Electronic Cigarettes: Effect on Federal Excise Taxes Collected on Traditional Cigarettes Is Not Currently Evident

Highlights

What GAO Found

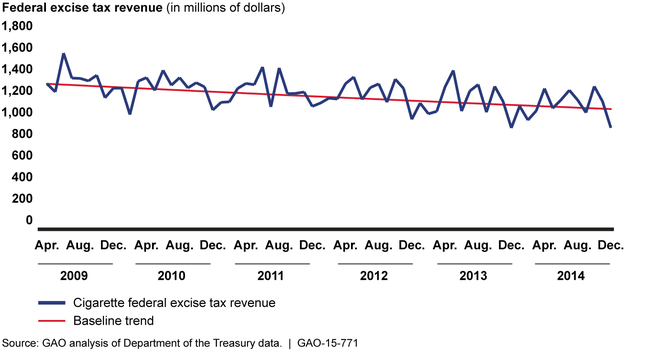

GAO's analysis found no evidence that use of electronic cigarettes (e-cigarettes) has affected federal excise tax (FET) revenue from traditional cigarettes, which has been declining over time (see figure). Possible reasons for the lack of a detectable effect include the small size of the e-cigarette market (estimated at $2.5 billion in 2014) relative to the cigarette market ($80 billion in the same year); lack of comprehensive and reliable data on e-cigarette quantities and prices; and lack of comprehensive and reliable information about the extent to which e-cigarettes substitute for cigarettes. If users consume e-cigarettes instead of cigarettes, cigarette FET revenue would decline as fewer cigarettes are consumed. Data from a recent survey by the Centers for Disease Control and Prevention showing high school students' increasing use of e-cigarettes and decreasing use of cigarettes suggest that these students may substitute e-cigarettes for cigarettes to some extent. If the percentage of high school students using cigarettes continues to decline, cigarette FET revenue could also decrease at a greater rate than the average historic trend observed since April 2009, when FET on cigarettes and other tobacco products was last increased.

Cigarette Federal Excise Tax Revenue Collected and 6-Year Historical Trend Line, April 2009-December 2014

Comprehensive data on e-cigarette quantities and prices are not available from federal agencies. The Department of the Treasury (Treasury) and Food and Drug Administration (FDA) do not collect data on e-cigarette quantities comparable to data that they collect for cigarettes and some other tobacco products. According to FDA officials, if e-cigarettes are deemed subject to FDA's tobacco product authorities as a result of a rule proposed in April 2014, the agency could start collecting some data on the types of e-cigarettes on the U.S. market but will not collect data on the quantities of e-cigarettes sold. The Bureau of Labor Statistics began collecting data on e-cigarette prices in September 2014 as part of its data collection for the Consumer Price Index, but these data are limited.

Why GAO Did This Study

While use of traditional cigarettes in the United States continues to decline, use of e-cigarettes is increasing. Treasury collects FET on cigarettes and other tobacco products manufactured in the United States. The Internal Revenue Code of 1986, as amended, does not specifically define or list a tax rate for e-cigarettes. The decline in cigarette use has led to a decline in cigarette FET revenue, from $15.3 billion in fiscal year 2010 to $13.2 billion in fiscal year 2014. FDA currently regulates four tobacco products. In April 2014, FDA proposed to deem additional tobacco products, including e-cigarettes, subject to its tobacco product authorities.

GAO was asked to examine issues related to the U.S. e-cigarette market. This report examines the extent to which (1) e-cigarette use affects cigarette FET revenue, and (2) data on quantities and prices of e-cigarettes on the U.S. market are available from federal agencies.

GAO conducted a regression analysis to assess the effect of e-cigarette use on cigarette FET revenue from April 2009 through December 2014, using Treasury data on FET revenue from cigarettes. GAO also reviewed agency documents and interviewed agency officials and industry experts.

Recommendations

GAO is not making recommendations in this report.