Taxpayer Advocate Service: Opportunities Exist to Improve Reports to Congress

Fast Facts

IRS's Taxpayer Advocate Service helps taxpayers deal with IRS by: 1) resolving individual taxpayer cases; and 2) working with IRS to resolve systemic problems that affect groups of taxpayers. The service has received over 2 million cases since 2011.

Each year, the service is required to give Congress two reports—one that discusses the most serious taxpayer problems, and another that discusses the service's objectives.

We recommended ways to improve these reports. For example, the objectives report could more clearly identify objectives and link them to planned activities to help Congress understand what the service is trying to achieve.

Highlights

What GAO Found

The budget for the Internal Revenue Service's (IRS) Taxpayer Advocate Service (TAS) declined by about 14 percent from fiscal years 2011 to 2020, when adjusted for inflation. For fiscal year 2020, TAS used most of its resources to assist individual taxpayers, known as case advocacy. TAS allocated about 76 percent of its $222 million budget and 86 percent of its almost 1,700 full-time equivalents to this purpose. The percentage of resources for case advocacy has decreased during the past decade—in fiscal year 2011 about 85 percent of the budget was devoted to it. For the same period, resources to address broader issues affecting groups of taxpayers, known as systemic advocacy, increased from 9 percent to 14 percent of the total budget. This shift is due in part to the reallocation of staff to better integrate systemic advocacy work and TAS's overall attrition rate more than doubling to 15.9 percent between fiscal years 2011 and 2019.

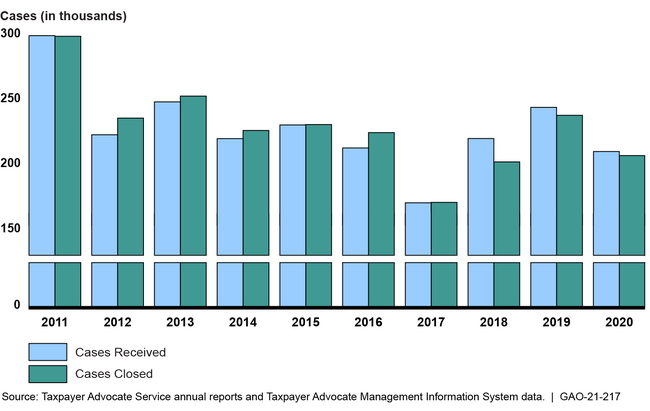

Since 2011, TAS has received more than 2 million taxpayer cases, of which almost half were referrals from other IRS offices. TAS closed more cases than it received each year from 2012 to 2017, but its inventory has grown since fiscal year 2018, due in part to attrition in case advocacy staff and an increase in taxpayers seeking assistance (see figure below).

Number of Taxpayer Cases Received and Closed, Fiscal Years 2011 to 2020

TAS has recently modified its two mandated reports to Congress by reducing their length and separately compiling legislative recommendations. It shortened its annual reports in part because the Taxpayer First Act reduced the required number of most serious taxpayer problems from “at least 20” to “the 10” most serious problems. GAO identified the following additional actions that could further improve TAS reporting.

Report outcome-oriented objectives and progress. The objectives for the upcoming fiscal year that TAS included in its most recent report are not always clearly identified and do not link to the various planned activities that are described. Further, the objectives TAS does identify do not include measurable outcomes. In addition, TAS's reports do not include the actual results achieved against objectives so it is not possible to assess related performance and progress. Improved performance reporting could help both TAS and Congress better understand which activities are contributing toward achieving TAS's objectives and where actions may be needed to address any unmet goals.

Consult with Congress and other stakeholders. TAS briefs congressional committees each year after publishing its annual report and solicits perspectives from stakeholders. TAS officials said they incorporate the perspectives into its objectives. However, TAS does not follow leading practices to consult congressional committees about its goals and objectives prior to publication at least once every 2 years. Thus, it misses opportunities to obtain congressional input on its objectives and performance reporting. Consultations would provide TAS opportunities to confirm if its goals incorporate congressional and other stakeholder perspectives and whether its reports meet their information needs.

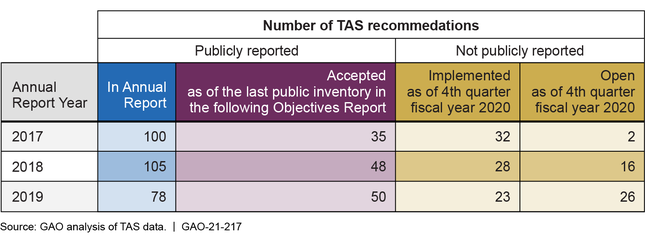

Publish updates on recommendation implementation status. By law, TAS's annual report must include an inventory of actions IRS has fully, partially, and not yet taken on TAS's recommendations to address the most serious problems facing taxpayers. If those recommendations take multiple years to implement, which some have as shown in the table below, updating the inventory would be required. In its objectives reports, TAS provides only a one-time inventory of IRS responses to TAS's recommendations made during the preceding year, including plans and preliminary actions taken for those IRS accepts for implementation. TAS does not publicly update the inventory in subsequent annual reports to reflect actions IRS takes or does not take to address TAS's recommendations. This reporting approach does not provide complete information on the status of actions IRS has taken to address serious problems facing taxpayers and also does not provide the information in the annual report, as required. Publishing such updated status information would support congressional oversight.

Taxpayer Advocate Service's (TAS) Recommendation Reporting and Status as of the Fourth Quarter of Fiscal Year 2020

GAO also identified options for TAS to consider to improve its reporting. These options include explaining changes to the list of the most serious taxpayer problems from year to year and streamlining report sections congressional staff use less frequently.

Why GAO Did This Study

TAS, an independent office within IRS, helps taxpayers resolve problems with IRS and addresses broader, systemic issues that affect groups of taxpayers by recommending administrative and legislative changes to mitigate such problems. Congress mandated that TAS issue two reports every year—one known as the annual report which includes sections on, among other things, the 10 most serious problems encountered by taxpayers, and the other known as the objectives report that discusses organizational objectives.

GAO was asked to review how TAS carries out its mission, focusing on resources and reporting. This report (1) describes TAS's resources and workload, and (2) assesses TAS's reporting to Congress and identifies opportunities for improvement.

GAO reviewed documents from TAS, IRS, and other sources, including TAS's annual and objectives reports and internal guidance; analyzed TAS's budget, staffing, and workload data for fiscal years 2011 through 2020; and interviewed knowledgeable TAS and IRS officials. GAO assessed TAS's reporting of its objectives and performance against statutory requirements, relevant internal control standards, and selected key practices for performance reporting developed by GAO. In addition, GAO reviewed relevant TAS web pages, analyzed the length and composition of TAS's reports, and interviewed key congressional committee staff to identify additional options to improve TAS's reporting.

Recommendations

GAO is making seven recommendations to help improve the usefulness of TAS's reports. GAO recommends, among other things, that the National Taxpayer Advocate take the following actions:

- Clearly identify TAS's objectives for the upcoming fiscal year and link them to TAS's planned activities.

- Define measurable outcomes for TAS's objectives.

- Expand TAS's reporting beyond planned activities to include the actual results it achieved through those activities.

- Consult with congressional stakeholders—at least once every 2 years—and other relevant stakeholders to obtain input on TAS's goals and measures and better understand stakeholders' information needs.

- Publish updates on the inventory of IRS's actions taken, partially taken, or not taken in response to recommendations made in the most serious problems section of TAS's annual report.

TAS agreed with all of GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should clearly identify TAS's objectives for the upcoming fiscal year in its objectives report. This should include clearly linking objectives to TAS's planned activities. (Recommendation 1) |

Closed – Implemented

The Taxpayer Advocate Service (TAS) has implemented this recommendation. In our review of TAS's Fiscal Years 2022 to 2024 Objectives Reports to Congress, we found that TAS added clear and consistent labels to more easily identify TAS's objectives and the planned activities that support those objectives. For example, in the 2024 Objectives Report, TAS clearly identified 17 Systemic Advocacy objectives, each with 1 to 5 related activities; 4 Case Advocacy objectives, each with 2 to 4 related activities; and 5 Research objectives, each with 2 to 4 related activities.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should define measurable outcomes for TAS's objectives. This may involve aligning TAS's existing performance goals with its objectives, and where gaps may exist, developing new performance goals. (Recommendation 2) |

Open – Partially Addressed

The Taxpayer Advocate Service (TAS) agreed with this recommendation, noting that it may face difficulties defining systemic advocacy outcomes that can be directly measured. As of August 2023, TAS has partially addressed this recommendation by publicly reporting on TAS's Annual Operational Plan webpage its progress toward meeting its goals and objectives. This reporting provides more transparency and accountability. However, our review of TAS's online Fiscal Year 2023 Operational Plan found that TAS has not determined an expected completion date for all objectives. Also, our review of TAS's FY 2024 Objectives Report found that TAS's objectives do not include measurable outcomes. To fully implement this recommendation, TAS needs to establish objectives with measurable outcomes. For objectives that may not be directly measurable or that may depend primarily on IRS actions, TAS could (1) identify the outcomes it is trying to achieve and related activities that can be quantitatively measured, (2) determine where a logical link exists between them, (3) create performance goals by assigning a performance target and time frame for each measured activity, and (4) align performance goals with broader organizational goals and objectives.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should expand TAS's reporting beyond planned activities to include the actual results it achieved through those activities. This performance reporting should include information to help assess progress toward objectives, including full-year performance data and trend information from past years. (Recommendation 3) |

Open

The Taxpayer Advocate Service (TAS) agreed with this recommendation. Beginning with the 2022 National Taxpayer Advocate Annual Report to Congress, TAS planned to include performance reporting for fiscal year 2022 and prior years and continue this practice in future Annual Reports. We reviewed TAS's 2022 Annual Report and found that TAS generally reported full-year performance. However, performance measures were not linked to objectives, and some measures did not include results or trend information from past years. We plan to review TAS's forthcoming 2023 Annual Report when published in Winter 2024 and will continue to follow up with TAS as needed.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should consult with congressional stakeholders—at least once every 2 years—and other relevant stakeholders to obtain input on TAS's goals and measures and better understand stakeholders' information needs. (Recommendation 4) |

Open – Partially Addressed

The Taxpayer Advocate Service (TAS) has partially addressed this recommendation. According to TAS, in June 2022, the National Taxpayer Advocate met with majority and minority staff from the House Ways and Means Subcommittee on Oversight and the Senate Finance Committee. TAS reported that during both briefings, the National Taxpayer Advocate described TAS's fiscal year 2023 objectives, summarized TAS's interest in receiving feedback regarding TAS's objectives and activities, and encouraged staffers to reach out if they have feedback, concerns, or additional suggestions to offer at any point during the year. To fully implement this recommendation, the National Taxpayer Advocate needs to continue to consult regularly with congressional and other stakeholders to obtain input on TAS's goals and measures and better understand stakeholders' information needs. We plan to review TAS's efforts to consult with stakeholders on TAS's fiscal year 2024 goals and measures and will follow up with TAS as needed.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should publish updates on the inventory of IRS's actions taken, partially taken, or not taken in response to recommendations made in the most serious problems section of TAS's annual report. Updates should include how long those actions have remained on the inventory as partially taken and not yet taken, as well as planned completion dates. Updates should also be discussed as part of TAS's annual report. (Recommendation 5) |

Open – Partially Addressed

The Taxpayer Advocate Service (TAS) has partially implemented this recommendation. TAS has published online information on the status of IRS actions in response to its administrative recommendations from TAS's 2014 to 2022 Annual Reports. The online recommendation status tracker includes IRS's responses to TAS's recommendations, the extent to which IRS adopted the recommendations, updates on corrective actions, and the due date for action on open recommendations. Recommendations can be sorted by annual report year and open/closed status to determine how long actions have been on the inventory. To fully implement this recommendation, TAS needs to discuss such information in its Annual Reports, as required by statute.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should better identify in TAS's annual report what statistical data and sections of the report were or were not included in IRS's review. This should include a discussion of whether IRS found the information it reviewed to be valid or methodologically sound. (Recommendation 6) |

Closed – Implemented

The Taxpayer Advocate Service (TAS) ) has implemented this recommendation. In our review of TAS's 2021 and 2022 Annual Reports, we found that the reports addressed our recommendation by (1) including a section on Data Compilation and Validation, (2) listing each report section and indicating whether IRS had reviewed the data for that section, and if not, the reason and what additional review occurred, and (3) stating that any disagreements about data or data presentation between IRS and TAS are noted in the report.

|

| Office of the Taxpayer Advocate | The National Taxpayer Advocate should update TAS guidance to reflect TAS's current procedures for reviewing annual report sections' statistical data with IRS. (Recommendation 7) |

Open – Partially Addressed

The Taxpayer Advocate Service (TAS) has partially addressed this recommendation. TAS has updated its Process Guide for the Annual Report to Congress to reflect TAS's procedures for reviewing statistical data with IRS for the annual report. TAS also plans to include these procedures in the Internal Revenue Manual. To fully implement this recommendation, TAS needs to finalize the update to the Internal Revenue Manual to include these procedures.

|