Trying to Understand the President’s Budget Proposal? Our Budget Glossary Can Help

Released today, the President’s budget request to Congress spans thousands of pages across multiple volumes. While it is just a proposal, it is the starting point for allocating up to trillions of dollars in federal resources every year. It is a critically important document that includes funding level requests for federal programs for the upcoming fiscal year and, in some cases, future fiscal years. At times, however, some of the terms can be a bit hard to understand. If you’re looking at the President’s budget, then our one-volume budget glossary can be a helpful reading aid.

We developed A Glossary of Terms Used in the Federal Budget Process as a basic reference document for Congress, federal agencies, and others interested in the federal budget-making process. In fact, we are updating the budget glossary and would greatly appreciate your input. To provide feedback on the glossary or suggest changes, please email budgetglossary@gao.gov.

In the past, we’ve highlighted how to navigate the complexities of the federal budget, looked at the future of the federal budget, and focused on the 4 phases of the annual budget cycle. Today we focus on how the Budget Glossary can help you understand the President’s budget.

Have a question about a term in the budget?

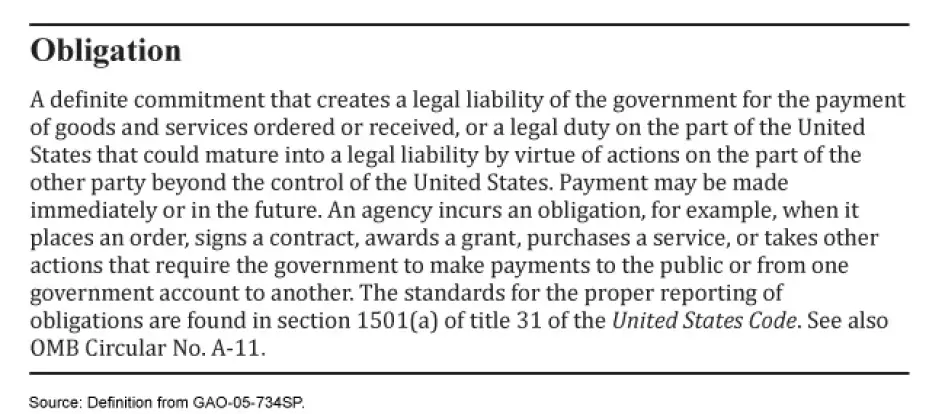

The budget glossary includes an alphabetized list of common terms used in the congressional and executive budget process, including “obligation,” “program and financing schedule,” and (you guessed it!) “budget.”

Image

Want to learn more about the budget process?

Appendix I of the budget glossary provides an overview of the 4 phases of the federal budget process: executive budget formulation, the congressional budget process, budget execution and control, and audit and evaluation. Appendix II illustrates the federal budget formulation process.

Interested in how the government tracks funds?

Appendix III of the budget glossary compares and contrasts two methods used to ensure the financial accountability of the government: obligational accounting and proprietary accounting.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.