Taxing Times: Turning to IRS for Help

It’s that time of year again—tax filing season. As you prepare to file your tax return, where do you turn for help?

Millions of taxpayers visit irs.gov for information or contact IRS during the filing season either on the phone, in person, or by mail. Today’s WatchBlog takes a closer look at some of the services IRS provides, and how IRS can better serve taxpayer needs.

IRS.gov services need your input

IRS offers a range of online services including:

- Tracking your refund

- Getting your tax transcripts if you need to obtain student loans or a mortgage

- Making arrangements with IRS if you need more time to pay what you owe

But how does IRS choose which services to provide on its website? We looked into this question and found that IRS prioritizes services primarily based on their potential to benefit the agency’s operations or because they can be developed quickly. And although IRS recognizes that taxpayers want more online options, it doesn’t consider taxpayer input in its prioritization process.

We recommended that IRS include taxpayer input when prioritizing new services to help avoid developing services that taxpayers don’t use.

Comparing online tax services

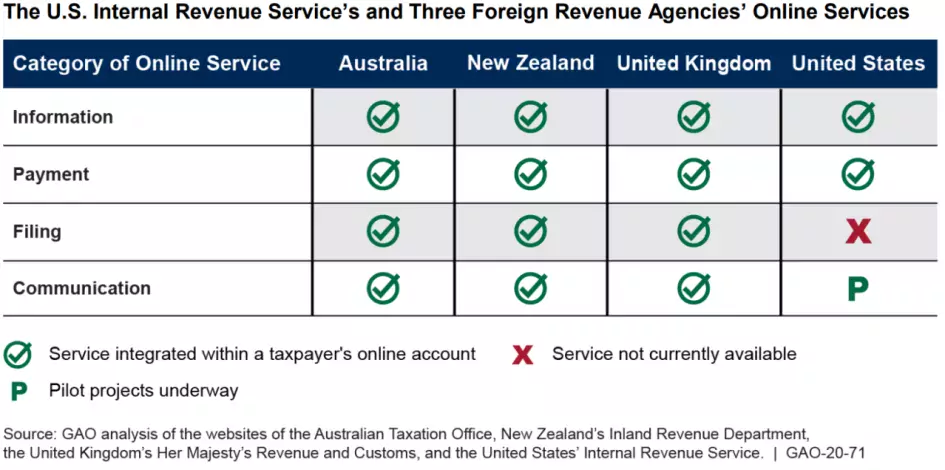

We also compared IRS’ online services to other foreign and state revenue agencies, and found that IRS doesn’t let taxpayers file taxes directly on its website like some of its counterparts.

IRS has long had an agreement with the tax industry to offer free electronic filing for low- and middle-income taxpayers through Free File, but the agreement long prohibited IRS from developing its own online filing service.

IRS and the consortium agreed to remove this prohibition in December 2019—shortly after our report was issued. We continue to believe IRS should assess all the potential benefits and costs prior to renewing the agreement beyond its scheduled expiration in October 2021.

Listen to our podcast with Jessica Lucas-Judy to learn more.

Services for taxpayers with limited English-language skills

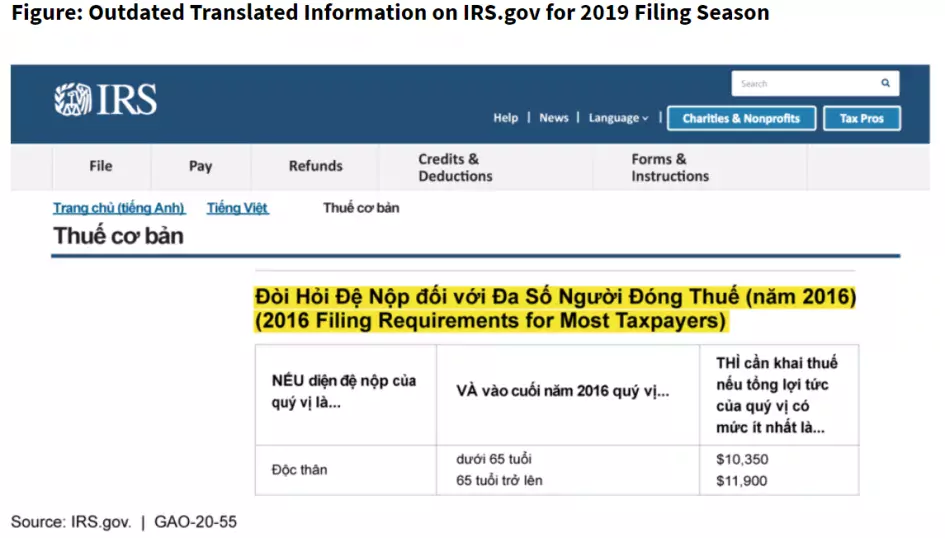

IRS offers a few services to taxpayers with limited-English proficiency. For example, Spanish-speaking taxpayers can call IRS to speak with a bi-lingual representative. However, we found that these services are very limited, and the translated content on its website is outdated (a summary of this report in Spanish is available here; un resumen de este informe en español está disponible aquí). IRS also hasn’t assessed whether to translate many of its common tax forms, such as the Form 1040.

We recommended that the IRS improve services to taxpayers with limited English skills, as this could improve taxpayer compliance.

Calling IRS may not always get you an answer

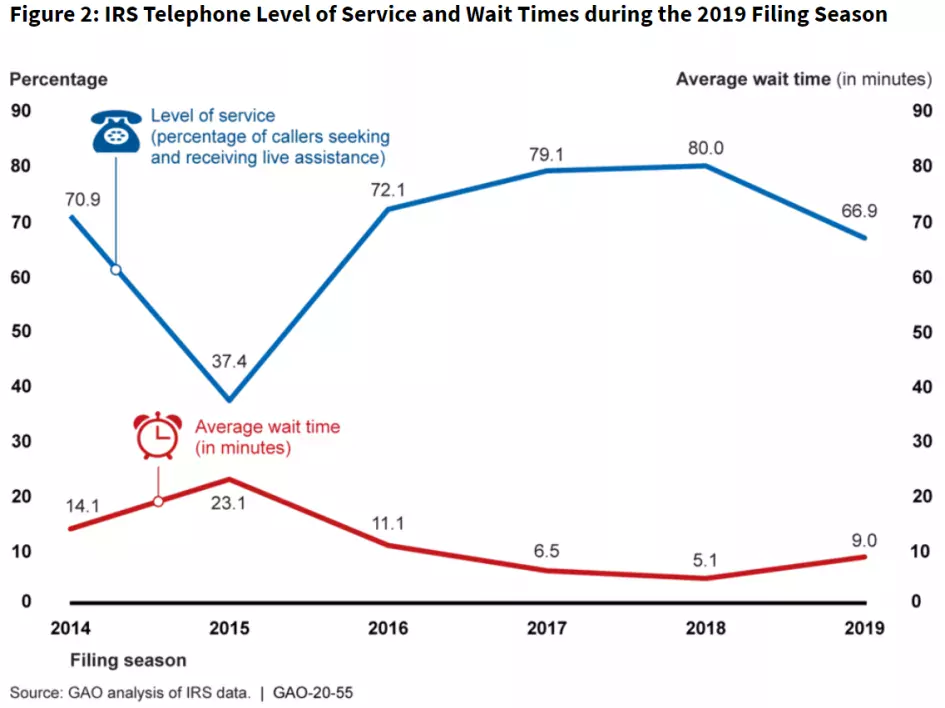

IRS receives tens of millions of calls during the filing season from taxpayers seeking assistance. For the 2019 filing season, IRS successfully implemented major tax law changes but faced training and hiring delays due to a partial government shutdown. As a result, we found that fewer taxpayers reached someone at IRS in 2019 compared to prior years and those that did waited on hold for about 9 minutes.

In addition, if you call with a question, it might not be one that IRS can answer. Each year, IRS makes a list of topics it considers “out of scope” and refers the taxpayer to irs.gov or a tax professional for assistance. We recommended that IRS post a list of these topics online for taxpayers to know before they call whether or not IRS can answer their question.

You can read more of our tax-related work here.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.