The Nation's Fiscal Health: Effective Use of Fiscal Rules and Targets

Fast Facts

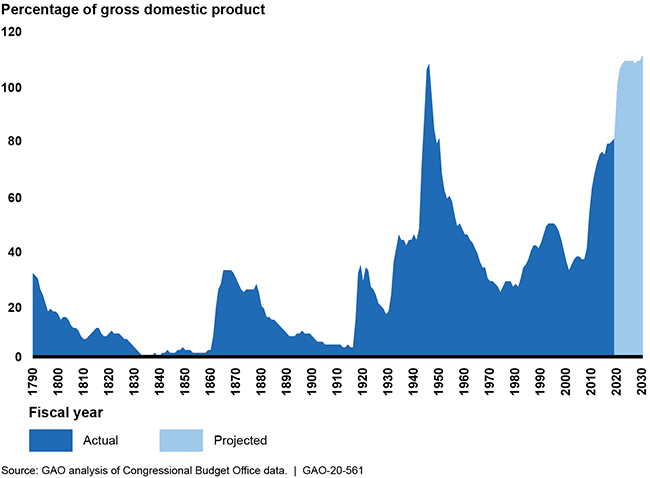

The government's public debt will reach 107% of GDP by the end of 2023—its highest point in history—according to the Congressional Budget Office. The growing debt will require attention once the economy has substantially recovered from COVID-19 and public health goals have been achieved.

Fiscal rules and targets can help manage debt by controlling factors like spending and revenue. We identified key considerations—like flexibility for national emergencies—to help Congress adopt new fiscal rules and targets.

Congress should consider establishing a long-term fiscal plan that includes fiscal rules and targets, informed by our key considerations.

Federal Debt Held by the Public

Highlights

What GAO Found

In fiscal year 2019, debt held by the public reached 79 percent of gross domestic product (GDP). The government's fiscal response to COVID-19 combined with the severe economic contraction from the pandemic will substantially increase federal debt. The Congressional Budget Office (CBO) projected that debt held by the public will reach 98 percent of GDP by the end of fiscal year 2020. The nation's fiscal challenges will require attention once the economy has substantially recovered and public health goals have been attained.

GAO has previously reported that a long-term plan is needed to put the government on a sustainable fiscal path. Other countries have used well-designed fiscal rules and targets—which constrain fiscal policy by controlling factors like expenditures or revenue—to contain excessive deficits. For example, Germany's constitution places limits on its deficits. The U.S. federal government has previously enacted fiscal rules, such as those in the Budget Control Act of 2011. However, current fiscal rules have not effectively addressed the misalignment between spending and revenues over time.

GAO identified key considerations to help Congress if it were to adopt new fiscal rules and targets, as part of a long-term plan for fiscal sustainability (see table).

Key Considerations for Designing, Implementing, and Enforcing Fiscal Rules and Targets

|

|

Setting clear goals and objectives can anchor a country's fiscal policy. Fiscal rules and targets can help ensure that spending and revenue decisions align with agreed-upon goals and objectives. |

|

|

The weight given to tradeoffs among simplicity, flexibility, and enforceability depends on the goals a country is trying to achieve with a fiscal rule. In addition, there are tradeoffs between the types and combinations of rules, and the time frames over which the rules apply. |

|

|

The degree to which fiscal rules and targets are binding, such as being supported through a country's constitution or nonbinding political agreements, can impact their permanence, as well as the extent to which ongoing political commitment is needed to uphold them. |

|

|

Integrating fiscal rules and targets into budget discussions can contribute to their ongoing use and provide for a built-in enforcement mechanism. The budget process can include reviews of fiscal rules and targets. |

|

|

Fiscal rules and targets with limited, well-defined exemptions, clear escape clauses for events such as national emergencies, and adjustments for the economic cycle can help a country address future crises. |

|

|

Institutions supporting fiscal rules and targets need clear roles and responsibilities for supporting their implementation and measuring their effectiveness. Independently analyzed data and assessments can help institutions monitor compliance with fiscal rules and targets. |

|

|

Having clear, transparent fiscal rules and targets that a government communicates to the public and that the public understands can contribute to a culture of fiscal transparency and promote fiscal sustainability for the country. |

Source: GAO analysis of literature review and interviews. | GAO-20-561

Why GAO Did This Study

Our nation faces serious challenges at a time when the federal government is highly leveraged in debt by historical norms. The imbalance between revenue and spending built into current law and policy have placed the nation on an unsustainable long-term fiscal path. Fiscal rules and targets can be used to help frame and control the overall results of spending and revenue decisions that affect the debt.

GAO was asked to review fiscal rules and targets. This report (1) assesses the extent to which the federal government has taken action to contribute to long-term fiscal sustainability through fiscal rules and targets, and (2) identifies key considerations for designing, implementing, and enforcing fiscal rules and targets in the U.S.

GAO compared current and former U.S. fiscal rules to literature on the effective use of rules and targets; reviewed CBO reports and relevant laws; and interviewed experts. GAO conducted case studies of national fiscal rules in Australia, Germany, and the Netherlands.

Recommendations

Congress should consider establishing a long-term fiscal plan that includes fiscal rules and targets, such as a debt-to-GDP target, and weigh GAO's key considerations to ensure proper design, implementation, and enforcement of these rules and targets.

The Department of the Treasury and other entities provided technical comments, which GAO incorporated as appropriate.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider establishing a long-term fiscal plan that includes fiscal rules and targets, such as a debt-to-GDP target. In doing so, Congress should weigh the key considerations discussed in this report to help ensure proper design, implementation, and enforcement of those rules and targets. (Matter for Consideration 1) | Since March 2024, the Senate and House have introduced several bills to address the federal government's long-term fiscal outlook. The Senate and House introduced bills to establish a commission to propose recommendations to improve the federal government's fiscal situation. The Senate also introduced a bill that would require the President's annual budget and congressional budget resolutions to include the ratio of debt to GDP. The House and Senate introduced resolutions proposing balanced budget amendments to the Constitution. Similar to a budget balance fiscal rule, the balanced budget amendments would require the President to submit a balanced budget annually and would prohibit total outlays to exceed total receipts for the fiscal year, unless Congress authorizes the excess. As of February 2025, Congress has taken no action on the introduced resolutions and bills. |