Treasury Judgment Fund: Transparency and Reliability Needed in Reporting Fund Balances and Activities

Highlights

What GAO Found

The Department of the Treasury (Treasury) did not provide the House Committee on the Judiciary (Committee) with the information the Committee requested on the Treasury Judgment Fund. Specifically, Treasury did not provide the Committee the Schedules of the Judgment Fund Non-Entity Assets, Non-Entity Costs, and Custodial Revenues that were prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP). Treasury also did not include appropriate note disclosures or Management's Discussion and Analysis, as requested by the Committee. Rather, Treasury provided nine exhibits containing selected Judgment Fund information to answer nine questions included in the Committee's request.

In addition, GAO identified numerous differences between amounts included in Treasury's exhibits and its annual Judgment Fund transparency reports to Congress and certain audited financial reports. GAO requested explanations for these differences, and Treasury provided explanations for some of them. Subsequently, Treasury officials discovered and explained that the exhibits were created in a faulty manner, resulting in an increased risk that they may contain unreliable information. Treasury officials stated that rather than expending resources to further explain differences and reconcile the exhibits with the other information, Bureau of the Fiscal Service (Fiscal Service) staff planned to submit new exhibits to the Committee; however, they did not provide a date by which they would do so.

GAO found that Treasury did not take appropriate steps consistent with its existing guidance for disseminating information to the public, such as performing appropriate reviews of information in the exhibits prior to providing them to the Committee, to ensure the quality and responsiveness of the information provided. The lack of reliable information on the Judgment Fund impairs the Committee's ability to provide effective oversight, including considering whether enacting new legislation would benefit the American people by ensuring better management of the Judgment Fund.

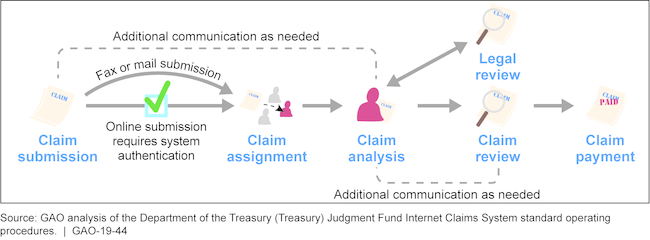

Fiscal Service has policies and procedures to help ensure that it only certifies payments for awards, judgments, and compromise settlements (claims) from the Judgment Fund that meet the following four tests: (1) claims are final, (2) claims are monetary, (3) one of the authorities specified in the Judgment Fund statute permits payment, and (4) payment is not legally available from any other source of funds (e.g., claims are only paid from the Judgment Fund when payment is not otherwise provided for in a specific appropriation or by another statutory provision).

Overview of the Treasury Judgment Fund Claims Process

Why GAO Did This Study

The Treasury Judgment Fund, managed by Fiscal Service, annually pays billions of dollars of claims on behalf of federal agencies. Transparent and reliable information is important for Congress to provide effective oversight of the Judgment Fund. In May 2017, the Committee requested that Treasury provide (1) Schedules of the Judgment Fund for fiscal years 2010 to 2016 prepared in accordance with U.S. GAAP, including appropriate disclosures to answer nine questions, and (2) information on processes and procedures used when paying claims.

GAO was asked to review the information that Treasury provided to the Committee. This report (1) evaluates the extent to which the Treasury-prepared information responds to the Committee's request and reconciles to financial information included in annual, audited financial reports and other reports and (2) describes Fiscal Service's documented procedures and related control activities for processing agency claims. To address these objectives, GAO compared the information provided by Treasury to other Treasury reports, conducted interviews with agency officials, and reviewed documented procedures for processing claims.

Recommendations

GAO recommends that Fiscal Service take steps to ensure that information provided to Congress undergoes a documented review to ensure the quality and responsiveness of the information provided. Fiscal Service did not concur or nonconcur with the recommendation but agreed with GAO concerns regarding the reliability of information provided to the Committee.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Commissioner of the Bureau of the Fiscal Service should take steps to ensure that information provided to Congress undergoes a documented review to ensure the quality and responsiveness of the information provided. (Recommendation 1) |

Closed – Implemented

Fiscal Service agreed with our concerns regarding the reliability of information contained in the exhibits provided to the Committee. After informing Treasury of the errors we identified, Treasury provided the Committee with a new set of data. In addition, in October 2018, the Bureau of Fiscal Service documented the review process for ensuring the quality of the information provided to Congress. This action addressed our recommendation.

|