Opportunity Zones: Data on Investment Activity and IRS Challenges Ensuring Taxpayer Compliance

Fast Facts

Congress created the Opportunity Zones incentive to spur investment in distressed communities. Taxpayers who invest in Qualified Opportunity Funds—which invest in zones—can get significant tax benefits.

According to IRS, over 6,000 of these funds invested about $29 billion in Opportunity Zones through 2019. The incentive attracted investment in housing, renewable energy businesses, and other projects.

We testified that IRS developed plans to ensure these funds comply with requirements. But its plans depend on data that isn't readily accessible—which could make it hard for IRS to find investors who aren't following the rules.

Example of development in an Opportunity Zone in Washington, D.C.

Highlights

What GAO Found

The 2017 law commonly known as the Tax Cuts and Jobs Act created a tax incentive that gave governors discretion to nominate generally up to 25 percent of their states' low-income census tracts as special investment areas called Opportunity Zones. The U.S. Department of the Treasury then verified eligibility and designated the nominated tracts. GAO found that on average, the selected tracts had higher poverty and a greater share of non-White populations than eligible, but not selected, tracts. These differences were statistically significant.

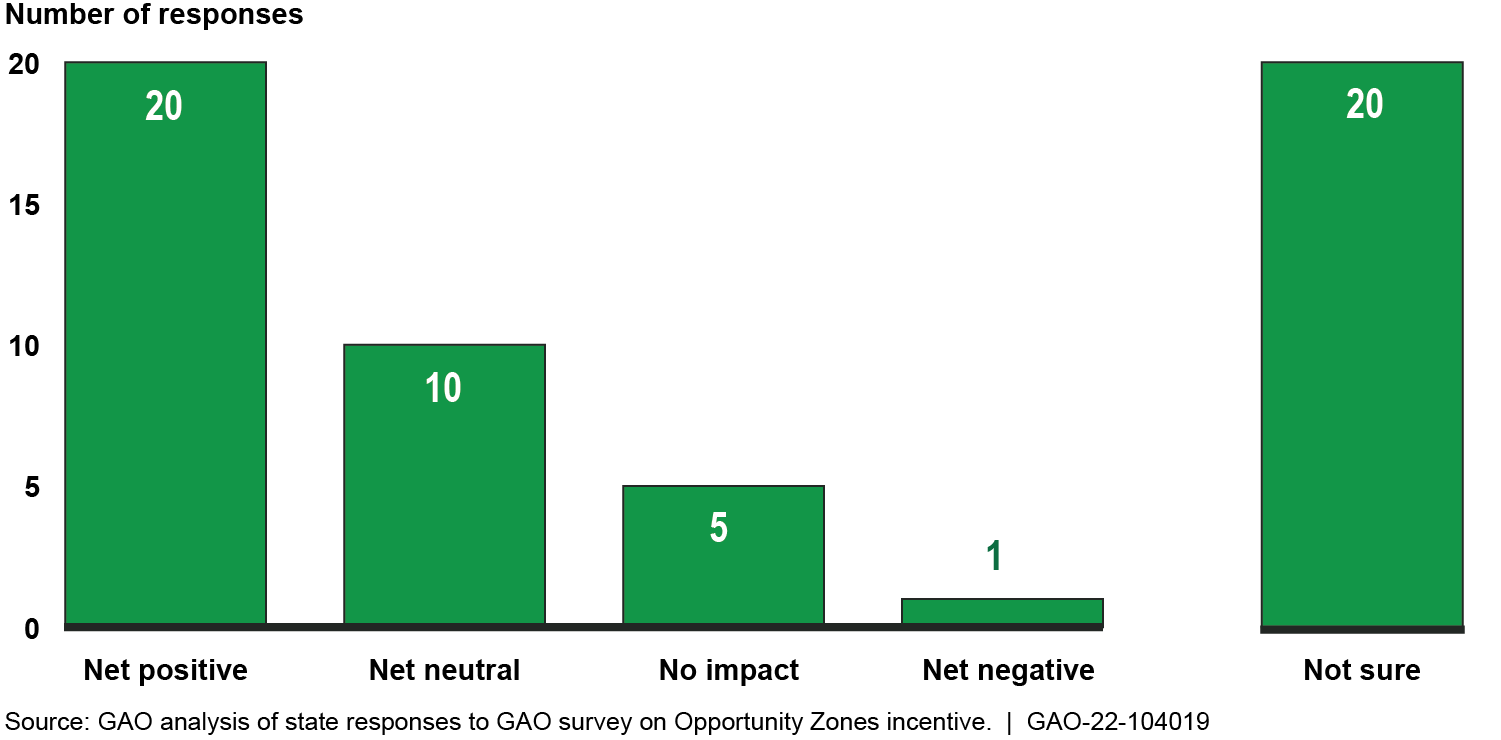

Most state government officials were aware of at least some Opportunity Zone investments but had differing views of the tax incentive's effect so far.

State Respondents' Views on Overall Impact of the Opportunity Zones Tax Incentive

Note: GAO surveyed government officials from the 50 states, Washington, D.C., and the five U.S. territories—American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands—and received 56 responses.

Based on case studies of Qualified Opportunity Funds—investment vehicles organized for investing in Opportunity Zones—the tax incentive attracted investment in a variety of projects, including multifamily housing, self-storage facilities, and renewable energy businesses. According to survey responses and other sources, most projects are real-estate focused.

Through 2019, more than 6,000 Qualified Opportunity Funds had invested about $29 billion, based on partial data from the Internal Revenue Service (IRS).

IRS developed plans to ensure Qualified Opportunity Funds and investors are complying with the tax incentive's requirements; however, IRS faces challenges in implementing these plans. Specifically, the plans depend on data that are not readily available for analysis. In addition, funds have attracted investments from high-wealth individuals, and some funds are organized as partnerships with hundreds of investors. IRS considers both of these groups to be high risk for tax noncompliance generally. However, IRS has not researched potential compliance risks these groups pose for this tax incentive. As a result, IRS may be unable to effectively direct compliance efforts.

Why GAO Did This Study

This testimony summarizes the information contained in GAO's October 2021 report, entitled Opportunity Zones: Census Tract Designations, Investment Activities, and IRS Challenges Ensuring Taxpayer Compliance (GAO-22-104019).

For more information, contact Jessica Lucas-Judy at (202) 512-6806 or LucasJudyJ@gao.gov.