Tax Filing Season: 2014 Performance Highlights the Need to Better Manage Taxpayer Service and Future Risks

Highlights

What GAO Found

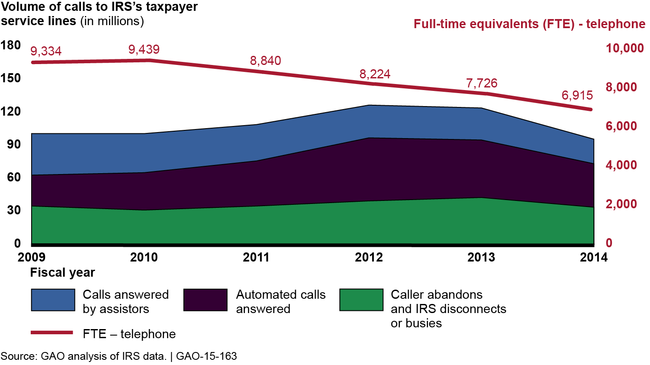

The Internal Revenue Service's (IRS) processing of tax returns was timely, even though the filing season was delayed due to the 2013 government shutdown. Continued growth in e-filing allows IRS to reduce costs and issue refunds faster. Although IRS received fewer calls in 2014, the percentage of callers seeking help who received it remained low and wait times remained high compared to prior years.

Call Volume to IRS's Taxpayer Service Telephone Lines and IRS Full-Time Equivalents (FTE) Devoted to Telephone Service, Fiscal Years 2009 through 2014

One way to improve taxpayer telephone service is to compare it to the best in business, as required by Congress and executive orders. However, IRS has not systematically made such a comparison for its telephone service because of budget constraints and difficulty in identifying comparable organizations, according to IRS officials. By not comparing itself to other call center operations, IRS is missing an opportunity to identify and address gaps between actual and desired service, and inform Congress about resources needed to close the gap. More efficient telephone service could help improve correspondence service because the same staff provides those services.

IRS did not set numerical goals—such as a reduction in wait time—or develop a plan to assess the effects of its 2014 service changes. Such information would help Congress, IRS managers, and others understand the benefits and potential budget tradeoffs associated with IRS service changes. This is important because IRS has identified additional service changes for 2015 and beyond.

IRS used its new enterprise-wide risk management approach to identify risks such as staffing and training. IRS has made good progress in setting up its risk management process. However, while risks were identified and countermeasures discussed, such as contingency plans and workload adjustments, most countermeasures were not specific. Without specific countermeasures identified in advance, IRS's ability to respond to adverse events may be hampered.

Why GAO Did This Study

During the filing season, IRS processes tax returns, issues refunds, and provides telephone, correspondence, online, and face-to-face service. GAO has reported that in recent years IRS has absorbed significant budget cuts and struggled to provide quality service. In response, IRS has taken steps, including eliminating some services and implementing a new risk management process. GAO assessed IRS's (1) 2014 filing season performance, including how it compares itself to best practices; (2) efforts to evaluate the effectiveness of 2014 service changes; and (3) actions to manage risk for filing season operations, among other objectives. GAO analyzed IRS documents and data, visited IRS facilities, and interviewed IRS officials and external stakeholders.

Recommendations

GAO recommends IRS systematically compare telephone service to the best in business, develop measures and a plan to analyze service changes, and include specific countermeasures in risk management plans.

IRS disagreed with comparing its telephone service to the best in business stating it (1) is not comparable to other organizations and (2) has done targeted comparisons. GAO disagrees. In its view, the recommendation remains valid and benchmarking all aspects of service to the best in business could help IRS improve its service. IRS agreed to develop measures and a plan to analyze service changes. It neither agreed nor disagreed to include specific countermeasures in its risk management plans.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of the Internal Revenue should direct the appropriate officials to systematically and periodically compare its telephone service to the best in business to identify gaps between actual and desired performance. |

In January 2017, IRS officials provided results of a benchmarking study that it completed in response to our recommendation. In that study, an IRS team compared IRS's service, measures and goals to comparable agencies and companies. For example, IRS compared the types of measures the companies used, including those that were primarily service-driven and resource-driven. As a result, the team recommended options for additional measures to indicate the level of access taxpayers have to service, including across channels. In addition, IRS concluded that the ideal level of service is 83 percent, which optimizes a balance between wait time, disconnects, and assistor availability. It also recommended exploring using new technology including email, online chat, and telephone call back features as well as to establish regularly scheduled follow-up benchmarking. With these benchmarking results, IRS can make more informed requests to Congress about resource requirements to deliver desired levels of service.

|

| Internal Revenue Service | The Commissioner of the Internal Revenue should direct the appropriate officials to include specific countermeasures or options in risk management plans that could guide a response when an adverse event occurs. |

In 2014, we found that the Internal Revenue Service (IRS) was using a new enterprise-wide risk management approach to identify risks and making good progress in establishing its risk management process. While IRS identified risks and countermeasures, such as contingency plans and workload adjustments, most countermeasures were not specific. Without specific countermeasures identified in advance, IRS's ability to respond to adverse events may be hampered. Therefore, we recommended that IRS include specific countermeasures or options in their risk management plans that could guide officials when an adverse event occurs. In May 2016, IRS officials reported that they had developed guidance covering the components of the Committee of Sponsoring Organization of the Treadway Commission (COSO) Enterprise Risk Management framework. The COSO framework includes the identification of risk responses or countermeasures in risk management plans. IRS reported that it had developed specific countermeasures in its risk management plans covering filing season readiness for those risks ranked highest in likelihood and impact. In August 2016, we reviewed an update to IRS's Wage & Investment Risk Register and found that risks associated with the filing season listed a series of specific mitigation steps for each risk identified. IRS identified additional mitigation steps that could be taken if the initial step fell short of the desired outcome.

|

| Internal Revenue Service | The Commissioner of the Internal Revenue should direct the appropriate officials to develop outcomes that are measurable and plans to analyze service changes that allow valid conclusions to be drawn so that information can be conveyed to Congress, IRS management, and others about the effectiveness of IRS's service changes and impact on taxpayers. |

IRS agreed with our recommendation and said that implementing it would allow the agency to determine the amount of resources that are reallocated as a result of the service initiatives, assess the taxpayer experience, and address additional opportunities for improvement. In February 2015, IRS established performance measures tracking mechanisms and assessments for evaluating its fiscal year 2015 service approach. We reviewed the document and determined that IRS developed measurable targets and plans to analyze the effects of each of the 5 service initiatives for fiscal year 2015. Additionally, IRS analyzed the results of the service initiatives at the end of the 2015 filing season, and plans to conduct another assessment at the end of fiscal year 2015. These efforts helped IRS determine the effectiveness of the fiscal year 2015 service initiatives, report on the results of them to Congress and other stakeholders, and make informed decisions on additional service initiatives in 2016 and beyond.

|