Medicare Advantage: Beneficiary Disenrollments to Fee-for-Service in Last Year of Life Increase Medicare Spending

Fast Facts

Medicare Advantage contracts with private insurers to provide health care coverage to beneficiaries. It pays plans a fixed monthly amount per beneficiary, unlike Medicare fee-for-service, which pays provider claims for services.

We found that Medicare Advantage beneficiaries in the last year of life disproportionately disenrolled to enroll in fee-for-service, indicating possible issues with their care. Shifting end-of-life costs to fee-for-service increased Medicare spending by hundreds of millions of dollars.

We recommended monitoring end-of-life Medicare Advantage disenrollments to identify and address potential quality of care concerns.

Highlights

What GAO Found

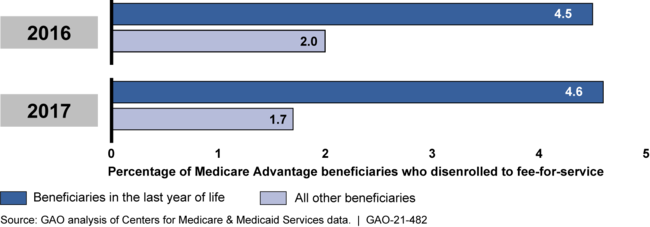

Under Medicare Advantage (MA), the Centers for Medicare & Medicaid Services (CMS) contracts with private MA plans to provide health care coverage to Medicare beneficiaries. MA beneficiaries in the last year of life disenrolled to join Medicare fee-for-service (FFS) at more than twice the rate of all other MA beneficiaries, GAO's analysis found. MA plans are prohibited from limiting coverage based on beneficiary health status, and disproportionate disenrollment by MA beneficiaries in the last of year life may indicate potential issues with their care. Stakeholders told GAO that, among other reasons, beneficiaries in the last of year life may disenroll because of potential limitations accessing specialized care under MA. While CMS monitors MA disenrollments, the agency does not specifically review disenrollments by beneficiaries in the last year of life. Doing so could help CMS better ensure the care provided to these beneficiaries.

Medicare Advantage Beneficiary Disenrollments to Join Fee-for-Service, 2016-2017

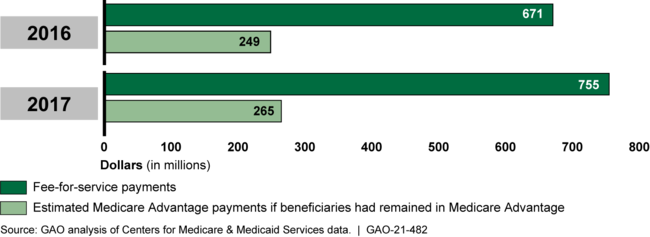

Beneficiaries in the last year of life who disenrolled from MA to join FFS increased Medicare costs as they moved from MA's fixed payment arrangement to FFS, where payments are based on the amount and cost of services provided. GAO's analysis shows that FFS payments for such beneficiaries who disenrolled in 2016 were $422 million higher than their estimated MA payments had they remained in MA, and were $490 million higher for those that disenrolled in 2017.

Estimated Medicare Advantage Payments for Beneficiaries in Last Year of Life that Disenrolled Compared to Fee-for-Service Payments, 2016-2017

Why GAO Did This Study

In contrast to Medicare FFS, which pays providers for claims for services, CMS pays MA plans a fixed monthly amount per beneficiary to provide health care coverage. For beneficiaries with higher expected health care costs, MA payments are increased. In 2019, CMS paid MA plans about $274 billion to cover about 22 million beneficiaries.

Prior GAO and other studies have shown that beneficiaries in poorer health are more likely to disenroll from MA to join FFS, which may indicate that they encountered issues with their care under MA. Beneficiaries in the last year of life are generally in poorer health and often require high-cost care.

GAO was asked to review disenrollment by MA beneficiaries in the last year of life. In this report, GAO examined (1) disenrollments from MA to join FFS by beneficiaries in the last year of life, and CMS's associated monitoring; and (2) the costs of such disenrollments to Medicare.

GAO analyzed CMS disenrollment and mortality data for 2015 through 2018—the most current data at the time of the analysis—to examine the extent of MA beneficiary disenrollment in the last year of life. To estimate the costs of disenrollment, GAO used CMS data to estimate payments for disenrolled beneficiaries had they remained in MA, and compared those estimates against those beneficiaries' actual FFS costs.

Recommendations

GAO recommends that CMS review disenrollments by MA beneficiaries in the last year of life as part of its monitoring. The Department of Health and Human Services concurred with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services | The Administrator of CMS should review disenrollments by MA beneficiaries in the last year of life as part of the agency's broader efforts to review disenrollments by MA beneficiaries in poorer health. (Recommendation 1) |

Closed – Implemented

CMS took action to address our recommendation in May 2022 by reviewing disenrollment patterns for beneficiaries in the last year of life by MA contract for 2019 through 2021. CMS stated that it plans to continue to conduct this review annually. By incorporating this review into its monitoring of MA contracts, CMS will be able to better identify and address potential concerns regarding the care provided to beneficiaries in the last year of life.

|