Larger Federal Deficits & Higher Interests Rates Point to the Need for Urgent Action

Increased federal spending in response to COVID-19, as well as rising interest rates, have added to our nation’s financial woes.

At $2.8 trillion, the FY 2021 budget deficit was the second largest in history—just short of the FY 2020 deficit of $3.1 trillion. These historically large deficits were due primarily to the economic disruptions caused by COVID-19—which decreased revenues in FY 2020—and the additional spending by the federal government in response to help the nation recover from the pandemic.

Additionally, while interest rates have been historically low during the last 20 years, the Congressional Budget Office (CBO) expects rates will increase during the next 30 years. As a result, newly-issued debt would cost the government more and maturing debt would have to be refinanced at the prevailing (potentially higher) interest rate.

Today’s WatchBlog post looks at our latest and sixth annual report on the nation’s fiscal health, including areas where immediate action is needed.

“GAO’s latest report on the nation’s fiscal health paints a sobering picture. Without substantive changes to revenue and spending policy, the federal debt is poised to grow faster than the economy, a trend that is unsustainable,” said Gene L. Dodaro, Comptroller General of the United States and head of the GAO.

Increasingly large deficits are driving unsustainable debt levels

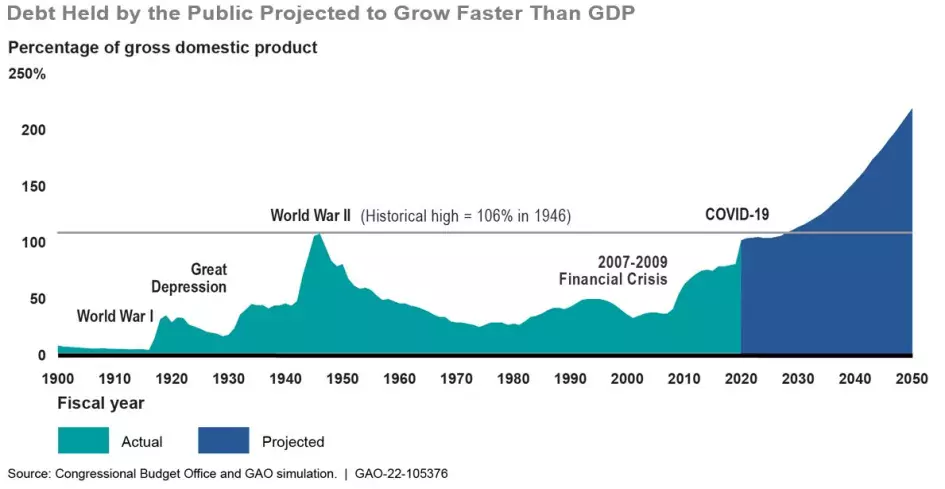

For most of the nation’s history, the government’s debt as a share of Gross Domestic Product (GDP) has increased during wartime and recessions. It has typically decreased during times of peace and economic expansion. However, this pattern has changed during more recent times. The federal government has run a deficit and added to its debt in every fiscal year since 2002. In our simulation below, debt will continue to grow faster than GDP during the next 30 years if no action is taken.

Image

Deficits represent the different between spending and revenues, and are composed of two parts:

- The primary deficit: the gap between non-interest (program) spending and revenues.

- Spending on net interest: primarily the cost to service federal debt.

The primary deficit is a key determinant of growth in the debt-to-GDP ratio, and is the area policymakers have the most control in addressing.

- Spending: Medicare, other federal health care programs, and Social Security are requiring an increasingly large share of federal resources—largely due to increasing health care costs and an aging population. Under our simulation, total spending for major federal health care programs and Social Security would account for 85% of projected revenue in 2050, up from 63% in 2019.

- Revenue: Average annual revenue as a share of GDP was lower over the last 20 years than in prior decades. From 2000 to 2021, revenue averaged 16.8% of GDP annually, compared to an annual average of 17.9% of GDP between 1980 and 2000.

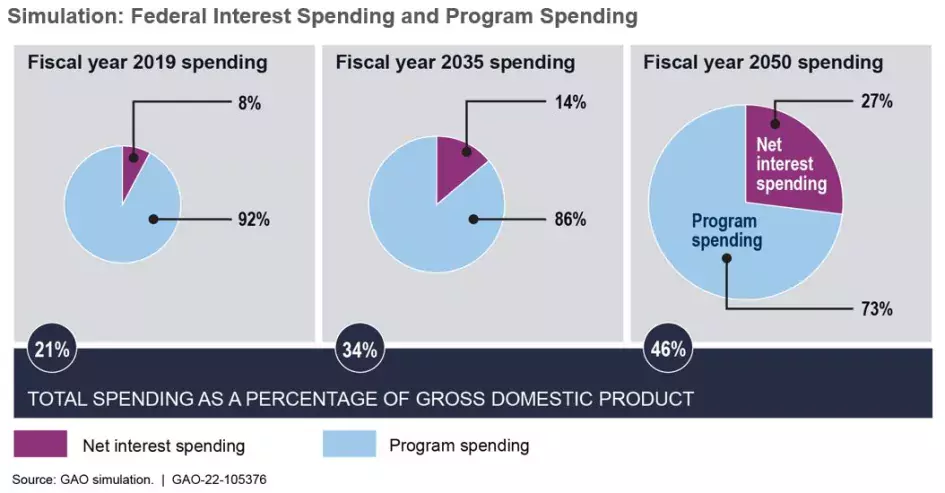

In recent years, the federal government’s spending on net interest has represented a relatively small share of total federal spending due to historically low interest rates. However, as debt continues to grow and if interest rates rise as projected, net interest spending is projected to increase, presenting additional challenges to fiscal sustainability. CBO projects that interest rates will slowly increase during the next 30 years—reaching 4.6% in 2050. As a result, newly-issued debt will cost the government more. Additionally, interest payments on maturing debt that is refinanced at higher interest rates would cost more than interest payments from the originally issued debt.

The below graphic shows our simulation for federal spending on net interest.

Image

Other fiscal risks that could affect the fiscal outlook include potential delays in raising the debt limit—which can disrupt financial markets and temporarily increase interest rates on some Treasury securities—and additional potential spending from certain fiscal exposures, such as such as global and regional military conflicts, economic downturns, public health emergencies, natural disasters, and climate change.

Actions needed to address the nation’s unsustainable fiscal path

An effective fiscal plan would support the difficult policy decisions needed to achieve a more sustainable fiscal policy, one where publicly-held debt is stable or declining relative to the size of the economy. Our work has identified several components of an effective fiscal plan:

- Incorporate well-designed fiscal rules and targets to help manage debt by controlling factors such as spending and revenue;

- Assess the drivers of the primary deficit, such as mandatory and discretionary spending and tax policy—including tax expenditures;

- Consider alternative approaches to the debt limit; and

- Address financing gaps for the Medicare Health Insurance and Social Security Old-Age Survivors Insurance trust funds, which are projected to be depleted by 2026 and 2033, respectively.

Our annual report identifies suggestions Congress could consider as part of a plan to put the government back on the path toward sustainable fiscal health.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.