Retirement Security: Some Parental and Spousal Caregivers Face Financial Risks

Fast Facts

About 10% of Americans per year cared for an elderly parent or spouse from 2011 through 2017. These family caregivers may risk their long-term financial security if they have to work less or pay for caregiving expenses such as travel or medicine.

More than half of people who cared for parents or spouses said they went to work late, left early, or took time off for care

Spousal caregivers at or near retirement age had less in retirement assets or Social Security income than non-caregivers

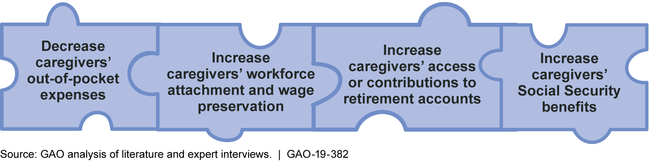

Experts and studies identified ways to potentially improve caregivers' retirement security, such as increasing their Social Security benefits

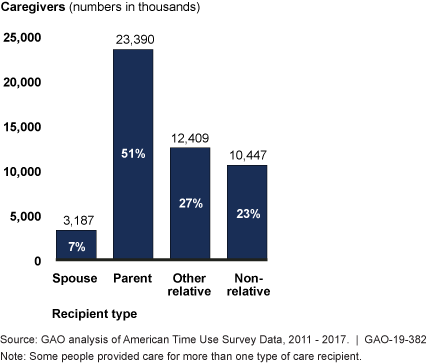

Family Caregivers in 2011-2017: Who Received the Care?

Bar chart showing most caregivers are caring for an elderly parent.

Highlights

What GAO Found

An estimated one in 10 Americans per year cared for a parent or spouse for some period of time from 2011 through 2017, and women were more likely than men to provide care, according to Bureau of Labor Statistics survey data. Both parental and spousal caregivers were older than the general population, with spousal caregivers generally being the oldest. In addition, spousal caregivers were less likely to have completed college or to be employed, and they had lower earnings than parental caregivers and the general population. Most parental and spousal caregivers provided care for several years, and certain groups were more likely to provide daily care, including women and minorities.

Some caregivers experienced adverse effects on their jobs and had less in retirement assets and income.

- According to data from a 2015 caregiving-specific study, an estimated 68 percent of working parental and spousal caregivers experienced job impacts, such as going to work late, leaving early, or taking time off during the day to provide care. Spousal caregivers were more likely to experience job impacts than parental caregivers (81 percent compared to 65 percent, respectively).

- According to 2002 to 2014 data from the Health and Retirement Study, spousal caregivers ages 59 to 66 had lower levels of retirement assets and less income than married non-caregivers of the same ages. Specifically, spousal caregivers had an estimated 50 percent less in individual retirement account (IRA) assets, 39 percent less in non-IRA assets, and 11 percent less in Social Security income. However, caregiving may not be the cause of these results as there are challenges to isolating the effect of caregiving from other factors that could affect retirement assets and income.

Expert interviews and a review of relevant literature identified a number of actions that could improve caregivers' retirement security, which GAO grouped into four policy categories. Experts identified various benefits to caregivers and others from the policy categories—as well as pointing out possible significant costs, such as fiscal concerns and employer challenges—and in general said that taking actions across categories would help address caregivers' needs over both the short-term and long-term (see figure). Several experts also said public awareness initiatives are critical to helping people understand the implications of caregiving on their retirement security. For example, they pointed to the need for education about how decisions to provide care, leave the workforce, or reduce hours could affect long-term financial security.

Four Policy Categories for Improving Caregivers' Retirement Security

Why GAO Did This Study

According to the U.S. Census Bureau, the number of people in the United States over age 65 is expected to almost double by 2050. As Americans age, family caregivers, such as adult children and spouses, play a critical role in supporting the needs of this population. However, those who provide eldercare may risk their own long-term financial security if they reduce their workforce participation or pay for caregiving expenses. GAO was asked to provide information about parental and spousal caregivers and how caregiving might affect their retirement security.

This report (1) examines what is known about the size and characteristics of the parental and spousal caregiving population, including differences among women and men; (2) examines the extent to which parental or spousal caregiving affects retirement security; and (3) identifies and discusses policy options and initiatives that could improve caregivers' retirement security.

GAO analyzed data from three nationally representative surveys; conducted an extensive literature review; and interviewed experts who are knowledgeable about caregiving or retirement security, engaged in research or advocacy around caregiving, or represent groups that might be affected by the identified policy approaches.

For more information, contact Charles Jeszeck at (202) 512-7215 or jeszeckc@gao.gov.