How Do Environmental, Social, and Governance Factors Relate to Investing?

Nonfinancial information about how companies operate can be an indicator of their long-term financial performance. This information includes how companies address environmental, social, and governance (ESG) factors. ESG factors include things like climate change impacts and cybersecurity programs that may affect a company’s bottom line and thus, its stock price. The current COVID-19 global pandemic has further highlighted the importance of ESG factors, such as workplace safety and employee retention.

In today’s WatchBlog, we explore GAO’s recent work, which describes how investors use ESG disclosures and the kind of information public companies disclose on these topics.

Image

How do investors use ESG information?

The Securities and Exchange Commission (SEC) requires companies to publicly disclose, among other things, certain financial information and potential risks to investors. But investors have been increasingly asking companies for more information on ESG factors. The use of ESG factors has emerged as a way for investors to understand potential risks and opportunities that may not be included in financial analysis. Most investors that we interviewed agreed that ESG factors can affect a company’s long-term financial performance. These investors said they use ESG information to monitor companies’ management of risks, inform their vote at shareholder meetings, or make stock purchasing decisions. Most investors said they are looking for more ESG information from companies in their disclosures.

What kind of ESG information do public companies disclose?

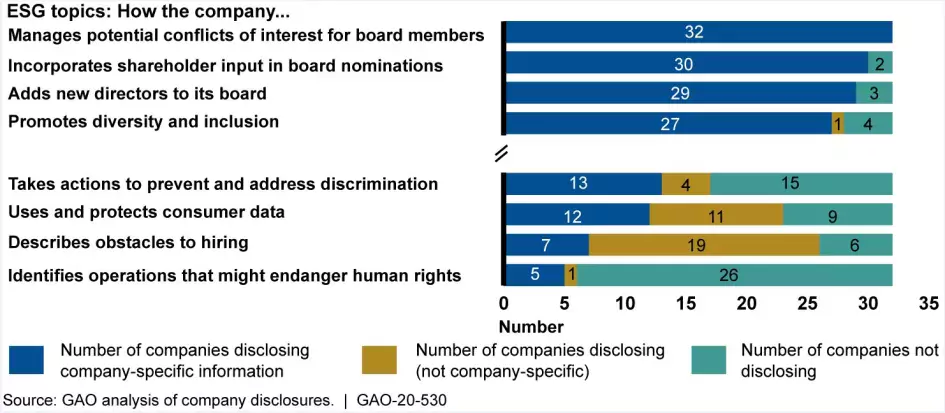

We reviewed documents for 32 public companies and identified disclosures across many ESG topics. But we also found gaps and inconsistencies that could limit their usefulness to investors. Of the ESG topics we reviewed, companies most often reported about topics such as board accountability, workforce diversity, and climate change, and the least on human rights. SEC requires companies to report certain governance information, which may help explain why board accountability topics were the most reported.

As the figure below shows, most companies provided ESG information that was specific to the company in their disclosures, in topic areas like board selection and governance. But in other areas, such as use and protection of consumer data, many companies shared either general information (not company-specific) or no information at all. For example, most companies provided only generic information when describing obstacles that might limit the company’s ability to hire the talent it needs.

Figure: The Four ESG Disclosure Topics We Reviewed with the Most and Least Company-Specific Disclosures, Generally Covering Data from 2018

Image

Note: We reviewed 32 companies’ 10-Ks, proxy statements, annual reports, and voluntary sustainability reports (generally with data from 2018, and some with data from 2017 and 2019).

Additionally, some companies used different units of measure or calculation methods. For example, companies used different base years when calculating their reduction in greenhouse gas emissions. For instance, airline companies we reviewed reported emission reductions with base years ranging from 1990 to 2017. This can make it hard for investors to compare ESG information across companies.

To learn more about the advantages and disadvantages of policy options to improve ESG disclosures, check out our recent report.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.