Deterring Financial Crime with the Bank Secrecy Act

Money laundering, terrorist financing, and other illicit activities pose threats to national security and the integrity of the U.S. financial system. The Bank Secrecy Act (BSA) requires financial institutions—such as banks and money transmitters—to verify customers’ identities and report suspicious activities to the federal government and law enforcement to help detect and prevent such crimes.

Today’s WatchBlog looks at our recent reports on how federal agencies and financial institutions share BSA information and federal oversight of banks’ compliance with certain BSA requirements—particularly when the banks’ customers are money transmitting businesses, such as Western Union or MoneyGram.

BSA Requirements

Financial institutions are generally required to:

- collect and retain various records of customer transactions

- verify customers’ identities

- design and implement an anti-money laundering program that is tailored to an institution’s products and services offered and the customers and locations served

- file certain reports (such as suspicious activity reports) that may help assist law enforcement investigations

Who is involved?

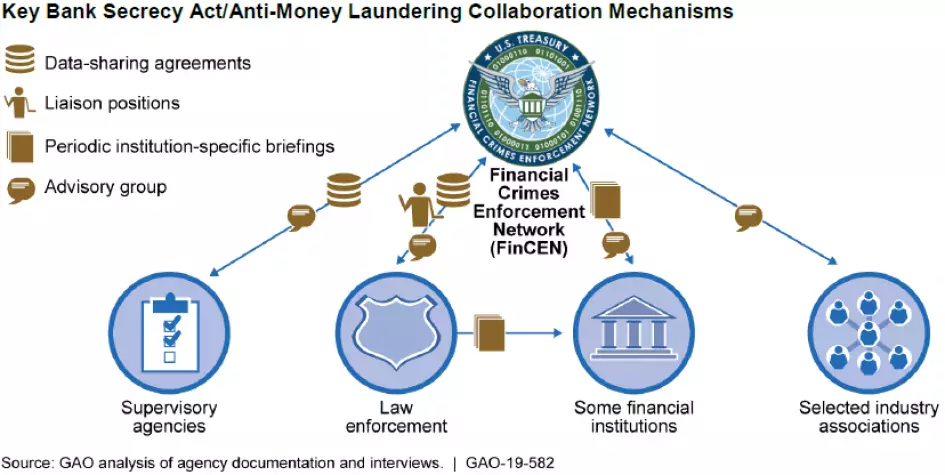

The Treasury Department’s Financial Crimes Enforcement Network collects and disseminates BSA data. It collaborates with supervisory agencies, which include regulators of financial markets (like the Federal Reserve) that conduct BSA examinations; law enforcement agencies (like the FBI) that investigate using BSA information; and private financial institutions that report on suspicious activity.

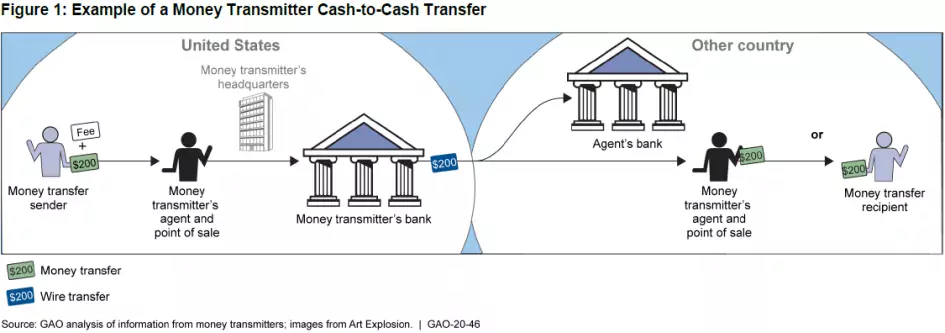

Money transmitters—which need bank accounts to conduct business—play an important role in the financial system. This is in part because they provide financial services to people less likely to use traditional banking services, as well as their prominent role in providing international money transfers.

How could they improve?

Financial institutions have said that BSA reporting requirements can be overly burdensome. They have also said they don’t know whether their reports are actually used, for example, in law enforcement investigations. We found that the Financial Crimes Enforcement Network could do a better job communicating in these areas and recommended, among other things, that it find ways to improve information sharing.

We also found that federal banking regulators could better prepare their examiners to question banks and request information about their money transmitter customers. We recommended that regulators take steps to improve examiners’ evaluation of banks’ compliance with BSA requirements, such as by providing more training.

Check out our recently issued reports on BSA information-sharing and BSA bank exams for more information.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.