Corporate Income Tax: Effective Rates Before and After 2017 Law Change

Fast Facts

Each year from 2014-2018, about half of large corporations and a quarter of profitable ones didn't owe federal taxes. For example, profitable corporations may not owe taxes due to prior years' losses.

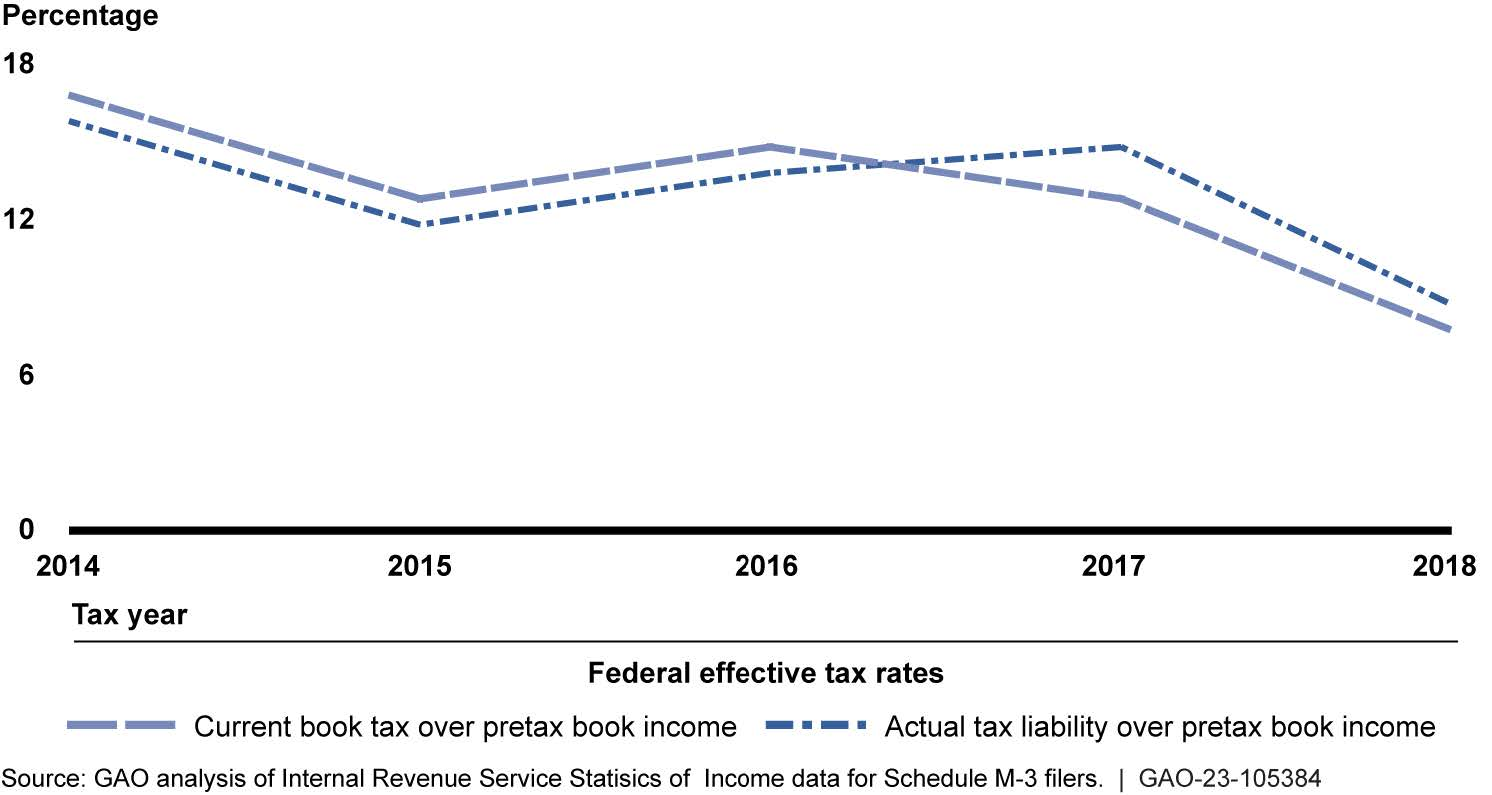

Average effective tax rates—the percentage of income paid after tax breaks—among profitable large corporations fell from 16% in 2014 to 9% in 2018.

A 2017 tax law lowered the top corporate rate from 35 to 21%, but other provisions altered effective tax rates in more complicated ways. For instance, changes to the way foreign income is recognized created tax liability from income not previously taxed under U.S. law, but often at reduced rates.

Highlights

What GAO Found

In each year from 2014 to 2018, about half of all large corporations had no federal income tax liability. For the purposes of this report, GAO considers “large corporations” to be those that filed Internal Revenue Service (IRS) Schedule M-3. This form is required for corporations with $10 million or more in assets. Among profitable large corporations, on average, 25 percent had no tax liability. Corporations may have no federal income tax liability for a number of reasons. For example, not all corporations are profitable in any given year or may have losses or credits from other years that can be used to offset current-year tax liabilities. Among large corporations, from 2014 through 2018, an average of approximately 44 percent reported a loss in a given year.

Effective tax rates measure tax liability as a proportion of income and are typically lower than the statutory tax rate because they reflect deferrals, credits, and other tax benefits. Among profitable large corporations, average effective tax rates varied between 2014 and 2018. The effective tax rates based on actual tax liability was as high as 16 percent in 2014 and as low as 9 percent in 2018. Tax rates based on corporations' financial reports (known as book tax) followed similar trends.

Average Effective Tax Rates for Profitable Large Corporations, 2014 to 2018

In December 2017, Congress passed Public Law 115-97—commonly known as the Tax Cuts and Jobs Act (TCJA). Among many changes, TCJA lowered the top statutory corporate tax rate from 35 percent to 21 percent. While effective tax rates decreased in 2018, total tax liability among profitable large corporations was slightly higher in both 2017 ($278 billion) and 2018 ($267 billion) than it was in 2016 ($262 billion). TCJA increased foreign-sourced income subject to tax in the U.S. and increased repatriations of income previously held offshore. However, TCJA often taxed this income at reduced rates. These changes may have contributed to a lower effective tax rate in 2018, but also generated tax liability from income that was previously not taxable under U.S. law.

Why GAO Did This Study

In 2016, prior to TCJA's passage, GAO reported that, from 2008 to 2012, between 18 percent and 24 percent of all profitable large corporations had no federal income tax liability. GAO also reported that those same corporations generally had effective tax rates between 13 percent and 16 percent of pretax book income.

GAO was asked to provide an update on effective tax rates after TCJA was enacted. In this report, GAO describes (1) the percentage of large corporations that had no federal income tax liability, (2) average effective tax rates of large corporations, and (3) changes in TCJA that may have affected corporate effective tax rates.

To conduct this work, GAO reviewed relevant literature, and analyzed IRS data for tax years 2014 to 2018 (the most recent data available). This includes the financial and tax information that corporations report on Schedule M-3. GAO also interviewed IRS officials and subject matter experts.

For more information, contact Jessica Lucas-Judy at (202) 512-6806 or LucasJudyJ@gao.gov.