscal year 2019 compared to fiscal year 2017, and the territory had a deficit of $33.3 million in fiscal year 2019. Worsening economic conditions and significant pension liabilities may affect CNMI's future debt repayment capacity. COVID-19 has hurt tourism, CNMI's primary industry.

Guam: Guam's total public debt outstanding as a share of GDP decreased slightly from 44 to 42 percent between fiscal years 2017 and 2019. Guam's total revenue increased 7 percent during this period and the territory had a surplus of $112.6 million in fiscal year 2019. Guam faces fiscal risks such as COVID-19's negative impact on tourism, Guam's primary industry, and significant pension liabilities.

United States Virgin Islands (USVI): USVI's total public debt outstanding as a share of GDP increased slightly from 68 to 69 percent of GDP between fiscal years 2016 and 2018, the most recent year for which audited financial data are available. During this period, USVI's yearly total revenue fluctuated but was 36 percent higher in fiscal year 2018 compared to fiscal year 2016, and the territory had a deficit of $29.4 million in fiscal year 2018. USVI's capacity for future debt repayment may be affected by its ability to create economic growth and its ability to manage its pension liabilities and address the pending insolvency of its public pension system. USVI's ability to create economic growth may be hampered by the adverse impact of COVID-19 on tourism, USVI's primary industry.

Why GAO Did This Study

The five permanently inhabited U.S. territories–Puerto Rico, USVI, American Samoa, CNMI, and Guam–borrow through financial markets. Puerto Rico, in particular, has amassed large amounts of debt, and began to default on debt payments in 2015. In 2017, hurricanes caused widespread damage in Puerto Rico and USVI. Further, in 2018, American Samoa, CNMI, and Guam experienced typhoons and cyclones. The effects of the COVID-19 pandemic on the territories' economies is not yet fully known.

In June 2016, Congress passed and the President signed the Puerto Rico Oversight, Management, and Economic Stability Act. It contains a provision for GAO to review the public debt of the five territories every 2 years.

In this report, for each of the five territories, GAO updates (1) trends in public debt and its composition; (2) trends in revenue and its composition, and in overall financial condition; and (3) the fiscal risk factors that affect each territory's ability to repay public debt. GAO analyzed the territories' single audit reports for fiscal years 2017, 2018, and 2019, as available; reviewed relevant documentation and analyses; and interviewed officials from the territories' governments, federal agencies, and industry groups.

For more information, contact Yvonne D. Jones at (202) 512-6806 or jonesy@gao.gov or David Gootnick at (202) 512-3149 or gootnickd@gao.gov.