Hardrock Mining Management: Selected Countries, U.S. States, and Tribes Have Different Governance Structures but Primarily Use Leasing

Fast Facts

Hardrock minerals (e.g., gold and silver) play a significant role in U.S. and global economies. In 2018, hardrock minerals extracted worldwide were valued at about $981 billion.

We reviewed how some foreign countries, U.S. states, and tribal governments manage hardrock mining. We found that the selected jurisdictions primarily use leasing to explore for minerals, develop new mines, extract minerals, and reclaim mined lands. These jurisdictions also collect royalties and taxes on minerals extracted.

However, few tribes allow hardrock mining on their lands. Those that do so share mining management responsibilities with federal agencies.

Yandicoogina Mine in Western Australia

Highlights

What GAO Found

Australia, Canada, and Chile—three top mineral-producing countries as of 2018—generally own the minerals on private and government lands and manage hardrock mining at the national or regional (state, provincial, or territorial) government levels. Australia and Canada use national and regional governments to manage mining, whereas Chile uses national governance structures. All three countries primarily use leasing to manage mining. However, some Canadian provinces allow mineral exploration using a location system that provides open access to land to stake a mining claim. Australia, Canada, and Chile collect royalties and corporate income taxes on mineral extraction; however, the types and rates vary. For example, Canada and Chile's royalties are based on operators' net proceeds, while some Australian regional governments' royalties are also based on net market value.

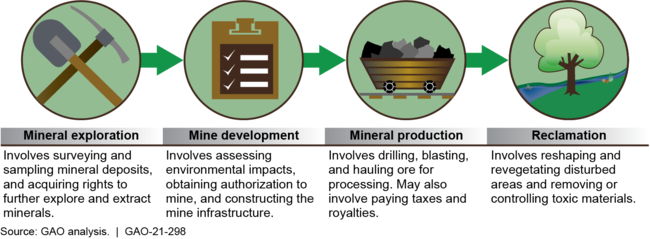

Primary Stages of Hardrock Mining

In 11 western states—Alaska, Arizona, California, Colorado, Idaho, Montana, New Mexico, Oregon, Utah, Washington, and Wyoming—responsibility for managing mining on state-owned lands, including trust lands, is decentralized among multiple governance structures. These states primarily use leasing, although Alaska also allows operators to stake mine claims on certain lands, according to state officials. All states collect royalties, or taxes that are similar to royalties, on mining. The types and rates vary, but states typically base their rates on quantity or weight, gross revenue, net smelter returns (based on the value of minerals extracted, with deductions for processing), or net proceeds.

Hardrock mining on trust and restricted fee lands (tribal lands) is managed by governance structures at the tribal and federal government levels, in accordance with the approaches established in tribal and federal law. Tribes decide whether to allow hardrock mining on their lands. If so, multiple governance structures at the tribal level may be involved in managing the mining, depending on the requirements of tribal law, which may vary by tribe. In addition, governance structures at the federal level are involved in managing mining. Two federal laws—the Indian Mineral Development Act of 1982 and the Indian Mineral Leasing Act—require the use of minerals agreements, as defined in regulation, or leases, respectively. However, few tribes allow hardrock mining on their lands, according to the Department of the Interior.

Why GAO Did This Study

Hardrock minerals such as gold, silver, and copper play a significant role in U.S. and global economies—in 2018, hardrock minerals extracted worldwide were valued at about $981 billion. However, extracting these minerals creates the potential for public health, safety, and environmental hazards. Different approaches exist to manage these hazards and hardrock mining.

GAO recently reported on the number and characteristics of mining operations on federal lands in GAO-20-461R and was also asked to review the methods different governments use to manage mining. This report describes the governance structures and approaches used to manage mining on (1) selected mineral-producing countries' land, (2) state-owned land in selected U.S. states, and (3) tribal lands subject to federal laws and regulations.

GAO reviewed laws, regulations, government documents, legal guides, and nongovernmental and industry reports. GAO also interviewed nongovernmental and mining association representatives and officials from selected states and countries. GAO selected countries that were top mineral producers, perceived by researchers to have good mining governance, and were attractive to mining investors. GAO selected states in the western region of the U.S. that produced the highest value of hardrock minerals compared with other U.S. regions. GAO examined federal laws and regulations that generally govern mining on tribal land and interviewed one tribe on mining approaches used.

For more information, contact Mark E. Gaffigan at (202) 512-3841 or gaffiganm@gao.gov.