Social Security Benefits: SSA Needs to Improve Oversight of Organizations that Manage Money for Vulnerable Beneficiaries

Fast Facts

Some Social Security beneficiaries rely on organizations like non-profits or nursing homes to help them manage their benefits. The Social Security Administration monitors these organizations to ensure benefits are not being misused.

Yet SSA does not require background checks for key employees of such organizations as it does for relatives or friends that assist beneficiaries. In addition, SSA accounting forms make it difficult to track in detail how these funds are spent.

We made 9 recommendations, including that SSA redesign its accounting forms and look into requiring background checks for employees at these organizations.

Social Security beneficiaries may rely on non-profits or other organizations to manage their benefits.

Woman in a complex wheelchair and her caregiver

Highlights

What GAO Found

The Social Security Administration (SSA) approves organizational payees—such as nursing homes or non-profits that manage the Social Security benefits of individuals unable to do so on their own—by assessing a range of suitability factors, such as whether the organizations have adequate staff to manage benefits for multiple individuals. However, GAO found that SSA's policy does not specify how to assess more complex suitability factors, such as whether an organization demonstrates sound financial management. Without clearer guidance, unqualified or ill-prepared organizational payees could be approved to manage benefits. Also, SSA does not currently require background checks for key employees of an organizational payee. In contrast, SSA requires background checks for individual payees—such as a relative or friend of the beneficiary. A comprehensive evaluation could help SSA determine whether and how to expand their use of background checks to organizational payees.

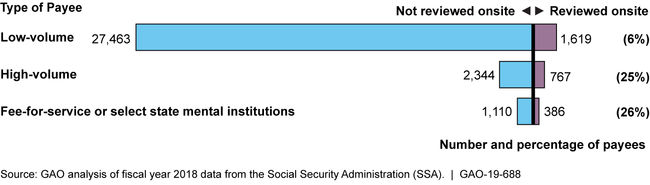

To ensure organizational payees are managing funds appropriately, SSA uses several monitoring tools, including resource-intensive onsite reviews. Certain organizational payees, such as those that charge fees for their services or have 50 or more beneficiaries (high-volume), receive onsite reviews every 3 to 4-years. In contrast, payees that serve fewer than 50 beneficiaries (low-volume)—the vast majority—are selected for review based on their estimated likelihood of misusing beneficiary funds, and a relatively low percent of them receive onsite reviews (see figure). SSA uses a predictive statistical model to identify higher risk low-volume payees, but the model's effectiveness cannot be fully assessed by GAO or others due to missing documentation on how it was designed. SSA officials said they will update the model in the future, but do not have a time frame for doing so. Establishing such a time frame and documenting design decisions are key steps toward assessing the model's effectiveness.

Number and Percentage of SSA Organizational Payees, by Payee Type, Reviewed Onsite in Fiscal Year 2018.

Another way SSA oversees organizational payees is by reviewing their annual accounting forms, but shortcomings exist in SSA's review of the form and in the form's content and design. For example, SSA lacks timeframes for following up on missing or problematic forms. Also, the accounting form does not capture complete information on whether payees co-mingle beneficiaries' funds in collective accounts, which can limit SSA's ability to monitor those risk-prone accounts. Establishing timeframes and revising the form could enhance the effectiveness of the annual accounting form as an oversight tool.

Why GAO Did This Study

Nearly a million individuals relied on organizational payees to manage their Social Security benefits in 2018. Due to an aging population more beneficiaries may need organizational payees in the future. These beneficiaries are among the most vulnerable because, in addition to being deemed incapable of managing their own benefits, they lack family or another responsible party to assume this responsibility. SSA reports that misuse of benefits by payees is rare, but its Office of Inspector General has identified cases of misuse that have harmed vulnerable beneficiaries. GAO was asked to review SSA's organizational payee program.

This review examines, among other things SSA's process for approving payees and its monitoring efforts. GAO reviewed relevant federal laws, regulations, policies, and guidance; analyzed SSA data from fiscal year 2018; analyzed the predictive statistical model SSA uses to select low-volume payees for on-site reviews; and interviewed SSA central office staff and regional, area, and field office staff in four regions selected for geographic diversity.

Recommendations

GAO is making nine recommendations in this report, including that SSA: clarify how to assess complex suitability factors; assess requiring background checks for organizational payees; establish a timeframe for reviewing the predictive model and document design decisions resulting from that review; and establish timeframes for, and conduct revisions of the accounting form. SSA agreed with all nine recommendations and provided technical comments that GAO incorporated as appropriate.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Social Security Administration | The Commissioner of the Social Security Administration should ensure that (a) the agency's policies and guidance are specific enough so field office staff know how to apply complex suitability criteria for assessing payee suitability, such as by providing a minimum set of specific questions; and (b) additional regional guidance that is made available to staff is centrally reviewed for compliance and completeness. (Recommendation 1) |

SSA agreed with this recommendation. Since April 2020 and most recently in September 2022, the agency reported that it is reviewing its representative payee suitability policy to identify areas that need improvement, which may include system enhancements and changes to forms. They anticipate their efforts to implement the recommendation will commence after implementing the Strengthening Protection for Social Security Beneficiaries Act of 2018, and continue until FY2024. We will consider closing this recommendation when SSA has provided documentation of changes made as a result of its review.

|

| Social Security Administration | The Commissioner of the Social Security Administration should create safeguards in the Electronic Representative Payee System (eRPS) to ensure that field office staff fully document all required information, such as the rationale for their decision, before approving an application. (Recommendation 2) |

SSA agreed with this recommendation and identified actions to address it. Specifically, SSA reported that, as part of implementing the Strengthening Protections for Social Security Beneficiaries Act of 2018, planned changes to eRPS will improve documentation of selection decisions. In August 2021 and February 2022, the agency reported that it is evaluating eRPS's functionality to determine if it can support the documentation of representative payee selection decisions. In September 2022 and December 2023, the agency reported it had no resources available for the effort. SSA said that it could implement additional safeguards in eRPS if resources are available after the agency has implemented all legally-required system changes. We will close this recommendation when SSA provides documentation that eRPS includes safeguards to ensure all required information has been entered prior to approving organizational representative payee applications.

|

| Social Security Administration | The Commissioner of the Social Security Administration should complete a plan, including timeframes, for comprehensively evaluating if and how to leverage external sources of information on organizations' suitability, such as by conducting background checks or credit checks on organizations or key staff that handle beneficiaries' funds or requiring organizations to conduct their own background checks on key staff. (Recommendation 3) |

SSA agreed with this recommendation and took actions to address it by carrying out a plan to assess the use of external sources information to assess organizations' suitability. Specifically, the agency awarded a contract in September 2020 to assess the risk of payee misuse among different types of payees and evaluate the use of credit checks for organizations applying to serve as payees. After the report was completed, SSA reviewed the results and concluded not to use credit checks to evaluate organizational payees because the report showed that the only type of organizational payees that pose a greater risk for misuse of payee funds - fee-for service payees - are already subject to credit checks.

|

| Social Security Administration | The Commissioner of the Social Security Administration should develop and implement mechanisms to systematically obtain and review feedback from organizational payees and communicate findings to SSA management. (Recommendation 4) |

SSA agreed with this recommendation. In April 2020, the agency reported that it is evaluating potential communication channels that can be used to implement a systematic approach to obtain feedback from organizational representative payees. As of March 2023, SSA had launched its new feedback tool - Engage SSA - for three weeks in late 2022. The agency subsequently compiled and analyzed the feedback gathered and made recommendations to address the concerns identified through the feedback tool. As a result, SSA is better positioned to help ensure the program is operating effectively and addressing payees' concerns. We encourage the agency to consider periodically collecting feedback on an ongoing basis.

|

| Social Security Administration |

Priority Rec.

The Commissioner of the Social Security Administration should (a) establish a plan and time frame for periodically reviewing the predictive model's design; (b) consider additional data sources that would allow for additional screening or modeling of potentially high-risk organizational payees; and (c) ensure that subsequent design decisions are documented in sufficient detail so the development process can be more fully understood and replicated, either by SSA or a knowledgeable third party, with minimal further explanation. (Recommendation 5) |

SSA agreed with this recommendation and took action to address it. SSA documented a plan to periodically review the predictive model's design and considered potential additional data sources. For example, SSA reviewed nursing home data from the Center for Medicare and Medicaid Services (CMS) as a predictive variable for use in their new organizational payee misuse model and determined that it would not enhance the current models' predictive power, and is developing the data set which will be used for model development. The agency also documented its planned approach to update the model in the future. SSA noted that as it updates the model it will fully document the process and results to allow for future oversight and review. As of January 2023, SSA had revised the model and related design decisions. The agency also stated it plans to document any future changes to the model or its features.

|

| Social Security Administration | The Commissioner of the Social Security Administration should require field offices to contact payees about missing or problematic annual accounting forms within a specific time frame. (Recommendation 6) |

SSA agreed with this recommendation and has taken steps to partially address it. In May 2024, SSA began issuing quarterly reports to regional commissioners identifying the number of problematic annual accounting forms pending for longer than 180 days in each region, along with processing tips and reminders. While this falls short of setting a required time frame to follow up on missing or problematic accounting forms, it may achieve the desired effect of reducing the backlog of outstanding accountings forms requiring follow up. To close this recommendation, SSA should provide documentation that the backlog of accounting forms has fallen in the first year of quarterly reporting.

|

| Social Security Administration | The Commissioner of the Social Security Administration should revise the annual accounting form to enhance its effectiveness. Such revisions could include (but not be limited to) more fully ascertaining the use of collective accounts, adopting stakeholders' recommendations on using the form to collect more meaningful data, and reflecting best practices from behavioral science insights in the design of the form. (Recommendation 7) |

SSA agreed with this recommendation. In April 2020, the agency reported that it continues to engage with agency stakeholders - including the User Experience Group - to identify revisions to the annual accounting form and redesign that reflects best practices from behavioral science insights. As of August 2021, SSA submitted to the Office of Management and Budget (OMB) the initial changes to the annual representative payee accounting form, which included improved instructions and design changes in line with current accessibility requirements. In September 2022, the agency reported that the initial changes are still pending OMB review, and the agency is considering additional revisions that may be necessary to implement the recommendation. In September 2023, SSA provided the revised forms and confirmed they are still awaiting OMB review. We will close this recommendation once the OMB-approved forms are in use.

|

| Social Security Administration | The Commissioner of the Social Security Administration should enhance the eRPS system to ensure that field offices are (a) alerted when collective accounts are due to be reviewed; and (b) able to take action on expired collective account information and thereby avoid payees' continued use of these accounts without oversight. (Recommendation 8) |

The Social Security Administration took several steps to address this recommendation. In November 2020, SSA reported that it verified that alerts are issued twice before collective account approvals expire (3 and 1 month prior). The agency also implemented a change to electronic Representative Payee System (eRPS) to enable field office technicians to search for and view expired accounts. In June 2021, SSA updated its collective account policy to specify that collective accounts remain in an editable format in eRPS for up to 30 days after accounts have expired. In April 2022, SSA clarified that these eRPS changes, when taken together, provide field office technicians the opportunity to take action on collective accounts after they have expired. We concur that these actions address the recommendation. Moving forward, it will be important that SSA monitor that expiring collective accounts are addressed timely.

|

| Social Security Administration |

Priority Rec.

The Commissioner of the Social Security Administration should, as it carries through with its plan to develop a risk assessment for the organizational payee program, ensure that that the plan reflects periodic consideration of findings from onsite reviews and audits. (Recommendation 9) |

SSA agreed with this recommendation. In September 2020, SSA published a report documenting the results of its fraud risk assessment of the representative payee program, covering both organizational as well as individual representative payees.. The risk assessment incorporated findings from onsite assessments and audits into its methodology. Furthermore, SSA reported that it plans to conduct an ongoing assessment of program risks every 3 years and consider audit findings within 5 years of assessment

|