Social Security Disability: Ticket to Work Helped Some Participants, but Overpayments Increased Program Costs

Fast Facts

The Ticket to Work program seeks to help those receiving Social Security disability benefits find jobs and reduce reliance on benefits.

We found:

- Participants (after 5 years) earned an estimated $2,451 more per year and were slightly more likely to leave the disability rolls than similar nonparticipants

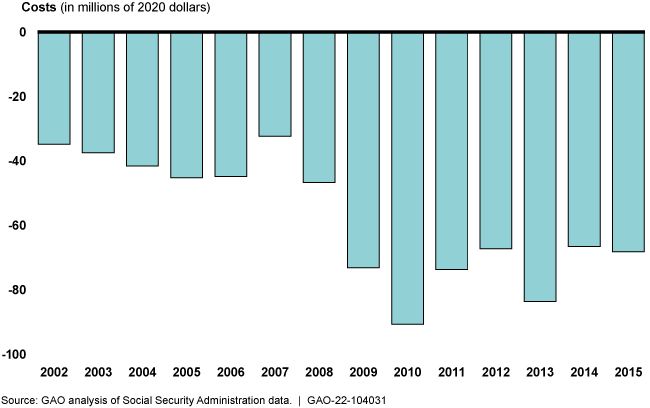

- From 2002 through 2015, program costs exceeded the savings in benefits by about $806 million

- Overpayments (which can occur if benefit adjustments are delayed) cost an estimated additional $133-169 million

We recommended that the Social Security Administration identify the root causes of these overpayments and take steps to address them.

Estimated Net Loss to the Social Security Administration from the Ticket to Work Program, 2002-2015

Highlights

What GAO Found

Disability beneficiaries participate in the Social Security Administration's (SSA) Ticket to Work and Self-Sufficiency program (Ticket to Work) by assigning a "ticket" to service providers who, in turn, provide help with employment. SSA compensates the service providers when Ticket to Work participants achieve designated levels of work and earnings. Using SSA data from 2002, when the program began, through 2018, the most recent year available, GAO estimated that 5 years after starting Ticket to Work, participants' average earnings were $2,451 more per year than that of similar nonparticipants. However, the majority of participants remained unemployed 5 years after starting Ticket to Work.

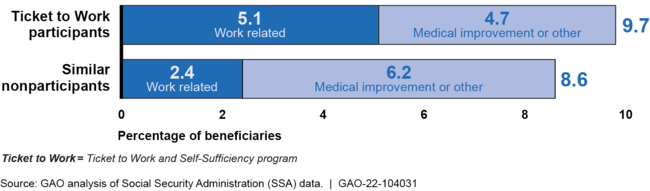

Based on GAO's analysis, the costs of Ticket to Work exceeded the savings in disability benefits to SSA by an estimated $806 million from 2002 through 2015, the most recent year with reliable savings data. Savings accrue when Ticket to Work participants receive lower benefits or leave the disability rolls due to earnings from work. GAO estimates that participants were slightly more likely to leave the rolls (9.7 percent) than nonparticipants who are similar across a range of characteristics such as age, gender, disability type, and education level (8.6 percent). A greater percentage of participants left the disability rolls due to work rather than for other reasons, such as medical improvement (see figure).

Percentage of Beneficiaries Who Left SSA's Disability Rolls 5 Years after Starting Ticket to Work versus Similar Nonparticipants, By Reason, 2002-2015

Note: Percentages were computed for Ticket to Work participants who began the program from 2002 through 2010 at 5 years after they started Ticket to Work and for a sample of similar nonparticipants. Parts may not sum to total because of rounding.

GAO estimates that SSA incurred an additional $133 million to $169 million in costs (above the $806 million) from disability benefit overpayments to Ticket to Work participants. Overpayments can occur when beneficiaries who work do not report earnings to SSA or SSA delays in adjusting their benefit amounts. SSA incurs costs when it allows a beneficiary to keep overpayments or expends resources to recover them. GAO estimates that Ticket to Work participants were more than twice as likely to receive overpayments 5 years after starting the program than nonparticipants. While SSA is investigating the root causes of overpayments across its benefit programs, it has not focused on overpayments among Ticket to Work participants, who face unique circumstances due to their ties to service providers. For example, participants may mistakenly think that service providers report their earnings to SSA. Addressing the root causes of overpayments among Ticket to Work participants would reduce repayment burdens on affected participants and increase savings for SSA and taxpayers.

Why GAO Did This Study

SSA pays billions of dollars in Disability Insurance and Supplemental Security Income benefits to people with disabilities. To help beneficiaries obtain employment and reduce dependence on disability benefits, Ticket to Work was established in 1999. The Explanatory Statement accompanying the Consolidated Appropriations Act, 2018 contains a provision for GAO to study the effects of the program.

This report examines, among other things, the extent to which Ticket to Work has led to increased earnings and other benefits for participants, and how the costs and savings from Ticket to Work compared over time. GAO conducted statistical analyses of SSA beneficiary data, analysis of Ticket to Work costs, a literature review, and interviews with program officials, service provider representatives, and disability policy experts.

Recommendations

GAO recommends SSA identify the root causes of overpayments to Ticket to Work participants and take appropriate actions to address them. SSA agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Social Security Administration | The Commissioner of Social Security should identify the root causes of overpayments to Ticket to Work participants specifically then take appropriate actions to address them. (Recommendation 1) |

Open

SSA agreed with this recommendation and carried out its own internal study to examine the root causes of overpayments. For DI beneficiaries, it found that the root causes of overpayments among Ticket to Work participants were similar to those of non-participants. However, SSA found that SSI Ticket participants had higher rates of non-work-related overpayments than non-participants. We believe these findings warrant additional examination. Although SSA expressed their intention to take no further action on this recommendation, this recommendation will remain open until SSA further examines what might be driving these results for the SSI population.

|