Small Business Administration: Disaster Loan Processing Was Timelier, but Planning Improvements and Pilot Program Evaluation Needed

Fast Facts

Para la versión de esta página en español, ver a GAO-20-369.

We reviewed how the Small Business Administration planned for and responded to Hurricanes Harvey, Irma, and Maria in 2017, among other things.

After the hurricanes, SBA accepted about 340,000 disaster loan applications and approved about 141,000, making more than $7 billion in loans to help business owners, homeowners, renters, and nonprofits recover. Loan processing averaged 18 days or less.

SBA’s disaster plans lack an in-depth discussion of how to deal with risks such as extended power outages that could curtail its response. We made 5 recommendations, including that SBA better document risks and how to mitigate them in its disaster plans.

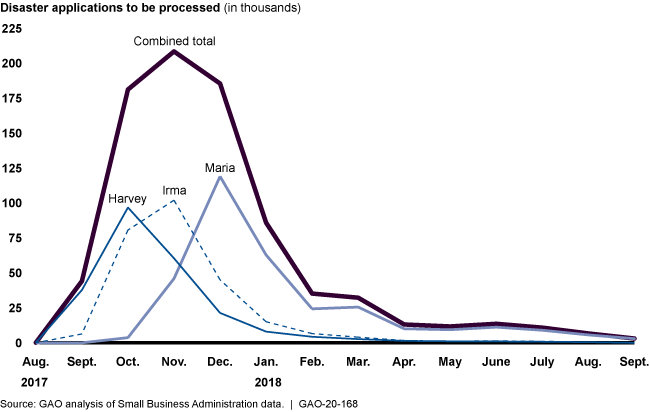

Number of Disaster Applications to Be Processed, by Hurricane and Month/Year

Line graph

Highlights

Para la versión de esta página en español, ver a GAO-20-369.

What GAO Found

The Small Business Administration's (SBA) Office of Disaster Assistance, which administers the Disaster Loan Program, regularly develops disaster plans but does not discuss risks and risk mitigation in detail in its planning documents. Specifically, SBA's current Disaster Preparedness and Recovery Plan lacks an in-depth discussion of risks (including extended power and communications outages) that could affect its disaster response. SBA's disaster response includes deploying staff to and establishing centers in disaster areas to accept loan applications. The aftermath of the 2017 hurricanes (Harvey, Irma, and Maria) illustrates how the risks affected SBA's disaster loan operations. For example, because of widespread power outages (particularly in Puerto Rico), loan applicants often could not submit applications electronically and SBA often could not call or e-mail applicants. As a result, SBA may not be adequately prepared to respond to challenges that arise during its disaster response efforts.

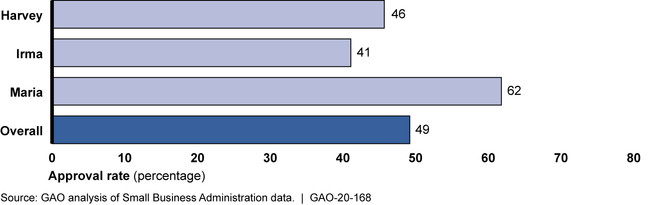

Changes SBA made to the loan application process since 2005 (such as implementing electronic applications) improved timeliness. For the 2017 hurricanes, SBA processed more than 90 percent of all loan applications (including those quickly declined or withdrawn) within its 45-day goal, averaging less than 18 days for each hurricane. Overall, about 49 percent of applications submitted after the 2017 hurricanes were approved (see figure). Applicants and others with whom GAO spoke noted some application challenges, including frequent changes to SBA contact staff and having to resend documents. According to SBA officials, staff changes resulted from turnover, among other reasons. Many applicants in Puerto Rico also encountered translation challenges during interactions with SBA.

Approval Rates for Disaster Loans for Three 2017 Hurricanes

SBA has no plans to evaluate its Express Bridge Loan Pilot Program, a loan guarantee program that began in October 2017 and is set to expire on September 30, 2020, and is intended to offer small businesses quicker funding after disasters. As of September 2019, SBA had received 93 applications, but most of them were incomplete and SBA had guaranteed only two loans. The Office of Capital Access, which manages the pilot, had not sought feedback from lenders on why so few loans had been made. Without evaluating program design and implementation, SBA's ability to make an informed decision on the program's future, including assessing potential demand for bridge loans, is limited.

Why GAO Did This Study

SBA assists most types of businesses regardless of size and others affected by natural and other declared disasters through its Disaster Loan Program. Disaster loans can be used to help rebuild or replace damaged property or continue business operations.

GAO was asked to review SBA's response to three 2017 hurricanes (Harvey, Irma, and Maria). This report examines SBA's (1) planning for and response to the 2017 hurricanes; (2) disaster loan application and review process; and (3) implementation of the Express Bridge Loan Pilot Program.

GAO analyzed SBA planning documents; summary data from SBA's Disaster Credit Management System for applications submitted between August 31, 2017, and September 24, 2018 (the period in which SBA processed nearly all loan applications for each hurricane); and SBA guidance on the bridge loan program. GAO interviewed small business owners and officials from local governments, business advocacy organizations, and Small Business Development Centers in Florida, Texas, Puerto Rico, and the U.S. Virgin Islands.

Recommendations

GAO is making five recommendations to SBA, including that it more comprehensively document risks and plans to mitigate these risks and evaluate the implementation of the Express Bridge Loan Pilot Program. Overall, SBA agreed with the recommendations, but described actions that partially address the recommendation for evaluating the pilot. GAO maintains it should be fully implemented, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration |

Priority Rec.

The Associate Administrator for the Office of Disaster Assistance should identify and document risks associated with its disaster response and plans to mitigate these risks in its disaster planning documentation. (Recommendation 1) |

SBA agreed with the recommendation. In December 2023, SBA finalized a framework for how the agency will engage communities in its disaster response. Among other things, the document identifies risks common in rural areas, such as geographic dispersion, damaged infrastructure, and the lack of access to high-speed internet. To help mitigate these potential risks, SBA has begun using Portable Loan Outreach Centers that can operate in rural locations and underserved communities. Because they have satellite internet and solar generators, these pop-up centers allow SBA to quickly establish temporary application intake centers where needed. SBA has also requested funds for a Mobile Loan Outreach Center which would operate out of a recreational vehicle, bus, or van. According to the agency, this would allow them to have roving business recovery centers and further help overcome these identified challenges. By taking these steps, SBA can better design its plans for and implementation of disaster response efforts and help ensure staff are adequately prepared to conduct operations in situations such as those encountered in Puerto Rico and the U.S. Virgin Islands.

|

| Small Business Administration |

Priority Rec.

The Associate Administrator for the Office of Disaster Assistance should identify the key elements of a disaster action plan and provide additional guidance to staff on how to incorporate these elements into future action plans. (Recommendation 2) |

SBA agreed with the recommendation. In December 2022, SBA provided a revised template for its disaster action plans and noted that it was developed after SBA had reviewed existing action plans and identified the critical elements. Among other things, the template requires the field operations center to identify its projected resource needs and outreach strategy. By taking these steps, SBA's Field Operations Centers will be less likely to miss opportunities to better tailor their response to individual disasters, improving the effectiveness of their responses.

|

| Small Business Administration | The Associate Administrator for the Office of Disaster Assistance should update its outreach plan to include information on region-specific risks or challenges, such as those encountered after the 2017 hurricanes. (Recommendation 3) |

SBA agreed with the recommendation. In December 2023, SBA finalized an Outreach and Engagement Framework, which, according to SBA officials, has replaced SBA's marketing and outreach plan. SBA has also incorporated this framework into its memos guiding the agency's responses for working with local jurisdictions and following incidents of gun violence. The initial phase of the framework includes assessing the area and its demographics, including the extent to which there are rural or underserved communities. The second phase includes outreach efforts to mitigate risks that SBA has identified as common in rural areas, such as geographic dispersion, damaged infrastructure, and the lack of access to high-speed internet. By taking these steps, SBA staff will be more adequately prepared to conduct outreach in areas with specific risks or challenges.

|

| Small Business Administration | The Associate Administrator for the Office of Disaster Assistance should establish metrics to measure the success of its outreach efforts during the response to a disaster. (Recommendation 4) |

In response to our recommendation, SBA established metrics to measure the success of its disaster outreach efforts and incorporated these metrics into its 2020 annual customer satisfaction survey. For example, the survey asked about the outreach efforts that the respondent was exposed to, such as in-person meetings and online media. The results showed that in-person meetings were the most popular method of outreach. SBA said that it intends to continue to track these metrics as part of its annual customer service surveys. By taking these steps, SBA will be able to determine how well and to what extent its outreach efforts have informed disaster survivors about the Disaster Loan Program, and make adjustments to improve the effectiveness of such efforts.

|

| Small Business Administration | The Associate Administrator for the Office of Capital Access should evaluate the implementation of the Express Bridge Loan Pilot Program to determine why so few loans have been made and if any design changes may be warranted before the end of the pilot. Such an evaluation could include assessing SBA's outreach efforts and seeking feedback from lenders. (Recommendation 5) |

The Express Bridge Pilot Program expired on March 13, 2021, and was not renewed. As SBA did not evaluate the implementation prior to the program's expiration and make corresponding changes to the program's design to encourage participation, we are closing the recommendation as "Not Implemented."

|