A Check-Up on the Government’s Fiscal Health

After 6 years of declining deficits, the federal deficit increased to $587 billion in 2016 and U.S. debt held by the public stood at about $14.2 trillion at the end of 2016. These figures are only expected to grow.

The federal government’s long-term fiscal outlook is unsustainable.

To help policymakers grapple with this problem, we regularly prepare long-term fiscal simulations to show how the federal debt could grow or shrink based on different policy choices.

Today, we released the first of an annual overview report on the federal government’s fiscal condition and long-term fiscal health, and updated our fiscal outlook webpage. Read on for some of the highlights, our latest video explaining the issue, and some solutions to this growing problem.

Structural imbalance

There is a structural imbalance between federal revenue and spending under current law. This leads to ever rising debt as a share of the economy—this is unsustainable.

Congress and the incoming administration will need to consider the whole range of federal activities and spending—entitlement and other mandatory programs, discretionary spending, and revenues. They will also need to make some tough policy choices in order to put the federal government on a path of long-term fiscal sustainability.

The issue is complicated, and the solutions won’t be easy, but our video explains some of the key facts, considerations, and potential solutions:

What are the drivers?

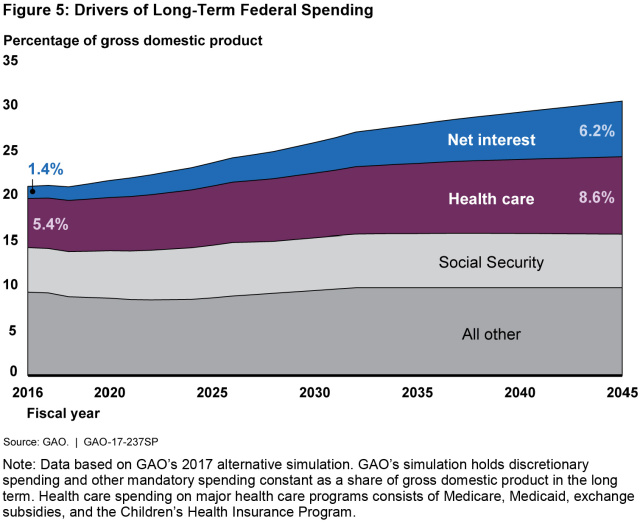

On the spending side, the two key drivers are mandatory spending programs, including Social Security, Medicare and Medicaid, and the interest the federal government pays on the national debt. As these grow they put pressure on other areas of the government and could limit the ability to respond to unforeseen events.

(Excerpted from GAO-17-237SP)

Opportunities

Although any long-term changes in spending and revenue will require legislation, federal agencies can help ensure a sustainable fiscal future. We identified four key actions for them:

- Reduce improper payments—estimated to be $144 billion in 2016, this is the amount of payments that should not have been made or that were made in an incorrect amount.

- Close the tax gap—the $458 billion difference between taxes owed to the government and taxes paid on time

- Eliminate duplication and inefficiencies in federal programs—our duplication and cost savings body of work has already resulted in over $55 billion in cost savings, and addressing all of our recommendations could result in billions more.

- Provide better information on programs and operations which can help, for example, improve transparency in federal spending data.

Check out our updated fiscal outlook page for the underlying assumptions, data, key reports, and more.

Comments on GAO’s WatchBlog? Contact blog@gao.gov

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.