Tobacco Taxes: Market Shifts toward Lower-Taxed Products Continue to Reduce Federal Revenue

Fast Facts

A 2009 law created a tax disparity among different types of tobacco products, with cigarettes, roll-your-own tobacco, and small cigars taxed at one rate and pipe tobacco and some large cigars taxed at lower rates.

In a 2012 report, we found that tax revenue decreased after the law because manufacturers made and consumers bought more of the lower-taxed products. We previously recommended that Congress consider ways to address the tax disparity, e.g., equalizing roll-your-own and pipe tobacco tax rates.

This update found that federal revenue would likely increase if taxes were equalized because lower-taxed products still dominate their markets.

Examples of Cigarette and Cigar Products

Three types of cigarettes (hand-, machine-, and factory-rolled) and three types of cigars (small, large, and traditional large).

Highlights

What GAO Found

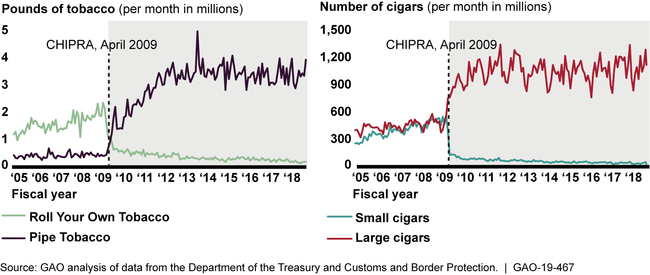

Large federal excise tax disparities among similar tobacco products after enactment of the Children's Health Insurance Program Reauthorization Act (CHIPRA) of 2009 led to immediate market shifts (see figure). Specifically, CHIPRA created tax disparities between roll-your-own and pipe tobacco and between small and large cigars, creating opportunities for tax avoidance and leading manufacturers and consumers to shift to the lower-taxed products. Following the market shifts after CHIPRA, the lower-taxed products have sustained their dominant position in their respective markets.

U.S. Sales of Roll-Your-Own and Pipe Tobacco and of Small and Large Cigars, Both Domestic and Imported, before and after the Children's Health Insurance Program Reauthorization Act (CHIPRA) of 2009

Market shifts to avoid increased tobacco taxes following CHIPRA have continued to reduce federal revenue. GAO estimates that federal revenue losses due to market shifts from roll-your-own to pipe tobacco and from small to large cigars range from a total of about $2.5 to $3.9 billion from April 2009 through September 2018, depending on assumptions about how consumers would respond to a tax increase.

Federal revenue would likely increase if Congress were to equalize the tax rate for pipe tobacco with the rates currently in effect for roll-your-own tobacco and cigarettes. GAO estimates that federal revenue would increase by a total of approximately $1.3 billion from fiscal year 2019 through fiscal year 2023 if the pipe tobacco tax rate were equalized with the higher rate for roll-your-own tobacco and cigarettes. While equalizing federal excise taxes on small and large cigars should raise revenue based on past experience, the specific revenue effect is unknown because data for conducting this analysis are not available. These data are not collected by the Department of the Treasury because such data are not needed to administer and collect large cigar taxes under the current tax structure.

Why GAO Did This Study

In 2009, CHIPRA increased and equalized federal excise tax rates for cigarettes, roll-your-own tobacco, and small cigars but did not equalize tax rates for pipe tobacco and large cigars—products that can be cigarette substitutes. GAO reported in 2012 and 2014 on the estimated federal revenue losses due to the market shifts from roll-your-own to pipe tobacco and from small to large cigars.

This report updates GAO's prior products by examining (1) the market shifts among smoking tobacco products since CHIPRA, (2) the estimated effects on federal revenue if the market shifts had not occurred, and (3) what is known about the revenue effects if Congress were to eliminate current tax disparities between smoking tobacco products. GAO analyzed data from the Department of the Treasury and U.S. Customs and Border Protection to identify sales trends for domestic and imported smoking tobacco products, to estimate the effect on tax collection if market substitutions had not occurred, and to model the effects of equalizing tax rates for smoking tobacco products.

Recommendations

In its 2012 report, GAO recommended Congress consider equalizing tax rates on roll-your-own and pipe tobacco and consider options for reducing tax avoidance due to tax differentials between small and large cigars. Treasury generally agreed with GAO's conclusions and observations. As of May 2019, Congress had not passed legislation to reduce or eliminate tax differentials between smoking tobacco products. Treasury also generally agreed with this report's findings.