Tax Administration: Better Coordination Could Improve IRS's Use of Third-Party Information Reporting to Help Reduce the Tax Gap

Fast Facts

How does the IRS ensure that your taxes are accurate?

The IRS gets information from employers, banks, and other third-parties about your income and other factors that can affect your tax bill. Mismatches between this information and what you report on your taxes can indicate errors or potential fraud.

The IRS processes billions of third-party information returns. But the system isn't managed strategically—returns come on paper and electronically, with different due dates, and are used by different compliance programs managed in different IRS offices.

Our recommendations are to increase coordination and improve IRS's use of information returns.

Highlights

What GAO Found

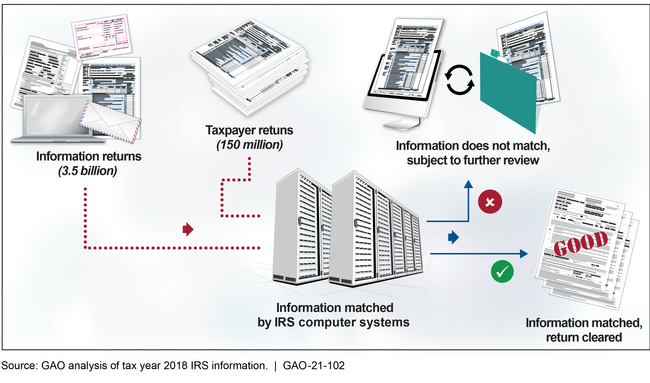

Information returns are forms filed by third parties, such as employers and financial institutions that provide information about taxable transactions. These forms are submitted to the Internal Revenue Service (IRS), the Social Security Administration, and taxpayers. Fifty unique types of information returns provide information on individual taxpayers and have a variety of purposes, such as reporting on wages earned or amounts paid that qualify for a tax credit or deduction. IRS identifies mismatches between information returns and tax returns for potential additional review, including enforcement actions. According to IRS research, taxpayers are more likely to misreport income when little or no third-party information reporting exists than when substantial reporting exists.

Overview of Internal Revenue Service's (IRS) Process for Matching Information Returns

IRS's ability to process and use information returns is limited by its outdated legacy information technology (IT) systems. In 2017, IRS developed a plan to modernize its information return processing systems; however, IRS paused its efforts due to, according to IRS, resource constraints. IRS has an opportunity to capitalize on prior planning efforts by re-evaluating and updating these efforts and integrating them into its broader IT modernization efforts.

IRS does not have a coordinated approach with cross-agency leadership that strategically considers how information reporting could be improved to promote compliance with the tax code. While information returns affect many groups across IRS and support multiple compliance programs, no one office has broad responsibility for coordinating these efforts. A formalized collaborative mechanism, such as a steering committee, could help provide leadership and ensure that IRS acts to address issues among the intake, processing, and compliance groups. For example, IRS has not undertaken a broad review of individual information returns to determine if thresholds, deadlines, or other characteristics of the returns continue to meet the needs of the agency.

Why GAO Did This Study

For tax year 2018, IRS received and processed more than 3.5 billion information returns that it used to facilitate compliance checks on more than 150 million individual income tax returns. By matching information reported by taxpayers against information reported by third parties, IRS identifies potential fraud and noncompliance.

GAO was asked to review IRS's use of information returns. This report provides an overview of information returns and assesses the extent to which IRS has a coordinated approach to identifying and responding to risks related to the use of information returns in the tax system, among other objectives.

GAO reviewed IRS documents and data on information returns filing, processing, and use, and interviewed cognizant officials. GAO compared IRS's efforts in this area to federal internal control standards, and IRS's strategic plan.

Recommendations

GAO is making nine recommendations to IRS, including that IRS revise its modernization plans for its information returns processing systems and incorporate it into broader IT modernization efforts and develop a collaborative mechanism to improve coordination among IRS groups that use information returns. IRS neither agreed, nor disagreed with the recommendations; however, IRS outlined actions it plans to take to address the recommendations. Social Security Administration had no comments.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should expedite final planning efforts and implement the expansion of IRS's capacity to allow for additional transcription of K-1 Schedules. (Recommendation 1) |

IRS originally neither agreed nor disagreed with this recommendation. However, in response to our recommendation, in January 2022, IRS added 17 elements to the transcription of Schedule K-1. In April 2022, IRS submitted documentation that the work was completed. As a result, IRS is now able to collect critical tax information from Forms 1065, Schedule K-1 submitted on paper. These forms are used to report a partner's share of income, deductions, and credits for their individual tax return. Having additional information from these forms transcribed and accessible to IRS compliance systems will enhance IRS's ability to cost-effectively identify and select the cases for further review.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should research, evaluate, and develop potential recommendations to expand third-party information reporting to include more information on sole proprietor's income and expenses. (Recommendation 2) |

IRS neither agreed nor disagreed with this recommendation. IRS officials reported that IRS will research and evaluate the tax administration benefits and taxpayer burdens of expanding third-party information reporting for sole proprietors' income and expenses. IRS officials reported that the agency was compiling a list of ideas that were proposed in the past but were never adopted and soliciting additional ideas within IRS. As of February 2024, IRS reported that it needed additional time to complete the analysis and develop a summary report, which it expects to complete in September 2024. Continued research on expanding third-party information reporting will help IRS develop additional recommendations to better understand sole proprietor income and expenses. To fully implement this recommendation, IRS needs to complete its research. Without options to help improve compliance for sole proprietorships, IRS is missing an opportunity to help address a significant part of the tax gap.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should evaluate characteristics of late information return filers to determine the effect of penalty assessment for late and incorrect information returns on third-party information reporting compliance. (Recommendation 3) |

IRS originally neither agreed nor disagreed with this recommendation. However, in September 2021, IRS provided us with its analysis of the effects of asserting penalties on late filers. Our review of the study found that it evaluated characteristics of late information return filers and compared data from a baseline year to subsequent years to determine if a trend in repeat filers existed for systemic penalty assessments. The study concluded that the information return penalty program is effective at encouraging information return filers to file returns timely and correctly. This is because the recidivism rate illustrates that once an information return penalty is assessed against a filer, that filer is less likely to be noncompliant in the future. IRS also considered reasonable cause waiver and abatement percentages and found that many filers who were initially considered to be noncompliant acted in a responsible manner to avoid the failure. By completing this assessment, IRS has determined that its penalty program is effective at promoting voluntary compliance. Additionally, in January, 2022, IRS completed a second phase of the study to provide additional data to be used internally. Our review of this study found that it provided trends, analysis, and recommendations to the Information Return Penalty Program. In conjunction, these two studies have provided IRS with additional information and internal recommendations the agency can use to strengthen the penalty program to help improve compliance with information return filing requirements.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should reassess the risks described and recommendations made in its internal 2016 report related to information returns and identify potential new risks and recommendations as a result of changes to the tax administration environment. (Recommendation 4) |

IRS neither agreed nor disagreed with this recommendation. However, IRS took action to implement the recommendation. In July 2021, IRS reported that it had begun reviewing the remaining risks in the 2016 internal report. At that time, IRS reported that most items identified in the 2016 report had been addressed and that some outstanding items could not be addressed due to legal or technological constraints. IRS also established an information returns working group comprised of IRS staff from various business operating divisions. In February 2022, IRS reported that it had completed its review of items in the 2016 report that would not require legislative or technological changes. These included reviewing recordkeeping systems and realigning some internal compliance units. IRS stated that the agency had decided not to pursue these items because IRS is in the process of restructuring its compliance units pursuant to the Taxpayer First Act and expects to consolidate recordkeeping systems as part of that process. IRS also reported that this working group had met twice to discuss risks, possible opportunities to better use information returns, and how IRS might make organizational improvements to maximize the agency's use of information returns. The group has compiled two lists of potential improvements which we have reviewed; one that would not require significant organizational, IT, or legislative changes and one that would require such changes. The working group provided these recommendations to the IRS NEXT Office to consider implementation of the recommendations. These actions have ensured that IRS reviewed the risks to the information return process and considered the recommendations made.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should prioritize and develop a timeline for implementing the remaining recommendations from its internal 2016 report related to information returns, along with any newly identified recommendations. (Recommendation 5) |

IRS originally neither agreed nor disagreed with this recommendation. However, in July 2021, IRS reported agreement with the recommendation. In February 2022, IRS reported that it had formed an internal working group to discuss risks, possible opportunities to better use information returns, and how IRS might make organizational improvements to maximize the agency's use of information returns. The group compiled two lists of potential improvements related to information returns - one that would not require significant organizational, information technology, or legislative changes and one that would require such changes. In March 2023, IRS officials reported that several of the working group's recommendations were prioritized in the first phase of the initiatives funded under the Inflation Reduction Act. In April 2023, IRS released its Strategic Operating Plan (SOP) describing these initiatives. IRS officials provided a crosswalk between the working groups' recommendations and initiatives and projects in the SOP. For example, projects related to providing taxpayers with access to their data, providing alerts, identifying issues at the time of filing, and pursuing appropriate enforcement for complex, high-risk, and emerging issues would address some of the recommendations made by the working group. The SOP also includes initiatives to improve technology at IRS. In December 2023, IRS developed the IRA Enterprise Roadmap which identifies priority outcomes and timelines showing when IRS will initiate and complete work on various projects. In February 2024, IRS also provided a timeline for its information reporting modernization (IR Mod) Plan, which will modernize the intake and use of information returns. This modernization effort will also help address some of the internal recommendations from the working group. By developing the IR Mod plan, SOP initiatives consistent with working group's recommendations, and completing a roadmap that prioritizes those projects and includes a timeline for achieving SOP outcomes, IRS has addressed the intent of our recommendation.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should revise the 2017 Information Returns Systems Modernization plans by evaluating changes in the environment, assessing risks to systems and programs, and detailing how the agency plans to address issues in the intake, processing, and use of information returns across business units. (Recommendation 6) |

IRS neither agreed nor disagreed with recommendations 6 and 7, which are related. However, IRS took steps to develop an updated Information Return System Modernization plan. For example, IRS developed a new internet platform that allowed businesses to electronically file information returns in the 1099 Form family for the 2023 filing season. In March 2023, IRS officials also reported that future releases of this system would modernize the intake and processing of other information return forms, such as those that are currently submitted through IRS's Filing Information Returns Electronically system. At that time, IRS officials reported that more specific plans were being developed as part of the Inflation Reduction Act strategic operating plan (SOP), which was released in April 2023. The SOP describes how IRS intends to use the funding Congress allocated to the agency through the Inflation Reduction Act and states that IRS will report regularly to Congress on its progress. The SOP included an initiative that described plans and projects to address issues in the intake, processing, and use of information returns. Many of these were similar to the efforts IRS described in their 2017 plan that we recommended IRS revise. IRS also developed the Information Returns Modernization Program to describe the scope of additional capabilities needed and the benefits of those enhancements. In addition, IRS developed an Information Returns Modernization 3-Year Road Map, showing when various functionalities related to information returns will be implemented and milestones achieved. By including this initiative in the SOP and developing supplemental materials describing additional details related to information returns modernization efforts, IRS met the intent of our recommendation. IRS now has an Information Returns Modernization plan that provides an overall picture of what IRS is investing in as well as the benefits expected from such an investment.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should submit a revised information returns system modernization plan to Congress that describes how it integrates with IRS's broader IT modernization efforts, the resources needed to achieve effective and timely modernization, and the proposed schedule and scope of the effort. (Recommendation 7) |

IRS neither agreed nor disagreed with recommendations 6 and 7, which are related. However, IRS took steps to develop an updated Information Return System Modernization plan. For example, IRS developed a new internet platform that allowed businesses to electronically file information returns in the 1099 Form family for the 2023 filing season. In March 2023, IRS officials also reported that future releases of this system would modernize the intake and processing of other information return forms, such as those that are currently submitted through IRS's Filing Information Returns Electronically system. At that time, IRS officials reported that more specific plans were being developed as part of the Inflation Reduction Act strategic operating plan (SOP), which was released in April 2023. The SOP describes how IRS intends to use the funding Congress allocated to the agency through the Inflation Reduction Act and states that IRS will report regularly to Congress on its progress. The SOP included an initiative that described plans and projects to address issues in the intake, processing, and use of information returns. Many of these were similar to the efforts IRS described in their 2017 plan that we recommended IRS revise. IRS also developed the Information Returns Modernization Program to describe the scope of additional capabilities needed and the benefits of those enhancements. In addition, IRS developed an Information Returns Modernization 3-Year Road Map, showing when various functionalities related to information returns will be implemented and milestones achieved. By including this initiative in the SOP and developing supplemental materials describing additional details related to information returns modernization efforts, IRS met the intent of our recommendation. IRS now has an Information Returns Modernization plan that provides an overall picture of what IRS is investing in as well as the benefits expected from such an investment.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop a plan and schedule to systematically evaluate the suite of information returns with a goal of improving compliance, and reducing fraud and reporting burden. The evaluation should consider factors such as filing requirement thresholds, deadlines for filing, corrections and amendment data, and the potential to consolidate similar forms and include recommendations for needed changes. (Recommendation 8) |

IRS neither agreed nor disagreed with this recommendation. However, in July 2021, IRS agreed to conduct an evaluation of a select group of information returns that are used for enforcement purposes. IRS plans to use the results of the study to determine if these forms continue to provide value and if changes to the current form revision processes are needed. For each of the selected returns, IRS will examine the revisions considered or made, and categorize each according to the factors we recommended. As of February 2024, IRS reported it needs additional time to complete this analysis and expects to complete this evaluation by September 2024. To fully implement this recommendation, IRS needs to complete its review of the suite of information returns. Without completing this comprehensive evaluation of information returns and their characteristics, IRS risks gathering information that it cannot use effectively in some areas and burdening filers and taxpayers and not gathering enough information for enhancing compliance in other areas.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop a collaborative mechanism to coordinate among the internal stakeholders who are responsible for the intake, processing, and use of information returns, as well as to improve outreach to external stakeholders in relation to information returns. (Recommendation 9) |

IRS neither agreed nor disagreed with this recommendation. In March 2024, IRS reported that the Deputy Commissioner for Service and Enforcement continues to work to ensure improved coordination and collaboration among IRS's business operating divisions. In addition, IRS reported it established a Joint Strategic Emerging Issues Team and launched the Information Returns Intake System, a modernized system third parties can use to file information returns. As part of its Strategic Operating Plan, IRS also reported it plans to implement a streamlined organizational structure, with four chief officers responsible for various functions within IRS, reporting directly to a new Deputy Commissioner. One of these new chief officers will be the Chief Taxpayer Compliance Officer, who will have responsibility in developing an agency-wide approach to use data to inform audit selection, including data from information returns. This effort will also be supported by the development of a new single source data platform that will include information return data for all the business operating divisions. Until IRS completes these efforts and implements a collaborative mechanism with a coordinated approach to using information returns, IRS risks missing opportunities to improve the effectiveness of its development, intake, processing, and use of information returns.

|