Financial Regulation: Complex and Fragmented Structure Could Be Streamlined to Improve Effectiveness

Highlights

What GAO Found

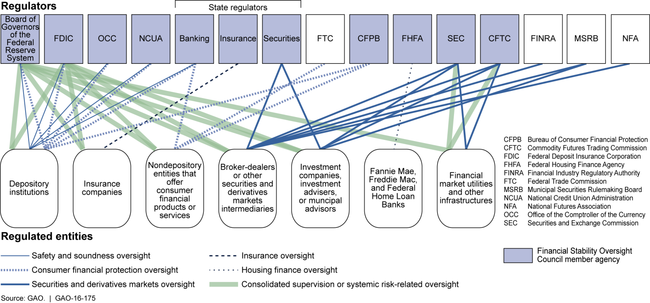

The U.S. financial regulatory structure is complex, with responsibilities fragmented among multiple agencies that have overlapping authorities. As a result, financial entities may fall under the regulatory authority of multiple regulators depending on the types of activities in which they engage (see figure on next page). While the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) made a number of reforms to the financial regulatory system, it generally left the regulatory structure unchanged.

U.S. regulators and others have noted that the structure has contributed to the overall growth and stability in the U.S. economy. However, it also has created challenges to effective oversight. Fragmentation and overlap have created inefficiencies in regulatory processes, inconsistencies in how regulators oversee similar types of institutions, and differences in the levels of protection afforded to consumers. GAO has long reported on these effects in multiple areas of the regulatory system. For example,

- Depository institutions. Inconsistencies in examination activities of the depository institution regulators can result in different conclusions regarding the safety and soundness of an institution and difficulties identifying emerging trends.

- Securities and derivatives markets. Securities and derivatives markets have become increasingly interconnected, and regulation of these markets by separate agencies has created challenges. For example, regulation of entities that engage in similar activities is at times duplicative and at other times inconsistent.

- Insurance. Insurance regulation is primarily state-based, and a lack of uniformity, including inconsistencies in the licensing of insurance agents and the approval of insurance products, has resulted in uneven consumer protection and increased costs to insurers.

In 2009, GAO established a framework for evaluating regulatory reform proposals and noted that an effective regulatory system would need to address certain structural shortcomings created by fragmentation and overlap. While changes made by the Dodd-Frank Act were consistent with some of the characteristics identified in this framework, the existing regulatory structure does not always ensure (1) efficient and effective oversight, (2) consistent financial oversight, and (3) consistent consumer protections. As a result, negative effects of fragmented and overlapping authorities persist throughout the system. For example, regulation of the swaps and security-based swaps markets by separate agencies creates potential market inefficiencies because of differences in certain of the agencies' rules for each product. GAO has previously made suggestions to Congress to modernize and improve the effectiveness of the financial regulatory structure. Without congressional action it is unlikely that remaining fragmentation and overlap in the U.S. financial regulatory system can be reduced or that more effective and efficient oversight of financial institutions can be achieved.

The Board of Governors of the Federal Reserve System (Federal Reserve) and OFR have been developing systemic risk monitoring efforts with similar goals, but have not effectively engaged in key collaboration practices that GAO has previously identified. As a result, OFR and the Federal Reserve could miss opportunities to benefit from each other's work and may conduct unnecessarily duplicative analyses.

FSOC‘s Systemic Risk Committee has improved interagency collaboration on systemic risk monitoring among regulators, but its process for identifying new threats continues to be based on participants' expert views and is not fully informed by OFR or the Federal Reserve's systemic risk monitoring efforts. Federal internal control standards call for the use of relevant, reliable, and timely information to achieve the entity's responsibilities. Without better access to existing systemic risk monitoring tools and other outputs, the committee may miss some risks or not identify them in a timely manner.

Although FSOC's mission is to respond to systemic risks, which may involve multiple entities, its recommendations are not binding and do not guarantee regulatory response. FSOC has authorities to designate certain entities or activities for enhanced supervision by a specific regulator, but these authorities may not allow FSOC to address certain broader risks that are not specific to a particular entity. For such risks, FSOC can recommend but not compel action. GAO's 2009 framework states that financial systems should include a mechanism for managing risks regardless of the source of the risks, and international best practices for systemic risk oversight state that macroprudential entities require authorities to foster the ability to act and ensure regulatory responses. Because of the limitations in FSOC's authorities, without congressional action FSOC may not have the tools it needs to carry out its mission to comprehensively respond to systemic risks, and it may be difficult to hold the council accountable for doing so.

U.S. Financial Regulatory Structure, 2016

Note: This figure depicts the primary regulators in the U.S. financial regulatory structure, as well as their primary oversight responsibilities. “Regulators” generally refers to entities that have rulemaking, supervisory, and enforcement authorities over financial institutions or entities. There are additional agencies involved in regulating the financial markets and there may be other possible regulatory connections than those depicted in this figure.

Why GAO Did This Study

The U.S. financial regulatory structure has evolved over the past 150 years in response to various financial crises and the need to keep pace with developments in financial markets and products in recent decades.

GAO was asked to review the financial regulatory structure and any related impacts of fragmentation or overlap. This report examines the structure of the financial regulatory system and the effects of fragmentation and overlap on regulators' oversight activities. GAO reviewed relevant laws and agency documents on their oversight responsibilities; held discussion groups with former regulators, industry representatives, and experts; and interviewed agency officials.

Recommendations

Congress should consider whether changes to the financial regulatory structure are needed to reduce or better manage fragmentation and overlap. Congress should also consider whether legislative changes are needed to align FSOC's authorities with its mission to respond to systemic risks. GAO also recommends that OFR and the Federal Reserve (1) jointly articulate individual and common goals for their systemic risk monitoring activities and engage in collaborative practices to support those goals; and (2) regularly and fully incorporate their monitoring tools, assessments, or results of monitoring activities into Systemic Risk Committee deliberations. Federal Reserve and OFR agreed with GAO's recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider whether additional changes to the financial regulatory structure are needed to reduce or better manage fragmentation and overlap in the oversight of financial institutions and activities to improve (1) the efficiency and effectiveness of oversight; (2) the consistency of consumer and investor protections; and (3) the consistency of financial oversight for similar institutions, products, risks, and services. For example, Congress could consider consolidating the number of federal agencies involved in overseeing the safety and soundness of depository institutions, combining the entities involved in overseeing the securities and derivatives markets, transferring the remaining prudential regulators' consumer protection authorities over large depository institutions to the Consumer Financial Protection Bureau, and the optimal role for the federal government in insurance regulation, among other considerations. | Legislation has been enacted that partially addresses GAO's suggested action. The Consolidated Appropriations Act, 2019 (Pub. L. No. 116-6) was signed into law and contains provisions that allow the Securities and Exchange Commission and the Commodity Futures Trading Commission to use funds for the interagency funding and sponsorship of a joint advisory committee to advise on emerging regulatory issues. The Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law. The law helps to address fragmentation in insurance oversight by requiring that the federal agencies involved in insurance regulation and the Federal Insurance Office that take a position or reasonably intend to take a position achieve consensus with state insurance regulators when they participate in negotiations on insurance issues before any international forum of financial regulators or supervisors. In addition, H.R. 7440, the Financial Services Innovation Act of 2024, was introduced in February 2024. The bill would require the Federal Reserve, the Consumer Financial Protection Bureau, the Department of Housing and Urban Development, the Federal Deposit Insurance Corporation, the Federal Housing Finance Agency, the National Credit Union Administration, the Office of the Comptroller of the Currency, and the Securities and Exchange Commission to establish offices of Finance Services Innovation (FSIO) to promote financial innovation and to establish an FSIO Liaison Committee to consult on the oversight of the FSIO and facilitate the cooperation of each FSIO to ensure the agencies share information and data. As of February 2025, there had been no further action on this bill. | |

| Congress should consider whether legislative changes are necessary to align FSOC's authorities with its mission to respond to systemic risks. Congress could do so by making changes to FSOC's mission, its authorities, or both, or to the missions and authorities of one or more of the FSOC member agencies to support a stronger link between the responsibility and capacity to respond to systemic risks. In doing so, Congress could solicit information from FSOC on the effective scope of its collective designation authorities, including any gaps. | As of February 2025, no legislation had been introduced that would align FSOC's authorities with its mission to respond to systemic risks, as GAO suggested in February 2016. Without legislative changes that would align FSOC's authorities with its mission, FSOC may lack the tools it needs to comprehensively address systemic risks that may emerge and a gap will continue to exist in the mechanisms for mitigating systemic risks. GAO will continue to monitor reform efforts to determine the extent to which they may help to align FSOC's authorities with its mission to respond to systemic risks. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Financial Research | To help regulators address regulatory fragmentation and improve FSOC's ability to identify emerging systemic risks, as OFR develops and refines its financial stability monitoring tools, it should work with FSOC to determine ways in which to fully and regularly incorporate current and future monitors and assessments into Systemic Risk Committee deliberations, including, where relevant, those that present disaggregated or otherwise confidential supervisory information. |

OFR presented information on several of its monitors at Systemic Risk Committee meetings in 2017, including its Financial System Vulnerabilities Monitor (formerly the Financial Stability Monitor), Financial Stress Index, and Money Markets Mutual Fund Monitor. Sharing these monitors at these meetings is consistent with the intent of GAO's February 2016 recommendation to fully and regularly incorporate current and future monitors and assessments into FSOC's Systemic Risk Committee deliberations. By sharing such monitors and information, the Systemic Risk Committee may identify and advance the analysis of systemic risks in a timely manner.

|

| Federal Reserve System | To help regulators address regulatory fragmentation and improve FSOC's ability to identify emerging systemic risks, the Federal Reserve should work with FSOC to regularly incorporate the comprehensive results of its systemic risk monitoring activities into Systemic Risk Committee deliberations. | Federal Reserve officials presented materials in May 2017 and November 2017 to the Systemic Risk Committee on topics that include information about the agency's Quantitative Surveillance Assessment. Federal Reserve officials also previously indicated that they provided a presentation to FSOC's Systemic Risk Committee in December 2016, which included comprehensive results from its systemic risk monitoring activities. In reviewing documentation from the May 2017 and November 2017 Systemic Risk Committee meetings, these actions appears to be consistent with GAO's February 2016 recommendation that the agency regularly incorporate the results of its systemic risk monitoring activities into...

|

| Office of Financial Research | To more efficiently and effectively monitor the financial system for systemic risks and reduce the risk of unnecessary duplication, OFR and the Federal Reserve should jointly articulate individual and common goals for their systemic risk monitoring activities, including a plan to monitor progress toward articulated goals, and formalize regular strategic and technical discussions around their activities and outputs to support those goals. | OFR and the Federal Reserve have taken steps in response to GAO's February 2016 recommendation. The Federal Reserve and OFR coordinated to organize semi-annual meetings to jointly discuss views from their respective monitoring of the financial system for risks. The agencies held two of these meetings in 2017. In a May 2017 meeting, the agencies discussed their approaches to financial stability monitoring and assessment and exchanged views on financial stability and potential threats. In an October 2017 meeting, OFR discussed its new heat map which had just been released and its overall assessment of financial stability. The Federal Reserve discussed its overall assessment of financial...

|

| Federal Reserve System | To more efficiently and effectively monitor the financial system for systemic risks and reduce the risk of unnecessary duplication, OFR and the Federal Reserve should jointly articulate individual and common goals for their systemic risk monitoring activities, including a plan to monitor progress toward articulated goals, and formalize regular strategic and technical discussions around their activities and outputs to support those goals. | OFR and the Federal Reserve have taken steps in response to GAO's February 2016 recommendation. The Federal Reserve and OFR coordinated to organize semi-annual meetings to jointly discuss views from their respective monitoring of the financial system for risks. The agencies held two of these meetings in 2017. In a May 2017 meeting, the agencies discussed their approaches to financial stability monitoring and assessment and exchanged views on financial stability and potential threats. In an October 2017 meeting, OFR discussed its new heat map which had just been released and its overall assessment of financial stability. The Federal Reserve discussed its overall assessment of financial...

|