Steel and Aluminum Tariffs: Commerce Should Improve Its Exclusion Request Process and Economic Impact Reviews

Fast Facts

In 2018, the President imposed tariffs on many steel and aluminum imports, and told the Department of Commerce to allow companies to request relief from paying these tariffs in certain circumstances.

Commerce rejected thousands of these "tariff exclusion requests" because companies made errors in their applications. It also did not decide most of the requests within its established deadlines, which created a backlog of almost 30,000 undecided requests. These issues delay relief for companies and increase work for the agency.

We recommended Commerce take steps to reduce applicant errors and make its decisions in a timelier manner.

Applicants submitted tariff exclusion requests to Commerce through the website Regulations.gov

Highlights

What GAO Found

The Department of Commerce (Commerce) has a four-phase process to review companies' requests to be excluded from having to pay Section 232 steel and aluminum tariffs. Commerce ensures an exclusion request is complete, accepts public input, evaluates materials submitted, and issues a final decision. Between March 2018 and November 2019, Commerce received over 106,000 requests; it rejected over 19,000 of them prior to decision due to incorrect or incomplete information. Although rejections may delay relief for requesters and can increase work for Commerce, the agency has not identified, analyzed, or taken steps to fully address the causes of these submission errors.

In deciding exclusion requests, Commerce examines objections from steel and aluminum producers to find whether the requested products are reasonably available domestically in a sufficient amount. Commerce may also decide exclusion requests based on national security issues, but has not done so. While Commerce approved two-thirds of exclusion requests, it most often denied requests that had technical errors or where a domestic producer had objected.

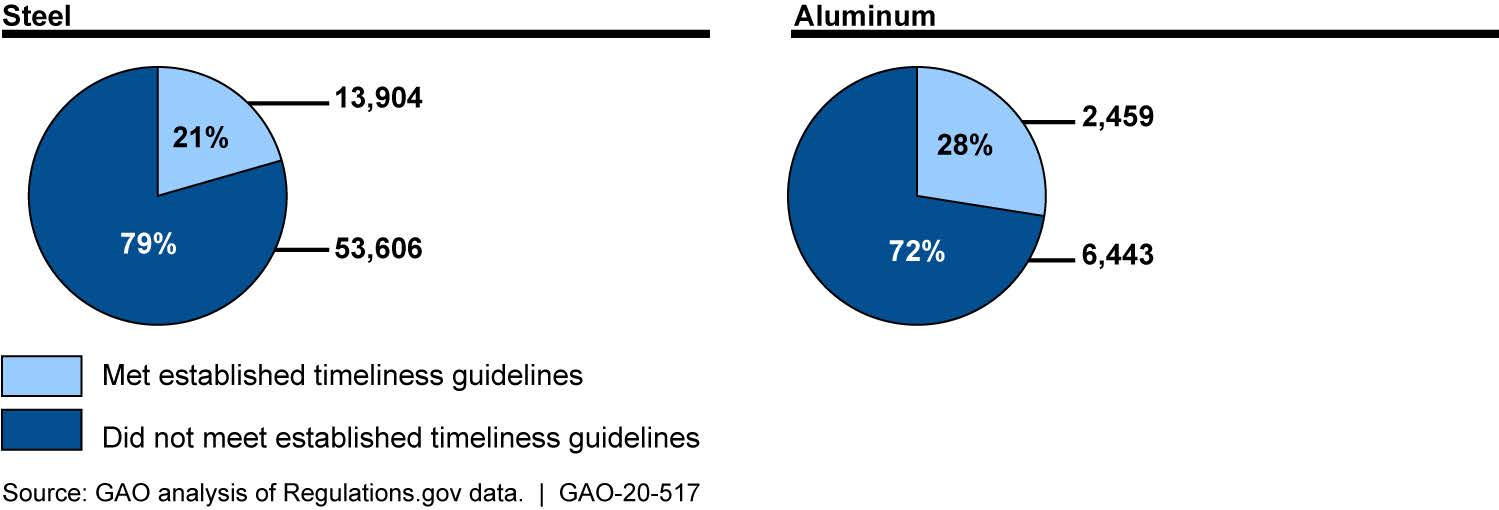

Commerce did not decide about three quarters of requests within its established timeliness guidelines, as shown in the figure, taking more than a year to decide 841 requests. Commerce took steps to improve timeliness, such as streamlining the review process for some requests and creating a new submission website, but continues not to meet guidelines and had a backlog of 28,000 requests as of November 2019. Until Commerce takes additional steps, companies will continue to encounter delays in obtaining relief.

Most Steel and Aluminum Exclusion Decisions Did Not Meet the Department of Commerce's Established Timeliness Guidelines from March 2018 to November 2019

Commerce has not documented the results from any reviews of the tariffs' impacts or assigned responsibility for conducting regular reviews. GAO found evidence of changes in U.S. steel and aluminum imports and markets. For example, imports covered by the tariffs declined after an initial surge and prices dropped after significant increases in earlier years. Evaluating whether the tariffs have achieved the intended goals and how they affect downstream sectors requires more in-depth economic analysis. Without assigning responsibility for conducting regular reviews and documenting the results, Commerce may be unable to consistently assess if adjustments to the tariffs are needed.

Why GAO Did This Study

Citing national security concerns over excess global supply of steel and aluminum, in March 2018 the President placed tariffs on the import of some products using Section 232 of the Trade Expansion Act of 1962. At the President's direction, Commerce established a process to provide relief, or exclusion, from the tariffs.

GAO was asked to review Commerce's Section 232 tariff exclusion process. This report assesses (1) the process Commerce uses to decide exclusion requests and to what degree it has accepted submitted requests; (2) what criteria and factors affected Commerce's decisions; (3) how often Commerce met established guidelines for the timely resolution of requests; and (4) the extent to which Commerce reviewed the impacts of the tariffs on steel and aluminum imports, as directed.

GAO analyzed Commerce's Bureau of Industry and Security and International Trade Administration records from March 2018 to November 2019, as well as data from the U.S. Census Bureau and the Department of Homeland Security, and spoke with agency officials.

Recommendations

GAO recommends that Commerce (1) identify, analyze, and respond to factors in the process that may cause submission errors; (2) take steps to improve timeliness of exclusion request decisions and address the backlog; and (3) assign responsibility for reviewing the tariffs' impact and document the results. Commerce concurred with all three recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Commerce | The Secretary of Commerce should direct BIS to identify, analyze, and respond to factors in the process that may cause submission errors. (Recommendation 1) |

In March 2021, Commerce officials reported that they had taken a number of actions to improve the process, and that they had seen a decline in the number of requests rejected and withdrawn. Commerce officials stated that they planned to issue guidance by the end of 2024 addressing the issues that GAO has raised. Presidential Proclamations 10895 and 10896 implemented changes to the Section 232 Steel and Aluminum process, including the termination of the tariff exclusions. According to Commerce, the Department is no longer accepting or considering new or pending Section 232 exclusion requests as of February 10, 2025. As a result, this recommendation is overtaken by events and GAO has closed the recommendation as no longer valid as of April 2025.

|

| Department of Commerce | The Secretary of Commerce should direct BIS to identify, assess, and make program changes to address issues that have impeded timeliness and created the backlog of exclusion requests. (Recommendation 2) |

In commenting on the report in September 2020, Commerce concurred with GAO's recommendation. In March 2021, Commerce reported changes they had made to their process and additional actions they would be taking. As of September 2024, Commerce officials stated that they planned to issue guidance by the end of 2024 addressing the issues that GAO has raised. Presidential Proclamations 10895 and 10896 implemented changes to the Section 232 Steel and Aluminum process, including the termination of the tariff exclusions. According to Commerce, the Department is no longer accepting or considering new or pending Section 232 exclusion requests as of February 10, 2025. As a result, this recommendation is overtaken by events and GAO has closed the recommendation as no longer valid as of April 2025.

|

| Department of Commerce | The Secretary of Commerce should assign responsibility for regularly reviewing the impact of the tariffs on steel and aluminum imports, including tariff exclusions, and document the results. (Recommendation 3) |

In March 2021, Commerce reported it identified BIS, in coordination with ITA, to be the lead bureau for regularly reviewing the impact of steel and aluminum tariffs on imports. In April 2023 BIS provided an analysis of the the impact of the tariffs on steel and aluminum, including tariff exclusion. BIS concluded that improvements in steel industry metrics (domestic production, imports, capacity utilization, import penetration, investment, employment) indicated that the 25 percent tariff on steel imports has been largely successful in achieving its objective. They concluded that the 10 percent tariffs on aluminum imports had been partially effective in achieving their objective with regard to the primary aluminum sector, and that the effect of tariffs on downstream aluminum producers was mixed. According to Commerce officials, these analyses may be used to inform future decisions or actions by the agency. As a result of these efforts, Commerce has improved its ability to provide policy makers with the accurate and complete information needed to make informed decisions about the section 232 tariff program and whether adjustments should be made to help the program achieve its objectives.

|