Reverse Mortgages Present Benefits and Risks for Senior Homeowners

You’ve seen them advertised on T.V. and asked, “What is a reverse mortgage?”

A reverse mortgage is a loan available to senior homeowners (62 years and older) that allows them to convert part of the equity in their homes into payments from lenders. Seniors may use reverse mortgages to help supplement their Social Security or other retirement income.

Reverse mortgages saw a surge in popularity during the last financial crisis (2007-2009). Homeowners facing financial struggles under the current economic crisis caused by the coronavirus pandemic might also be considering a reverse mortgage to supplement their income. While they can be used as financial tools to allow older homeowners to stay in their homes, they come with risks.

Unlike traditional (or “forward”) mortgages, a reverse mortgage does not require a borrower to repay the loan as long as they meet certain conditions such as maintaining their home and paying property taxes and homeowners insurance. Also unlike forward mortgages, reverse mortgages do not have fixed terms (for example 30 years). Instead, the loan is in place until the borrower dies, pays off the loan, leaves the property (for example, if the borrower sells the home), or defaults. At that point, the loan terminates and the senior (or their heirs) have to pay back the loan.

The vast majority of reverse mortgages are made under the Home Equity Conversion Mortgage (HECM) program, which is administered by the Federal Housing Administration (FHA). FHA insures private lenders against loan losses. As of the end of fiscal year 2018, FHA had insured more than 1 million HECMs, which included about 630,000 active loans and about 468,000 terminated loans.

Congress established the HECM program in 1988 to help meet the financial needs of elderly homeowners. However, in recent years, a growing percentage of reverse mortgages have ended because borrowers defaulted on their loans.

Why would a loan that requires no monthly payments default?

Reverse mortgage borrowers can default if they violate conditions of the mortgage. For example, a borrower might fail to pay property taxes or homeowners insurance. A reverse mortgage might also default if the borrower no longer occupies the home as a primary residence or has not kept the home in good repair.

When a reverse mortgage defaults and the loan terminates, seniors are at risk of losing their homes to foreclosure.

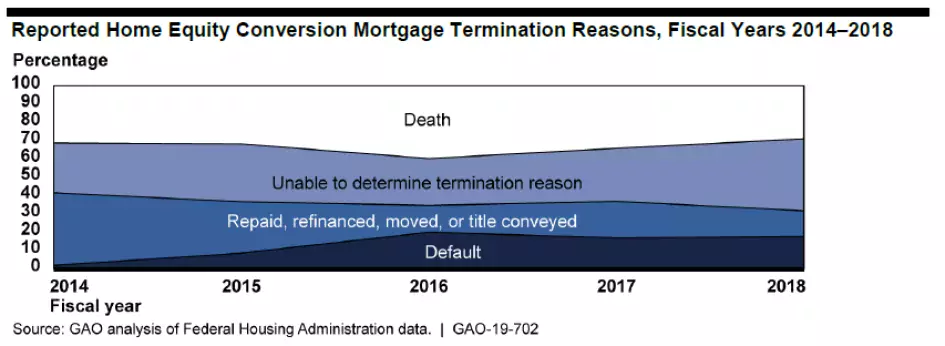

In a 2019 report, we found that defaults increased from 2% of loan terminations in 2014 to 18% in 2018, mostly due to borrowers failing to meet occupancy requirements or paying property taxes and insurance. We also found that FHA’s data did not show the reason for a large number of terminations. In 2015, FHA allowed loan servicers to put borrowers who are behind on property charges onto repayment plans to help prevent foreclosures for these seniors. But only about 22 percent of these borrowers had received this option.

Reported Home Equity Conversion Mortgage Termination Reasons, Fiscal Years 2014-2018

We also found that FHA could do a better job evaluating the performance of its reverse mortgage program and overseeing the companies that service these loans. We made 9 recommendations to improve FHA’s oversight of reverse mortgages and testified before Congress about our findings in September 2019.

Check out our recently issued report, testimony, and podcast to learn more about reverse mortgages and FHA’s oversight. And also tune into our podcast with Director Alicia Puente Cackley to learn more about reverse mortgages.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.