The Nation's Fiscal Health: Information on the Spending and Revenue Implications of Potential Debt Targets

Fast Facts

The federal government was on an unsustainable long-term fiscal path even before the COVID-19 pandemic. Debt is now projected to hit a historical high in 2023, in part because the pandemic led to a severe economic contraction and increased spending for pandemic relief. The growing debt will require attention once the economy has substantially recovered from COVID-19.

This report provides illustrative examples of the spending cuts and revenue increases it would take to reach 6 different debt-to-GDP targets over 30 years. Our interactive tool shows these scenarios and how the changes to variables, like GDP growth, affect them.

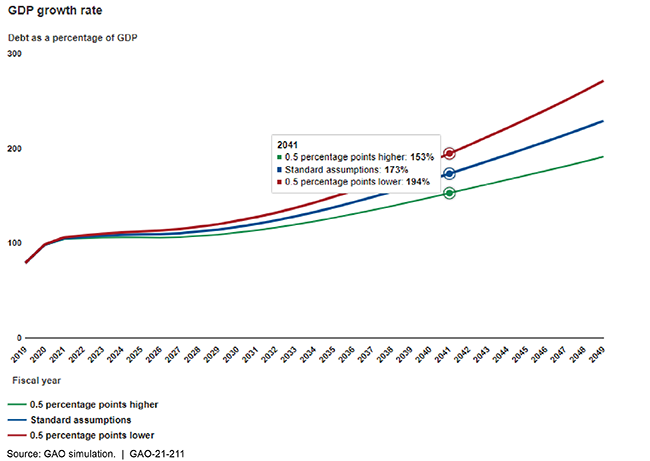

This excerpt from our interactive tool shows how changes could affect the debt.

Highlights

What GAO Found

The COVID-19 pandemic has necessitated major federal spending to respond to the national public health emergency and resulting economic turmoil. This response and the severe economic contraction from the pandemic have led to increased federal debt. Once the COVID-19 pandemic abates and the economy has substantially recovered, Congress and the administration will need to address the federal government’s fiscal challenges. To help change the long-term fiscal path, in September 2020 GAO recommended that Congress consider establishing a long-term fiscal plan that includes fiscal rules and targets, such as a debt-to-gross domestic product (GDP) target.

In this report, GAO analyzed the changes in spending and revenue needed to reach six potential debt-to-GDP targets at the end of a 30-year period (2020-2049). To reach any of the targets, policymakers will need to cut program spending, increase revenue, or, most likely, a combination of both (see table).

Illustrative Examples of Changes Needed to Achieve Debt-to-GDP Targets

| Debt target, percent of GDP (end of 30 years) | Spending and revenue: total change over 30 years | Program spending alone: Immediate and permanent decrease needed in annual projected program spendinga | Revenue alone: Immediate and permanent increase needed in annual projected revenue |

| Percent | Dollars, trillions | Percent | Percent |

| 140 | 25.4 | 13.8 | 18.5 |

| 120 | 31.2 | 16.9 | 22.8 |

| 100 | 37 | 20 | 27 |

| 80 | 42.8 | 23.1 | 31.2 |

| 60 | 48.5 | 26.3 | 35.4 |

| 0 (paying off all debt) | 65.9 | 35.7 | 48.1 |

Source: GAO simulation. | GAO-21-211.

Note: The simulation used for this analysis generally reflect historical trends, such as the extension of tax provisions scheduled to expire. It does not account for potential macroeconomic effects of fiscal policy changes over time.

aProgram spending consists of all spending except interest payments on debt held by the public.

When considering the spending and revenue changes needed to achieve various debt-to-GDP targets, policymakers may also consider how changes in assumptions about key variables—such as discretionary spending, revenue, and GDP—affect these fiscal outcomes. For example, if GDP growth is greater than expected, policymakers may have to make smaller spending cuts or revenue increases to reach a selected debt-to-GDP target than those that would be needed based on GAO’s standard assumptions.

GAO created an interactive web tool accompanying this report to allow users to enter different assumptions for each of these variables. This tool illustrates how these changes would affect the different debt-to-GDP targets over time, as well as the changes in spending and revenue needed to achieve various targets. This tool can be found at https://www.gao.gov/products/GAO-21-211.

Why GAO Did This Study

Even before the fiscal and economic effects resulting from COVID-19, an imbalance between federal revenue and spending that is built into current law and policy was contributing to the growing federal debt. The Congressional Budget Office projects that by 2023 federal debt held by the public will reach 107 percent of GDP, its highest point in U.S. history. This situation—in which federal debt grows faster than GDP—means that our nation is on an unsustainable fiscal path.

GAO was asked to review issues related to fiscal rules and targets and the federal fiscal condition. In response to this request, in September 2020, GAO issued a report (GAO-20-561) on key considerations for the design, implementation, and enforcement of fiscal rules and targets. This report supplements that work and describes how changes in assumptions of future spending and revenue affect the federal government’s projected fiscal condition.

GAO updated its long-term simulations of federal revenue and spending to (1) analyze six potential debt-to-GDP targets and (2) measure the fiscal gap—the policy change needed to reach a given debt-to-GDP fiscal target from the start to the end of 30-years. GAO also analyzed how changes in key variables affected the debt-to-GDP targets and the fiscal gap.

For more information, contact Jeff Arkin at (202) 512-6806 or arkinj@gao.gov.