Higher Education: IRS and Education Could Better Address Risks Associated with For-Profit College Conversions

Fast Facts

A for-profit college can be converted into a nonprofit college if it's sold to a tax-exempt organization and the Education Department approves the conversion.

We testified that in about a third of cases we identified, college owners or officials held leadership roles in the college's tax-exempt buyer. If that is the case, they aren't allowed to use their influence to inflate the college's sale price or otherwise improperly benefit from the conversion.

But IRS staff didn't always follow guidance to assess improper benefit risks. Also, Education doesn't assess ongoing risks in its reviews. We recommended improvements in agency review processes.

Highlights

What GAO Found

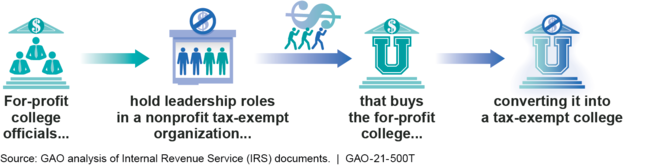

In its December 2020 report, GAO identified 59 for-profit college conversions that occurred from January 2011 through August 2020. A for-profit college may convert to nonprofit status for different reasons. In about one-third of the conversions, GAO found that former owners or other officials were insiders to the conversion—for example, by creating the tax-exempt organization that purchased the college or retaining the presidency of the college after its sale (see figure). While leadership continuity can benefit a college, insider involvement in a conversion poses a risk that insiders may improperly benefit—for example, by influencing the tax-exempt purchaser to pay more for the college than it is worth. Once a conversion has ended a college's for-profit ownership and transferred ownership to an organization the Internal Revenue Service (IRS) recognizes as tax-exempt, the college must seek Department of Education approval to participate in federal student aid programs as a nonprofit college. GAO also found in its December 2020 report that Education had approved 35 colleges as nonprofit colleges since January 2011 and denied two; nine were under review and 13 closed prior to Education reaching a decision.

Figure: Example of a For-Profit College Conversion with Officials in Insider Roles

IRS guidance directs staff to closely scrutinize whether significant transactions with insiders reported by an applicant for tax-exempt status will exceed fair-market value and improperly benefit insiders. If an application contains insufficient information to make that assessment, guidance says that staff may need to request additional information. In its December 2020 report, GAO found that for two of 11 planned or final conversions involving insiders that were disclosed in an application, IRS approved the application without certain information, such as the college's planned purchase price or an appraisal report estimating the college's value. Without such information, IRS staff could not assess whether the price was inflated to improperly benefit insiders, which would be grounds to deny the application. If IRS staff do not consistently apply guidance, they may miss indications of improper benefit.

Education has strengthened its reviews of for-profit college applications for nonprofit status, but it does not monitor newly converted colleges to assess ongoing risk of improper benefit. In two of three cases GAO reviewed in depth for its December 2020 report, college financial statements disclosed transactions with insiders that could indicate the risk of improper benefit. Education officials agreed that they could develop procedures to assess this risk through its audited financial statement reviews. Until Education develops and implements such procedures for new conversions, potential improper benefit may go undetected.

Why GAO Did This Study

A for-profit college may convert to nonprofit status for a variety of reasons, such as wanting to align its status and mission. However, in some cases, former owners or other insiders could improperly benefit from the conversion, which is impermissible under the Internal Revenue Code and Higher Education Act of 1965, as amended.

This statement—based on GAO's December 2020 report (GAO-21-89)—discusses what is known about insider involvement in conversions and the extent to which IRS and Education identify and respond to the risk of improper benefit. We also requested updates from IRS and Education officials on any agency actions taken to implement the December 2020 report recommendations.

Recommendations

In its December 2020 report, GAO made three recommendations, including that IRS assess and improve its conversion application review process. In response, IRS said it would assess its review process. As of March 2021, IRS said it had begun this assessment and would improve its process as appropriate.

In its December 2020 report, GAO also recommended that Education develop and implement procedures to monitor newly converted colleges. Education agreed with GAO's recommendation. As of March 2021, Education said it had not yet begun developing these new procedures, but that it planned to do so after completing efforts to establish a new financial analysis division.