Rooting Out Fraud in Federal Small Business Research Awards

In 2019, a software developer in Chicago submitted bank statements from a fake investor to obtain a small business award. The developer was later sentenced to prison and ordered to pay $200,000 in restitution. The case—one of several others like it—underlines the importance of small business award oversight to prevent fraud, waste, and abuse.

Eleven federal government agencies award federal dollars to small businesses through 2 grant programs—the Small Business Innovation Research program and the Small Business Technology Transfer program. These programs are designed to encourage research and development, including the commercialization of technologies. The programs, combined, awarded small businesses almost $4 billion in FY 2019. The Small Business Administration is responsible for overseeing these grant programs to detect and prevent fraud, waste, and abuse.

In today’s WatchBlog post we look at our recent report about how SBA oversees these awards and its requirements to verify the eligibility of recipients.

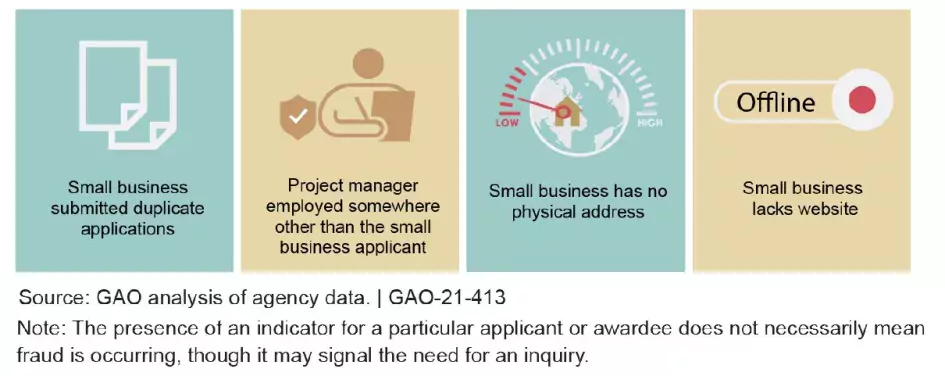

What are some indicators of fraud?

The federal agencies that issue small business awards have established a set of indicators for identifying potential fraud.

Among them, a fraudulent small business might submit duplicate applications, lack a physical location, or not have a website. These and other factors are early indicators that an application for an award might be fraudulent and worth a closer look.

Examples of Indicators Agencies Use to Identify Potential Fraud in Research Awards

Image

How does SBA help prevent fraud?

SBA has a number of requirements in place to prevent fraud, waste, and abuse for agencies participating in 2 small business award programs.

Among them, agencies must collect certifications of ownership and other eligibility requirements from the awardee when they receive their award and during the life of the award.

Another requirement is that agencies establish and communicate a written policy that all agency personnel involved with the award programs notify the agency’s office of inspector general if anyone suspects fraud, waste, or abuse.

We found that the 11 federal agencies participating in award programs largely implemented SBA’s requirements.

What else can be done to prevent fraud, waste, and abuse?

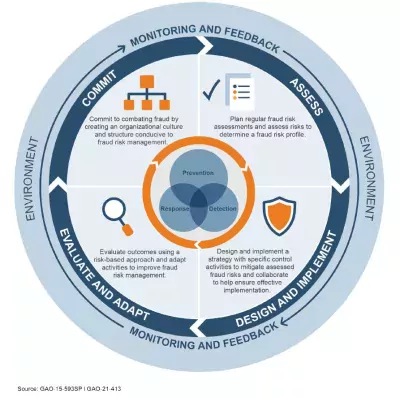

To help government managers better protect taxpayer’s money, we identified leading practices for managing fraud risks and organized them into a conceptual framework.

The Fraud Risk Management Framework

Image

The Fraud Risk Management Framework encompasses control activities to prevent, detect, and respond to fraud, with an emphasis on prevention, as well as structures and environmental factors that help managers achieve their objective to mitigate fraud risks.

Based on this framework, we made 21 recommendations to the agencies included in our report on how to detect and prevent fraud, waste, and abuse in these programs.

Find out more about our framework and fraud in these research award programs by checking out our new report.

- Questions on the content of this post? Contact the WatchBlog team at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.