Bank Supervision: FDIC Could Better Address Regulatory Capture Risks

Fast Facts

"Regulatory capture" is when regulators act in the interest of the regulated industry, rather than in service of the public good. This can be a problem in banking regulation, where regulators may be swayed by future job offerings and more.

We found that the Federal Deposit Insurance Corporation has several policies for documenting bank examination decisions, which can reduce the risk of regulatory capture. However, FDIC staff did not always clearly document their analysis of how banks addressed areas of concern identified during examinations.

We recommended that FDIC improve how it documents banks' progress at addressing FDIC's concerns.

Highlights

What GAO Found

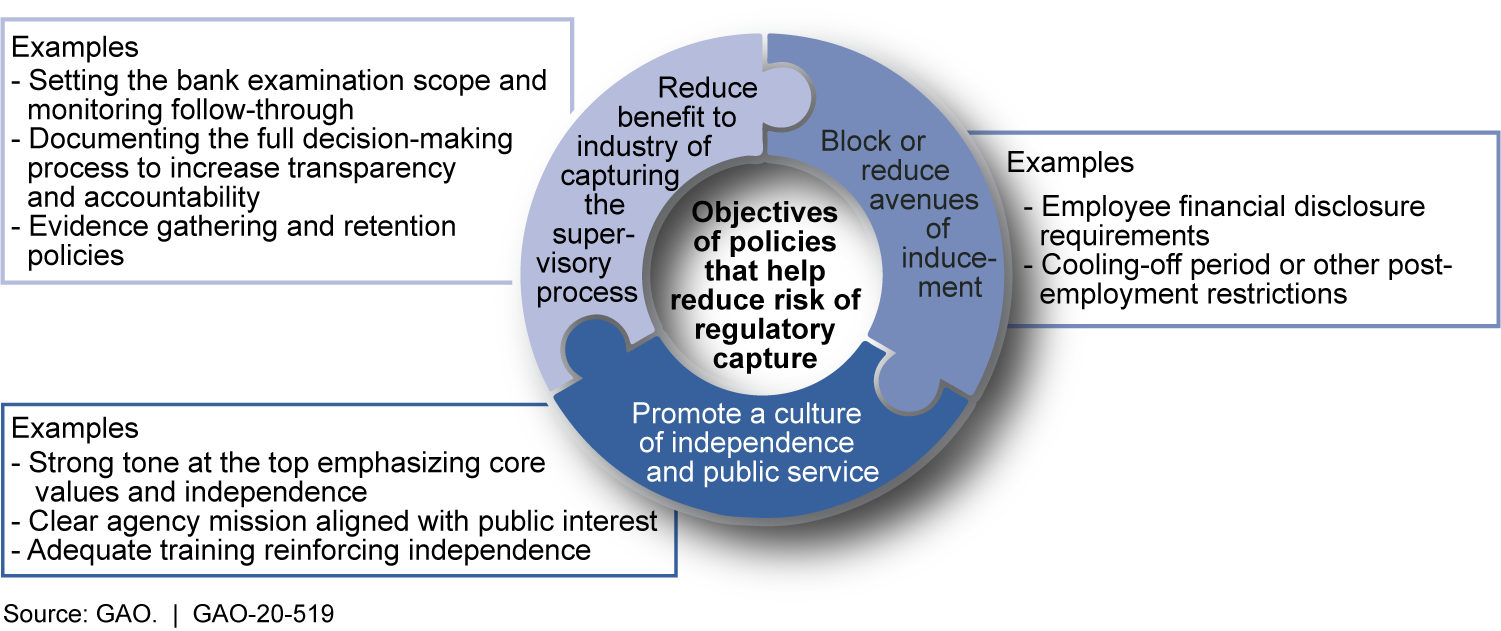

The Federal Deposit Insurance Corporation (FDIC) has designed policies to address the risk of regulatory capture by reducing the potential benefit to industry of capturing the examination process, reducing avenues of inducement, and promoting a culture of independence and public service (see figure).

Framework for Reducing Risk and Minimizing Consequences of Regulatory Capture

FDIC has several policies for documenting bank examination decisions that help promote transparent decision-making and assign responsibility for decisions. Such policies are likely to help reduce benefits to industry of capturing the examination process. However, GAO found that some examinations were not implemented consistent with FDIC policies and that gaps in FDIC policies limited their effectiveness. For example, GAO found that managers sometimes did not clearly document how they concluded that banks had addressed recommendations. By improving adherence to agency policies, FDIC management could better address threats to capture in the examination process.

GAO found that FDIC has policies to address potential conflicts of interest that could help block or reduce avenues of inducement. For example, FDIC has post-employment conflict-of-interest policies designed to prevent former employees from exerting undue influence on FDIC and to reduce industry's ability to induce current FDIC employees with prospective employment arrangements. One such policy requires the agency to review the workpapers of examiners-in-charge who accept employment with banks they examined in the prior 18 months. However, FDIC has not fully implemented a process for identifying when to review the workpapers of departing examiners to assess whether independence has been compromised. In particular, FDIC does not have a process for collecting information about departing employees' future employment. By revising its examiner-departure processes, the agency could better identify when to initiate workpaper reviews.

FDIC has identified regulatory capture as a risk as part of its enterprise risk management process. The agency has documented 11 mitigation strategies that could help address that risk. Identified mitigation strategies include rotating examiners-in-charge, national examination training, and ethics requirements.

Why GAO Did This Study

FDIC supervises about 3,300 financial institutions to evaluate their safety and soundness. Some analyses by academic researchers have identified regulatory capture in supervision as one potential factor contributing to the 2007–2009 financial crisis. Regulatory capture is defined as a regulator acting in the interest of the regulated industry rather than in the public interest.

GAO was asked to review regulatory capture in financial regulation. This report examines FDIC's (1) processes for encouraging transparency and accountability in the bank examination process, (2) processes to minimize potential conflicts of interest among examination staff, and (3) agency-wide efforts to address the risks of regulatory capture and compromised independence. GAO reviewed FDIC's policies and enterprise risk management framework, analyzed bank examination workpapers, and interviewed supervisory staff.

Recommendations

GAO is making four recommendations to FDIC related to managing the risk of regulatory capture, including improving documentation of banks' progress at addressing FDIC recommendations and revising examiner-departure processes. FDIC neither agreed nor disagreed with these recommendations, but described actions it would take in response to them. FDIC's actions, if fully implemented, would address two of the four recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Deposit Insurance Corporation | The Division Director for Risk Management Supervision (RMS) should require case managers to document how high-risk areas in the scoping plan were considered by the examination team if they were not addressed in the examination report. (Recommendation 1) |

In November 2021, FDIC officials provided documentation of examination policies they updated in March 2021 to require that examiners-in-charge discuss proposed changes to the examination scope with their manager and obtain concurrence for any material changes in the examination scope. Although this policy change likely would improve management's control over changes to scoping plans, it would not necessarily create better documentation to track how FDIC's case managers reviewed whether the work described in the scoping plan was appropriately evaluated and documented by the examination team. As stated in our report, if case managers documented that examination procedures for areas not discussed in the examination report were assessed and that examiners' conclusions about these areas were well-supported, RMS management would have better assurance that case managers were monitoring examination teams' procedures and conclusions for all planned aspects of the examination. We continue to believe that RMS management could better assure the effectiveness of the case-manager review process by implementing a requirement for case managers to review and document how all elements of the examination scope--including those not discussed in the report of examination--were addressed by the examination team. In August 2023, FDIC officials indicated that they did not intend to take further steps beyond those already taken to address this recommendation.

|

| Federal Deposit Insurance Corporation | The Division Director for RMS should implement policies to require that higher-level managers review case managers' documentation that describes whether banks have fully addressed MRBAs. (Recommendation 2) |

In January 2022, RMS revised the agency's policies to require that a higher-level manager review and sign off on case managers' supporting documentation for determining that banks have addressed MBRAs. Instituting this supervisory review measure will help FDIC ensure case manager compliance with FDIC's policies for closing MBRAs and transparency in FDIC's decision-making.

|

| Federal Deposit Insurance Corporation | The Division Director for RMS should revise examination documentation retention policies to increase the retention period beyond one examination cycle for banks with satisfactory or better composite ratings. (Recommendation 3) |

In April 2021, FDIC updated its policies to require that examination staff begin retaining examination workpapers for three examination cycles. For banks where FDIC alternates with state examiners to conduct examinations, the policy required that FDIC retain workpapers for at least two FDIC-led examinations. FDIC had planned to assess the effectiveness of its revised workpaper retention policy after three years. In September 2023, FDIC made its workpaper retention policy permanent. A memo describing the changes cited recent instances where workpapers sought by FDIC staff were not readily available in the agency's electronic document system, as well as recommendations from GAO and the FDIC Office of the Inspector General. Increasing the document retention period will facilitate FDIC officials' ability to investigate potentially improper actions by examiners that go back farther than one examination cycle.

|

| Federal Deposit Insurance Corporation | The FDIC Chairman should direct RMS and the Legal Division Ethics Unit to develop a process for systematically requesting and collecting information on where departing examiners, including examiners-in-charge, enter into employment after leaving FDIC. (Recommendation 4) |

FDIC instituted a pilot program in March 2021 to collect data from departing examiners in the Division of Risk Management Supervision (RMS) and Division of Depositor and Consumer Protection (DCP). Under the pilot program, an FDIC manager was assigned to collect information about the employee's perspective on their tenure with the FDIC, the reasons for resignation, and the examiner's post-FDIC plans. FDIC stated it planned to use this information to help the agency understand the reasons examiners leave the FDIC and identify factors that may help the FDIC retain examiners. in February 2022, RMS and DCP officials concluded that the information collected under the pilot program was informative and determined to make the survey program permanent. The survey program will improve FDIC's ability to assess whether an employee's independence may have been compromised by a future employment opportunity.

|