COVID-19 May Be Delaying College Decisions, But Federal Programs Stand Ready To Help Students Succeed

May 1st—also known as National College Decision Day—is an important day for prospective students. It’s traditionally the deadline to submit acceptance letters and deposits to attend a 4-year college in the fall. However, many colleges have delayed that deadline and suspended college tours due to the COVID-19 (coronavirus) pandemic.

Even so, the prospect of college brings excitement and angst to students preparing for the big transition to higher education. We think the federal government should prepare for college too. We’ve written a number of reports in recent years about how federal programs can set up college students for success.

Today’s WatchBlog explores.

Meeting student needs

Many college students may not have enough to eat. But of the 3.3 million students who were potentially eligible for food stamps (the Supplemental Nutrition Assistance Program or SNAP) in 2016, less than half said they participated. Colleges are responding by opening food pantries on campuses and helping students understand complicated SNAP rules. But we recommended that the Food and Nutrition Service also help by clarifying these rules and sharing information on how states can help eligible students use SNAP.

Additionally, 1 in 5 undergrads were raising children in 2015-16, and child care costs can make it harder for them to graduate. A Department of Education program helps students with low incomes pay for child care. However, we found that student parents may be eligible for larger loans to cover child care. We recommended that the department encourage schools to publicize potential loan increases to cover child care.

Promoting skills and training

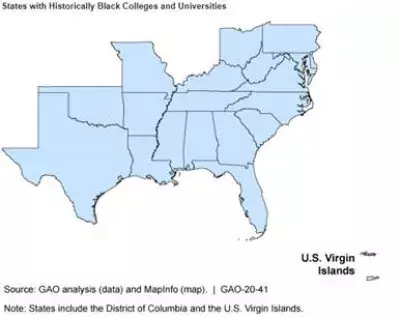

Historically Black Colleges and Universities (HBCUs) educated over 226,000 African-American students pursuing a college degree in 2017. The Small Business Administration works with colleges and universities to provide entrepreneurial training and counseling for students. We found that it provided such training and counseling to at least 16 HBCUs. However, SBA has collected only limited information about its programs and activities with HBCUs. We recommended that it do so to assess whether its efforts are proving effective.

Student debt

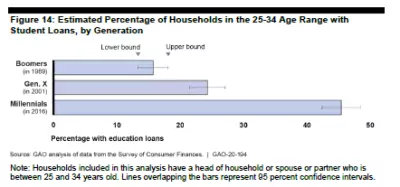

Millennials have significantly more student debt than previous generations, which could affect their ability to purchase a home or accumulate wealth.

One way the federal government can help students manage this debt is through the Public Service Loan Forgiveness program. This program forgives federal student loan balances for borrowers who have made 10 years of payments while working in certain public service jobs. Borrowers can also take advantage of income-driven repayment plans, which base monthly payments on income and family size, while pursuing forgiveness.

However, 99% of borrower applications for loan forgiveness through this program have been denied. Borrowers may be confused about program requirements because the Department of Education does not provide enough information on them—such as a comprehensive list of qualifying employers. We recommended that the department make more information available to borrowers about the Public Service Loan Forgiveness program. The department has subsequently taken initial steps to streamline the program’s application process and released a new online tool to help borrowers better understand the eligibility requirements, but should still do more to help borrowers determine whether employment with specific employers will qualify them for the program.

To learn more about our work on college students, check out our reports.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.