COVID-19: Brief Update on Initial Federal Response to the Pandemic

Fast Facts

This report updates our oversight of some aspects of the federal response to the COVID-19 pandemic. Findings include:

Spending. Federal obligations totaled $1.5 trillion and expenditures totaled $1.3 trillion, as of June 30.

Public health. Between January 1 and June 30, about 125,000 more deaths occurred from all causes than would normally be expected—an indicator of the pandemic's effect on health care outcomes.

Actions. Agencies have taken action on some of our June 2020 recommendations. For example, Treasury officials stated that nearly 70 percent of $1.6 billion in economic impact payments sent to the deceased has been recovered.

Highlights

Why GAO Did This Study

As of August 20, 2020, the U.S. had over 5.5 million cumulative reported cases of COVID-19, and 158,000 reported deaths, according to federal agencies. The country also continues to experience serious economic repercussions and turmoil. Four relief laws, including the CARES Act, were enacted between March and July 2020 to provide appropriations for the response to COVID-19.

The CARES Act includes a provision for GAO to report bimonthly on its ongoing monitoring and oversight efforts related to COVID-19. This second report examines federal spending on the COVID-19 response; indicators for monitoring public health and the economy; and the status of matters for congressional consideration and recommendations from GAO’s June 2020 report (GAO-20-625).

GAO reviewed data through June 30, 2020 (the latest available) from USAspending.gov, a government website with data from government agencies. GAO also obtained, directly from the agencies, spending data, as of July 31, 2020, for the six largest spending areas, to the extent available.

To develop the public health indicators, GAO reviewed research and federal guidance. To understand economic developments, GAO reviewed data from federal statistical agencies, the Federal Reserve, and Bloomberg Terminal, as well as economic research.

To update the status of matters for congressional consideration and recommendations, GAO reviewed agency and congressional actions.

What GAO Found

In response to the national public health and economic threats caused by COVID-19, four relief laws making appropriations of about $2.6 trillion had been enacted as of July 31, 2020. Overall, federal obligations and expenditures government-wide of these COVID-19 relief funds totaled $1.5 trillion and $1.3 trillion, respectively, as of June 30, 2020. GAO also obtained preliminary data for six major spending areas as of July 31, 2020 (see table).

COVID-19 Relief Appropriations, Obligations, and Expenditures for Six Major Spending Areas, as of July 2020

| Spending area | Appropriationsa ($ billions) |

Preliminary obligationsb ($ billions) |

Preliminary expendituresb ($ billions) |

| Business Loan Programs | 687.3 | 538.1 | 522.2c |

| Economic Stabilization and Assistance to Distressed Sectors | 500.0 | 30.4 | 19.2c |

| Unemployment Insurance | 376.4 | 301.1 | 296.8 |

| Economic Impact Payments | 282.0 | 273.5 | 273.5 |

| Public Health and Social Services Emergency Fund | 231.7 | 129.6 | 95.9 |

| Coronavirus Relief Fund | 150.0 | 149.5 | 149.5 |

| Total for six spending areas | 2,227.4 | 1,422.2 | 1,357.0 |

Source: GAO analysis of data from the Department of the Treasury, USAspending.gov, and applicable agencies. | GAO-20-708

aCOVID-19 relief appropriations reflect amounts appropriated under the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, Pub. L. No. 116-123, 134 Stat. 146; Families First Coronavirus Response Act, Pub. L. No. 116-127, 134 Stat. 178 (2020); CARES Act, Pub. L. No. 116-136, 134 Stat. 281 (2020); and Paycheck Protection Program and Health Care Enhancement Act, Pub. L. No. 116-139, 134 Stat. 620 (2020). These data are based on appropriations warrant information provided by the Department of the Treasury as of July 31, 2020. These amounts could increase in the future for programs with indefinite appropriations, which are appropriations that, at the time of enactment, are for an unspecified amount. In addition, this table does not represent transfers of funds that federal agencies may make between appropriation accounts or transfers of funds they may make to other agencies.

bObligations and expenditures data for July 2020 are based on preliminary data reported by applicable agencies.

cThese expenditures relate to the loan subsidy costs (the loan’s estimated long-term costs to the United States government).

The CARES Act included a provision for GAO to assess the impact of the federal response on public health and the economy. The following are examples of health care and economic indicators that GAO is monitoring.

Health care. GAO’s indicators are intended to assess the nation’s immediate response to COVID-19 as it first took hold, gauge its recovery from the effects of the pandemic over the longer term, and determine the nation’s level of preparedness for future pandemics, involving subsequent waves of either COVID-19 or other infectious diseases.

For example, to assess the sufficiency of testing—a potential indicator of the system’s response and recovery—GAO suggests monitoring the proportion of tests in a given population that are positive for infection. A higher positivity rate can indicate that testing is not sufficiently widespread to find all cases. That is higher positivity rates can indicate that testing has focused on those most likely to be infected and seeking testing because they have symptoms, and may not be detecting COVID-19 cases among individuals with no symptoms.

Although there is no agreed-upon threshold for the test positivity rate, governments should target low positivity rates. The World Health Organization recommends a test positivity rate threshold of less than 5 percent over a 14-day period. As of August 12, 2020, 12 states and the District of Columbia had met this threshold (38 states had not). Resolve to Save Lives, another organization, recommends a threshold of less than 3 percent over a 7-day period, and 11 states and the District of Columbia had met this threshold (39 states had not) as of August 12, 2020.

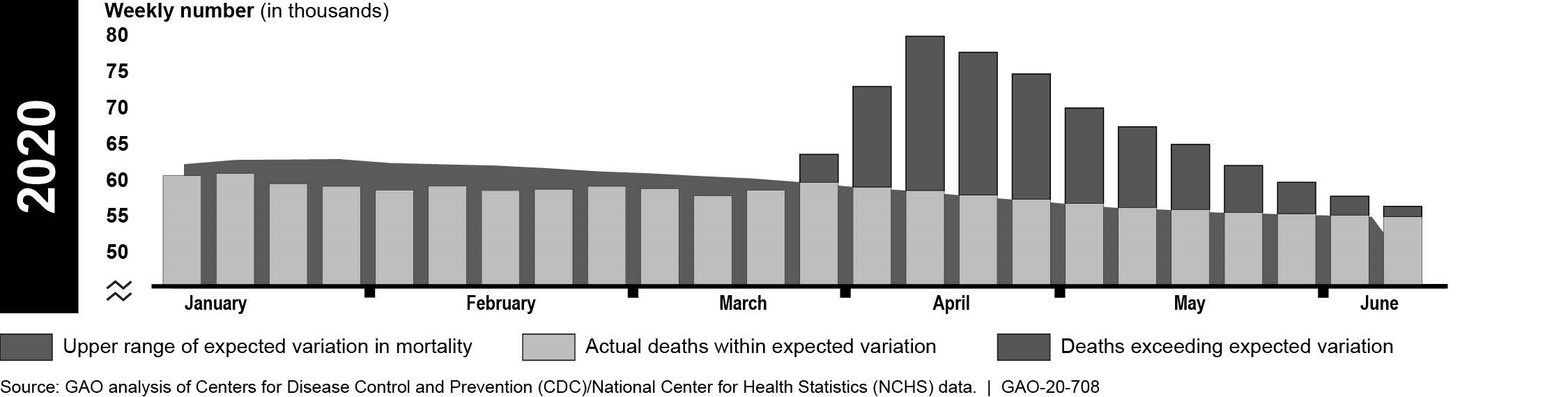

GAO also suggests monitoring mortality from all causes compared to historical norms as an indicator of the pandemic’s broad effect on health care outcomes. Mortality rates have tended to be consistent from year to year. This allows an estimation of how much mortality rose with the onset of the pandemic, and provides a baseline by which to judge a return to pre-COVID levels. According to Centers for Disease Control and Prevention data, about 125,000 more people died from all causes January 1–June 13 than would normally be expected (see figure).

CDC Data on Higher-Than-Expected Weekly Mortality, January 1 through June 13, 2020

Note: The figure shows the number of deaths from all causes in a given week that exceeded the upper bound threshold of expected deaths calculated by CDC on the basis of variation in mortality experienced in prior years. Changes in the observed numbers of deaths in recent weeks should be interpreted cautiously as this figure relies on provisional data that are generally less complete in recent weeks. Data were accessed on July 16, 2020.

Economy. GAO updated information on a number of indicators to facilitate ongoing and consistent monitoring of areas of the economy supported by the federal pandemic response, in particular the COVID-19 relief laws. These indicators suggest that economic conditions—including for workers, small businesses, and corporations—have improved modestly in recent months but remain much weaker than prior to the pandemic.

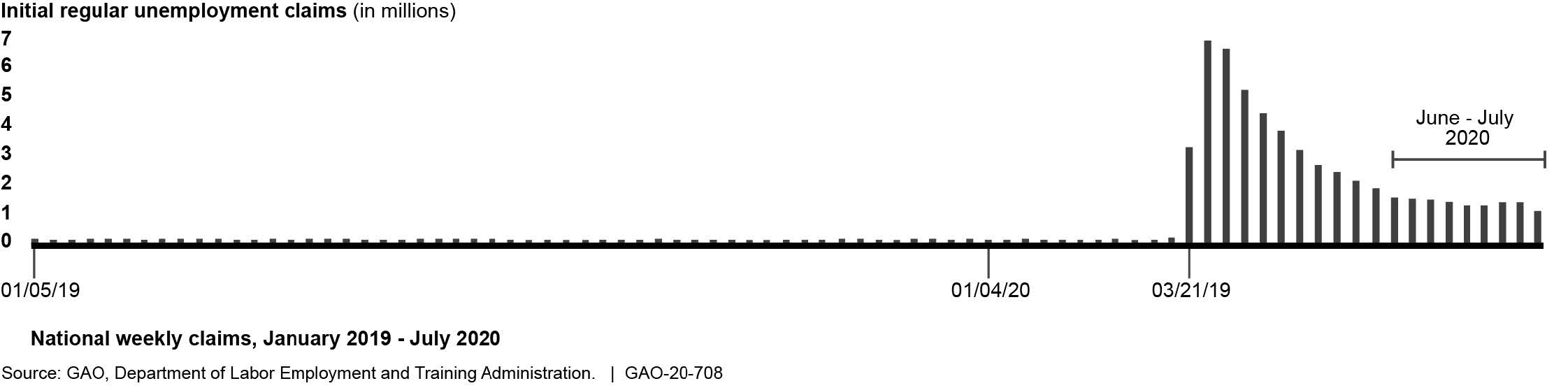

In June and July initial regular unemployment insurance (UI) claims filed weekly averaged roughly 1.4 million (see figure), which was six and a half times higher than average weekly claims in 2019, but claims have decreased substantially since mid-March, falling to 971,000 in the week ending August 8, 2020. Increasing infections in some states and orders to once again close or limit certain businesses are likely to pose additional challenges for potentially fragile economic improvements, especially in affected sectors, such as the leisure and hospitality sector.

National Weekly Initial Unemployment Insurance Claims, January 2019–July 2020

Note: See figure 5 in the report.

As GAO reported in June, consistent with the urgency of responding to serious and widespread health issues and economic disruptions, federal agencies gave priority to moving swiftly where possible to distribute funds and implement new programs designed to help small businesses and the newly unemployed, for example. However, such urgency required certain tradeoffs in achieving transparency and accountability goals. To make mid-course corrections, GAO made three recommendations to federal agencies:

- To reduce the potential for duplicate payments from the Paycheck Protection Program (PPP)—a program that provides guaranteed loans through lenders to small businesses—and unemployment insurance, GAO recommended that the Department of Labor (DOL), in consultation with the Small Business Administration (SBA) and the Department of the Treasury (Treasury), immediately provide information to state unemployment agencies that specifically addresses PPP loans, and the risk of improper unemployment insurance payments. DOL issued guidance on August 12, 2020, that, among other things, clarified that individuals working full-time and being paid through PPP are not eligible for UI.

- To recoup economic impact payments totaling more than $1.6 billion sent to decedents, GAO recommended that the Internal Revenue Service (IRS) consider cost-effective options for notifying ineligible recipients of economic impact payments how to return payments. IRS has taken steps to address this recommendation. According to a Treasury official, nearly 70 percent of the payments sent to decedents have been recovered. However, GAO was unable to verify that amount before finalizing work on this report. GAO is working with Treasury to determine the number of payments sent to decedents that have been recovered. Treasury was considering sending letters to request the return of remaining outstanding payments but has not moved forward with this effort because, according to Treasury, Congress is considering legislation that would clarify or change payment eligibility requirements.

- To reduce the potential for fraud and ensure program integrity, GAO recommended that SBA develop and implement plans to identify and respond to risks in PPP to ensure program integrity, achieve program effectiveness, and address potential fraud. SBA has begun developing oversight plans for PPP but has not yet finalized or implemented them.

In addition, to improve the government’s response efforts, GAO suggested three matters for congressional consideration:

- GAO urged Congress to take legislative action to require the Department of Transportation (DOT) to work with relevant agencies and stakeholders, such as HHS, the Department of Homeland Security (DHS), and international organizations, to develop a national aviation-preparedness plan to ensure safeguards are in place to limit the spread of communicable disease threats from abroad, while also minimizing any unnecessary interference with travel and trade. In early July 2020, DOT collaborated with HHS and DHS to issue guidance to airports and airlines for implementing measures to mitigate the public health risks associated with COVID-19, but it has not developed a preparedness plan for future communicable disease threats. DOT has maintained that HHS and DHS should lead such planning efforts as they are responsible for communicable disease response and preparedness planning, respectively. In June 2020, HHS stated that it is not in a position to develop a national aviation-preparedness plan as it does not have primary jurisdiction over the entire aviation sector or the relevant transportation expertise. In May 2020, DHS stated that it had reviewed its existing plans for pandemic preparedness and response activities and determined it is not best situated to develop a national aviation-preparedness plan. Without such a plan, the U.S. will not be as prepared to minimize and quickly respond to future communicable disease events.

- GAO also urged Congress to amend the Social Security Act to explicitly allow the Social Security Administration (SSA) to share its full death data with Treasury for data matching to help prevent payments to ineligible individuals. In June 2020, the Senate passed S.4104, referred to as the Stopping Improper Payments to Deceased People Act. If enacted, the bill would allow SSA to share these data with Treasury's Bureau of the Fiscal Service to avoid paying deceased individuals.

- Finally, GAO urged Congress to use GAO's Federal Medical Assistance Percentage (FMAP) formula for any future changes to the FMAP—the statutory formula according to which the federal government matches states' spending for Medicaid services—during the current or any future economic downturn. Congress has taken no action thus far on this issue.

GAO incorporated technical comments received the Departments of Labor, Commerce, Health and Human Services, Transportation, and the Treasury; the Federal Reserve; Office of Management and Budget; and Internal Revenue Service. The Small Business Administration commented that GAO did not include information on actions taken and controls related to its loan forgiveness program or its plans for loan reviews. GAO plans to provide more information on these topics in its next CARES Act report.

For more information, contact A. Nicole Clowers at (202) 512-7114 or clowersa@gao.gov.