Paycheck Protection Program: Program Changes Increased Lending to Smaller and Underserved Businesses

Fast Facts

In response to COVID-19, Congress created the Paycheck Protection Program to help small businesses get forgivable loans. But self-employed people and businesses owned by minorities, women, and veterans initially faced challenges getting loans.

We testified that these challenges prompted Congress and the Small Business Administration to:

- Approve 600 new lenders—including nonbanks, who largely didn't participate in the first round of the program

- Develop guidance to encourage more self-employed people to apply

- Target funding to the smallest and minority-owned businesses

These changes helped traditionally underserved businesses get loans.

Highlights

What GAO Found

The Paycheck Protection Program (PPP) supported small businesses through forgivable loans for payroll and other eligible costs. Early lending favored larger and rural businesses, according to GAO's analysis of Small Business Administration (SBA) data. Specifically, 42 percent of early loans (approved April 3–16, 2020) went to larger businesses (10 to 499 employees), although these businesses accounted for only 4 percent of all U.S. small businesses. Larger businesses were more likely to have a preexisting lending relationship with a bank. Businesses in rural areas also received a high share of early loans despite being traditionally underserved.

Other traditionally underserved businesses—in particular, businesses owned by self-employed individuals, minorities, women, and veterans—faced challenges obtaining loans, prompting Congress and SBA to make a series of changes shortly after the program launched. For example:

- SBA admitted about 600 new lenders, including nonbanks (generally, lending institutions that do not accept deposits).

- SBA developed guidance helping self-employed individuals participate in the program.

- SBA targeted funding to minority-owned businesses in part through Community Development Financial Institutions.

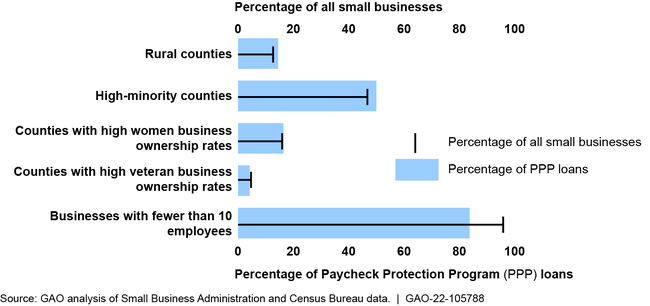

Lending to traditionally underserved businesses increased noticeably after these changes were implemented. By the time PPP closed in June 2021, lending in traditionally underserved counties was proportional to their representation in the overall small business community (see figure). While lending to businesses with fewer than 10 employees remained disproportionately low, it increased significantly over the course of the program.

Paycheck Protection Program Loans, by Type of Business or County

Why GAO Did This Study

The COVID-19 pandemic resulted in significant turmoil in the U.S. economy, leading to temporary and permanent business closures and high unemployment. In response, in March 2020, Congress established PPP under the CARES Act and ultimately provided commitment authority of approximately $814 billion for the program over three phases. When initial program funding ran out in 14 days, concerns quickly surfaced that certain businesses were unable to access the program, prompting a series of changes by Congress and SBA.

This testimony addresses (1) which small businesses received early PPP loans and (2) how program changes affected small business participation in PPP. It is based on GAO's September 2021 report on PPP (GAO-21-601). For that report, GAO analyzed loan-level PPP data from SBA and county-level data from the U.S. Census Bureau.

For more information, contact William B. Shear at (202) 512-8678 or shearw@gao.gov.